Emergence of Smart Technologies

The emergence of smart technologies is reshaping the operational analytics market in the GCC. Innovations such as the Internet of Things (IoT) and smart sensors are generating vast amounts of data, which organizations can harness to gain insights into their operations. This influx of data presents both opportunities and challenges for businesses, as they must invest in analytics solutions capable of processing and interpreting this information effectively. The operational analytics market is poised for growth as companies adopt smart technologies to enhance their operational capabilities. It is projected that the integration of IoT with operational analytics could lead to a market expansion of approximately 25% by 2027, indicating the transformative potential of smart technologies in driving analytics adoption.

Growing Emphasis on Regulatory Compliance

The operational analytics market is significantly influenced by the growing emphasis on regulatory compliance within the GCC. As governments implement stricter regulations across various sectors, organizations are compelled to adopt analytics solutions that ensure compliance with these mandates. This trend is particularly pronounced in industries such as finance and healthcare, where adherence to regulations is critical. The operational analytics market is expected to benefit from this shift. Companies are seeking to leverage analytics tools to monitor compliance and mitigate risks. It is estimated that the demand for compliance-related analytics solutions could account for approximately 20% of the overall market by 2026, highlighting the importance of regulatory adherence in driving market growth.

Increased Focus on Operational Efficiency

An increased focus on operational efficiency is driving the growth of the operational analytics market in the GCC. Organizations are actively seeking ways to streamline processes, reduce costs, and enhance productivity. By utilizing operational analytics, businesses can identify inefficiencies and optimize their operations accordingly. This trend is particularly relevant in sectors such as logistics and supply chain management, where operational analytics can lead to significant cost savings and improved service delivery. Recent studies indicate that companies implementing operational analytics solutions have reported efficiency gains of up to 30%, underscoring the potential impact of analytics on operational performance. As the competitive landscape intensifies, the pursuit of operational efficiency will likely remain a primary driver for the market.

Investment in Advanced Analytics Technologies

Investment in advanced analytics technologies is a key driver propelling the operational analytics market in the GCC. Companies are increasingly allocating resources towards sophisticated analytics tools that enable them to extract actionable insights from vast datasets. This investment is not only aimed at enhancing operational efficiency but also at fostering innovation and improving customer experiences. The operational analytics market is expected to witness a substantial increase in funding, with estimates suggesting that investments could reach upwards of $1 billion by 2026. This influx of capital is likely to accelerate the development and adoption of cutting-edge analytics solutions, further solidifying the market's growth trajectory.

Rising Demand for Data-Driven Decision Making

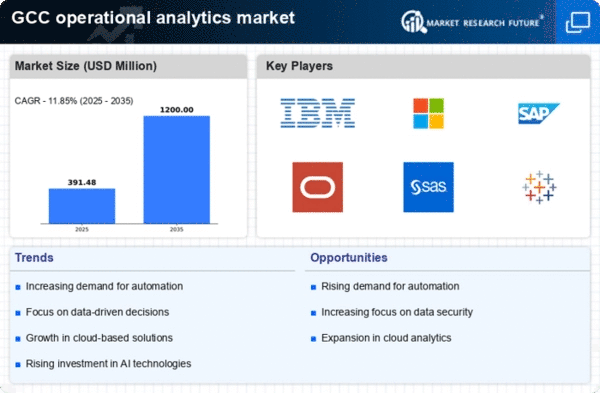

The operational analytics market is experiencing a notable surge in demand for data-driven decision making across various sectors in the GCC. Organizations are increasingly recognizing the value of leveraging data analytics to enhance operational efficiency and drive strategic initiatives. This trend is particularly evident in industries such as retail and manufacturing, where data insights can lead to improved inventory management and production processes. According to recent estimates, the operational analytics market in the GCC is projected to grow at a CAGR of approximately 15% over the next five years, reflecting the growing reliance on data analytics for informed decision making. As businesses strive to remain competitive, the integration of operational analytics into their core strategies becomes essential.