Supportive Regulatory Framework

A supportive regulatory framework in the GCC region is fostering growth in the nasal mucosa-drug-supply-device market. Regulatory bodies are increasingly recognizing the importance of nasal drug delivery systems and are streamlining approval processes for new devices. This regulatory support encourages innovation and investment in the development of advanced nasal delivery technologies. Furthermore, the establishment of clear guidelines for clinical trials and product approvals is likely to enhance market entry for new players. As a result, the nasal mucosa-drug-supply-device market is expected to flourish, with an anticipated increase in the number of approved products and devices available to healthcare providers.

Increasing Prevalence of Respiratory Disorders

The rising incidence of respiratory disorders in the GCC region is a crucial driver for the nasal mucosa-drug-supply-device market. Conditions such as asthma and allergic rhinitis are becoming more common, leading to a heightened demand for effective treatment options. According to recent health statistics, approximately 20% of the population in GCC countries suffers from some form of respiratory ailment. This trend necessitates the development and supply of innovative drug delivery devices that can effectively target the nasal mucosa, ensuring rapid absorption and improved patient outcomes. As healthcare providers seek to enhance therapeutic efficacy, the nasal mucosa-drug-supply-device market is poised for significant growth, driven by the need for advanced solutions that cater to this increasing patient demographic.

Rising Investment in Healthcare Infrastructure

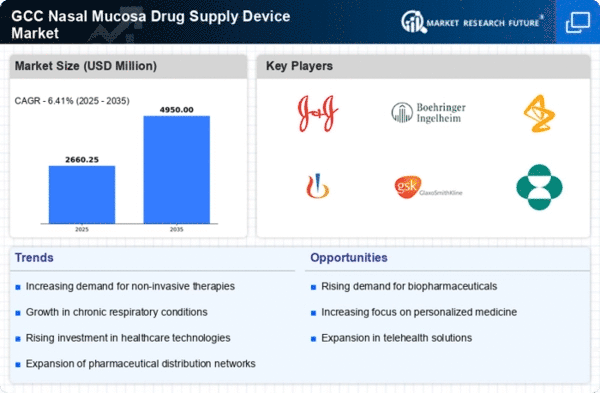

The GCC region is witnessing a surge in investment in healthcare infrastructure, which is positively impacting the nasal mucosa-drug-supply-device market. Governments are allocating substantial funds to enhance healthcare facilities and improve access to advanced medical technologies. This investment is likely to facilitate the adoption of innovative nasal drug delivery systems, as healthcare providers seek to offer cutting-edge treatment options to patients. Additionally, the expansion of healthcare facilities is expected to increase the demand for effective drug delivery devices, further driving market growth. Analysts project that the nasal mucosa-drug-supply-device market could see a compound annual growth rate (CAGR) of 12% over the next five years as a result of these infrastructural developments.

Growing Awareness of Nasal Drug Delivery Benefits

There is a notable increase in awareness regarding the advantages of nasal drug delivery systems among healthcare professionals and patients in the GCC. The nasal mucosa-drug-supply-device market benefits from this trend, as practitioners recognize the potential for rapid onset of action and reduced systemic side effects associated with nasal administration. Educational initiatives and marketing campaigns have contributed to this awareness, highlighting the effectiveness of nasal devices in delivering vaccines and medications. As a result, the market is projected to expand, with an estimated growth rate of 15% annually over the next five years, as more healthcare providers adopt these innovative delivery methods.

Technological Innovations in Drug Delivery Systems

Technological advancements in drug delivery systems are significantly influencing the nasal mucosa-drug-supply-device market. Innovations such as smart inhalers and micro-needling devices are enhancing the precision and efficiency of drug delivery through the nasal route. These technologies not only improve patient compliance but also optimize therapeutic outcomes by ensuring accurate dosing. The market is witnessing an influx of research and development investments aimed at creating more sophisticated devices that can cater to diverse patient needs. As a result, the nasal mucosa-drug-supply-device market is expected to experience robust growth, with a projected market value reaching $500 million by 2027.