Supportive Regulatory Frameworks

The supportive regulatory frameworks established by GCC governments are fostering growth in the metal implants-medical-alloys market. Regulatory bodies are increasingly streamlining the approval processes for new medical devices, including metal implants, which encourages innovation and market entry. This regulatory support is crucial for manufacturers looking to introduce advanced alloys that meet safety and efficacy standards. As a result, the market is likely to witness an influx of new products, enhancing competition and driving down costs for consumers. The proactive stance of regulatory agencies in promoting high-quality medical solutions is expected to bolster the overall market landscape.

Increasing Healthcare Expenditure

The rising healthcare expenditure in the GCC region is a pivotal driver for the metal implants-medical-alloys market. Governments and private sectors are investing heavily in healthcare infrastructure, which includes advanced surgical procedures requiring high-quality metal implants. For instance, healthcare spending in the GCC is projected to reach approximately $104 billion by 2025, reflecting a growth rate of around 7.5% annually. This increase in funding facilitates the adoption of innovative medical technologies, including metal implants made from advanced alloys. As hospitals and clinics upgrade their facilities and equipment, the demand for reliable and durable metal implants is likely to surge, thereby propelling the market forward.

Aging Population and Chronic Diseases

The demographic shift towards an aging population in the GCC is significantly influencing the metal implants-medical-alloys market. As the population ages, the prevalence of chronic diseases such as osteoporosis and arthritis increases, necessitating surgical interventions that often require metal implants. According to recent statistics, the elderly population in the GCC is expected to double by 2030, leading to a higher demand for orthopedic and dental implants. This trend suggests that healthcare providers will increasingly rely on advanced metal alloys to ensure the longevity and effectiveness of implants, thereby driving market growth. The metal implants-medical-alloys market is poised to benefit from this demographic change as more patients seek surgical solutions.

Technological Innovations in Implant Design

Technological innovations in implant design are transforming the landscape of the metal implants-medical-alloys market. Advances in 3D printing and computer-aided design (CAD) are enabling the creation of customized implants tailored to individual patient anatomies. This customization not only enhances the fit and functionality of implants but also reduces the risk of complications. The integration of smart materials and coatings is also gaining traction, potentially improving the performance and longevity of metal implants. As these technologies continue to evolve, they are likely to attract investment and interest from healthcare providers, further stimulating growth in the market.

Rising Awareness of Advanced Medical Solutions

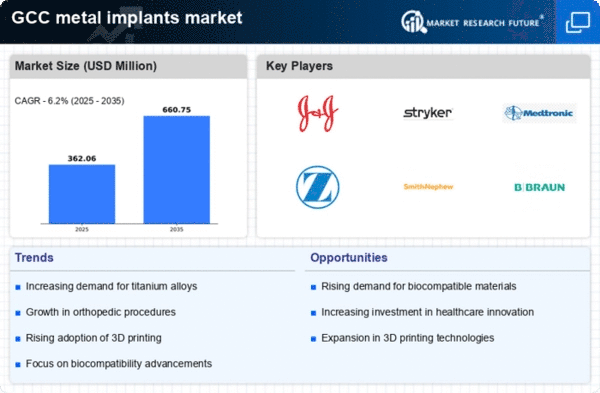

There is a growing awareness among healthcare professionals and patients regarding the benefits of advanced medical solutions, which is positively impacting the metal implants-medical-alloys market. Educational initiatives and training programs are enhancing the understanding of the advantages of using high-performance alloys in medical applications. This awareness is likely to lead to increased adoption rates of metal implants, as both surgeons and patients recognize the long-term benefits of using superior materials. Furthermore, the market is expected to see a compound annual growth rate (CAGR) of around 6% over the next five years, driven by this heightened awareness and the demand for quality healthcare solutions.