Increasing Healthcare Expenditure

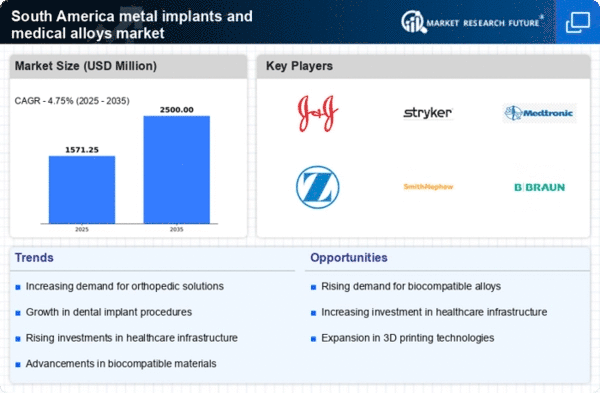

The rising healthcare expenditure in South America is a pivotal driver for the metal implants-medical-alloys market. Governments and private sectors are investing more in healthcare infrastructure, which includes advanced surgical procedures and medical technologies. This trend is reflected in the increasing allocation of budgets towards healthcare, with some countries reporting growth rates of over 10% annually. As healthcare facilities upgrade their equipment and expand their services, the demand for high-quality metal implants and medical alloys is likely to surge. This investment not only enhances patient care but also stimulates the market for innovative materials that meet stringent regulatory standards. Consequently, the metal implants-medical-alloys market is poised for growth as healthcare systems evolve to accommodate more complex surgical interventions.

Growing Awareness of Personalized Medicine

The shift towards personalized medicine in South America is emerging as a crucial driver for the metal implants-medical-alloys market. As healthcare providers increasingly recognize the importance of tailoring treatments to individual patient needs, the demand for customized implants is likely to rise. This trend is supported by advancements in materials science and manufacturing technologies, enabling the production of bespoke metal alloys that cater to specific anatomical requirements. The metal implants-medical-alloys market must respond to this growing demand by investing in research and development to create materials that offer enhanced compatibility and performance. This focus on personalization could potentially reshape the landscape of medical implants, leading to improved patient satisfaction and outcomes.

Surge in Sports Injuries and Rehabilitation

The increasing incidence of sports injuries in South America is another significant driver for the metal implants-medical-alloys market. With a growing interest in sports and physical activities, particularly among the youth, the number of injuries requiring surgical intervention is on the rise. Estimates suggest that sports-related injuries could lead to a market growth of around 15% in the coming years. This trend necessitates the use of advanced metal implants that can withstand the physical demands of active individuals. The metal implants-medical-alloys market is thus challenged to innovate and provide solutions that cater to the specific needs of athletes, ensuring faster recovery and improved performance.

Aging Population and Rising Chronic Diseases

The demographic shift towards an aging population in South America significantly influences the metal implants-medical-alloys market. As the population ages, the prevalence of chronic diseases such as osteoporosis and arthritis increases, necessitating more orthopedic surgeries. Reports indicate that by 2030, the elderly population in South America is expected to rise by approximately 20%, leading to a higher demand for metal implants. This demographic trend compels healthcare providers to seek durable and biocompatible materials for implants, thereby driving the market for medical alloys. The metal implants-medical-alloys market must adapt to these changing needs, focusing on developing materials that enhance longevity and reduce the risk of complications in older patients.

Regulatory Support for Advanced Medical Technologies

Regulatory bodies in South America are increasingly supportive of advanced medical technologies, which positively impacts the metal implants-medical-alloys market. Streamlined approval processes for new materials and devices encourage innovation and facilitate market entry for novel products. This regulatory environment fosters collaboration between manufacturers and healthcare providers, leading to the development of cutting-edge metal alloys that enhance patient outcomes. The metal implants-medical-alloys market benefits from this trend as it allows for quicker adaptation to technological advancements and changing healthcare needs. As regulations evolve, the market is likely to see an influx of innovative solutions that address both safety and efficacy.