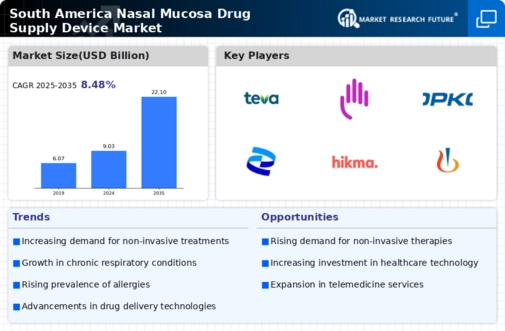

Emergence of Innovative Drug Formulations

The nasal mucosa-drug-supply-device market is being driven by the emergence of innovative drug formulations designed for nasal delivery. Pharmaceutical companies are investing in research and development to create new formulations that enhance bioavailability and patient compliance. For example, the introduction of mucoadhesive formulations and nanoparticle-based systems is revolutionizing the way drugs are delivered through the nasal route. This innovation is expected to capture a significant share of the market, as patients and healthcare providers seek more effective treatment options. The nasal mucosa-drug-supply-device market is likely to thrive as these novel formulations gain traction in clinical settings.

Growing Prevalence of Respiratory Disorders

The rising incidence of respiratory disorders in South America is a crucial driver for the nasal mucosa-drug-supply-device market. Conditions such as asthma, allergic rhinitis, and chronic obstructive pulmonary disease (COPD) are becoming increasingly common, affecting millions. According to health statistics, approximately 20% of the population in urban areas suffers from some form of respiratory ailment. This growing patient base necessitates effective treatment options, thereby propelling the demand for innovative drug delivery systems that target the nasal mucosa. The nasal mucosa-drug-supply-device market is likely to benefit from this trend, as healthcare providers seek efficient and rapid delivery methods to improve patient outcomes.

Rising Awareness of Nasal Drug Delivery Benefits

There is a growing awareness among healthcare professionals and patients regarding the advantages of nasal drug delivery systems. The nasal mucosa-drug-supply-device market is experiencing a shift as more stakeholders recognize the benefits of this method, such as rapid absorption and reduced systemic side effects. Educational campaigns and professional training programs are increasingly emphasizing these advantages, leading to a higher acceptance rate among practitioners. This trend is likely to enhance the market's growth, as healthcare providers are more inclined to recommend nasal delivery systems for various therapeutic applications, thereby expanding the nasal mucosa-drug-supply-device market.

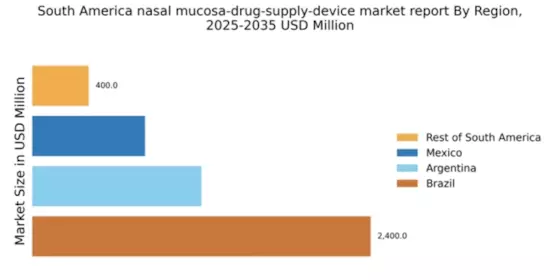

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure across South America is significantly influencing the nasal mucosa-drug-supply-device market. Governments and private entities are channeling funds into enhancing healthcare facilities, which includes the procurement of advanced medical devices. For instance, Brazil and Argentina have reported substantial increases in healthcare spending, with Brazil allocating over $100 billion annually to improve health services. This investment is expected to facilitate the adoption of modern drug delivery systems, including those targeting the nasal mucosa. As healthcare facilities upgrade their capabilities, the nasal mucosa-drug-supply-device market stands to gain from improved access to innovative treatment options.

Regulatory Support for Nasal Drug Delivery Systems

Regulatory bodies in South America are increasingly supportive of nasal drug delivery systems, which is positively impacting the nasal mucosa-drug-supply-device market. Streamlined approval processes and guidelines for nasal formulations are encouraging manufacturers to invest in this sector. For instance, agencies like ANVISA in Brazil are working to establish clear regulations that facilitate the introduction of new nasal drug delivery devices. This regulatory support is expected to foster innovation and competition within the market, ultimately benefiting patients by providing them with a wider array of treatment options. The nasal mucosa-drug-supply-device market is poised for growth as a result of these favorable regulatory developments.