Increase in Eye Disorders

The prevalence of eye disorders in the GCC region is a significant driver for the optical coherence-tomography market. Conditions such as diabetic retinopathy, glaucoma, and age-related macular degeneration are on the rise, necessitating advanced diagnostic tools for effective management. Reports indicate that the incidence of diabetes in the GCC is among the highest globally, with approximately 20% of the adult population affected. This alarming statistic correlates with an increased demand for optical coherence tomography, as it provides detailed imaging of the retina and optic nerve. The ability to detect and monitor these conditions early can lead to better treatment outcomes, thus propelling the market forward. As healthcare providers seek to enhance their diagnostic capabilities, the optical coherence-tomography market is poised for substantial growth.

Rising Geriatric Population

The increasing geriatric population in the GCC region is a crucial driver for the optical coherence-tomography market. As the population ages, the prevalence of age-related eye conditions is likely to rise, necessitating advanced diagnostic solutions. By 2025, it is estimated that the proportion of individuals aged 65 and older in the GCC will reach approximately 10%, leading to a higher demand for effective diagnostic tools. Optical coherence tomography is particularly valuable in assessing and managing age-related ocular diseases, providing detailed imaging that aids in timely intervention. The growing awareness of eye health among the elderly population further contributes to the demand for these diagnostic systems. Consequently, the optical coherence-tomography market is expected to expand significantly, driven by the needs of an aging demographic.

Growing Healthcare Expenditure

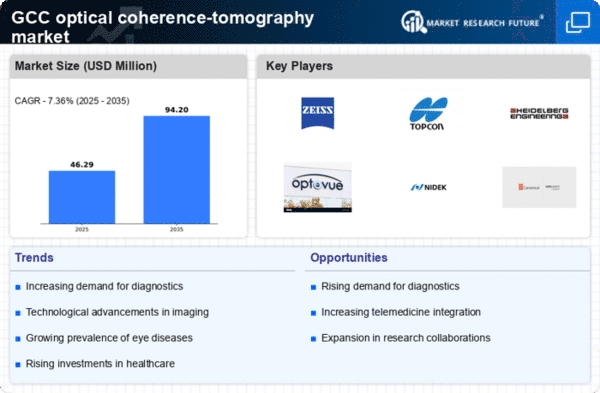

The optical coherence-tomography market is experiencing growth due to increasing healthcare expenditure in the GCC region. Governments and private sectors are investing significantly in healthcare infrastructure, which includes advanced diagnostic tools like optical coherence tomography. In 2025, healthcare spending in the GCC is projected to reach approximately $100 billion, reflecting a compound annual growth rate (CAGR) of around 5%. This financial commitment facilitates the acquisition of cutting-edge technologies, enhancing the capabilities of healthcare providers. As hospitals and clinics upgrade their equipment, the demand for optical coherence-tomography systems is likely to rise, thereby driving market expansion. Furthermore, the emphasis on improving patient outcomes and diagnostic accuracy aligns with the adoption of these advanced imaging modalities, indicating a robust future for the optical coherence-tomography market.

Technological Integration in Healthcare

The integration of advanced technologies in healthcare is a pivotal factor influencing the optical coherence-tomography market. The rise of telemedicine and digital health solutions in the GCC is transforming how healthcare services are delivered. Optical coherence tomography systems are increasingly being integrated with electronic health records (EHR) and telehealth platforms, facilitating remote consultations and improved patient management. This technological synergy enhances the accessibility of diagnostic services, particularly in rural and underserved areas. As healthcare providers adopt these integrated solutions, the demand for optical coherence-tomography systems is expected to increase. The market is likely to benefit from this trend, as it aligns with the broader movement towards digitization in healthcare, ultimately improving patient care and operational efficiency.

Regulatory Support for Advanced Diagnostics

Regulatory bodies in the GCC are increasingly supporting the adoption of advanced diagnostic technologies, including optical coherence tomography. Initiatives aimed at improving healthcare quality and patient safety are encouraging the use of innovative imaging modalities. The introduction of streamlined approval processes for medical devices is likely to expedite the entry of new optical coherence-tomography systems into the market. This regulatory environment fosters competition and innovation, as manufacturers are motivated to develop state-of-the-art products. Furthermore, government policies promoting research and development in medical technology are expected to enhance the capabilities of optical coherence-tomography systems. As a result, the optical coherence-tomography market is anticipated to flourish, driven by a favorable regulatory landscape that encourages the adoption of advanced diagnostic tools.