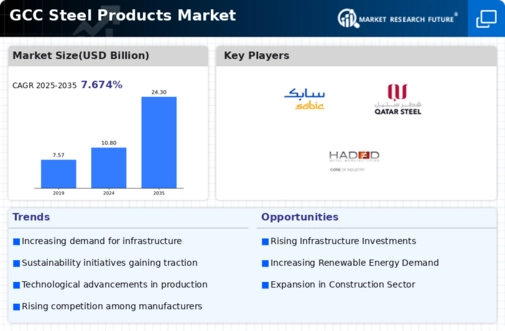

Rising Construction Activities

The steel products market is experiencing a surge in demand due to increasing construction activities across the GCC region. Governments are investing heavily in infrastructure projects, including roads, bridges, and residential buildings. For instance, the construction sector in the GCC is projected to grow at a CAGR of approximately 5.5% from 2025 to 2030. This growth is likely to drive the demand for steel products, as they are essential materials in construction. Additionally, the ongoing urbanization trends in cities like Dubai and Riyadh further contribute to the heightened need for steel products. As a result, the steel products market is poised to benefit significantly from these developments, indicating a robust growth trajectory in the coming years.

Government Regulations and Policies

The steel products market is influenced by various government regulations and policies aimed at promoting local manufacturing and reducing imports. In the GCC, initiatives such as tariffs on imported steel and incentives for domestic production are being implemented to bolster the local steel industry. For example, the Saudi government has introduced measures to support local steel manufacturers, which could lead to a potential increase in market share for domestic products. Furthermore, regulations focusing on quality standards and environmental compliance are shaping the operational landscape for steel producers. These policies not only enhance competitiveness but also ensure that the steel products market aligns with national economic goals.

Growing Demand from Automotive Sector

The automotive sector is emerging as a significant driver for the steel products market in the GCC. With the rise in vehicle production and sales, the demand for high-quality steel components is increasing. The automotive industry in the region is projected to grow at a CAGR of around 4% over the next five years, which could lead to a substantial uptick in steel consumption. Manufacturers are focusing on lightweight steel solutions to enhance fuel efficiency and reduce emissions, further propelling the demand for specialized steel products. This trend indicates that the steel products market is likely to see a robust increase in orders from automotive manufacturers.

Investment in Renewable Energy Projects

Investment in renewable energy projects is becoming a pivotal driver for the steel products market. The GCC countries are increasingly focusing on diversifying their energy sources, with substantial investments in solar and wind energy projects. For instance, the UAE has committed to generating 50% of its energy from clean sources by 2050, which necessitates the use of steel products for infrastructure development. The construction of solar farms and wind turbines requires a significant amount of steel, thereby creating new opportunities for manufacturers. This shift towards renewable energy not only supports sustainability goals but also indicates a growing market for steel products in the energy sector.

Technological Innovations in Production

Technological advancements in steel production processes are transforming the steel products market. Innovations such as automation, artificial intelligence, and advanced manufacturing techniques are enhancing efficiency and reducing production costs. For instance, the adoption of electric arc furnaces is becoming more prevalent in the GCC, allowing for more sustainable steel production. This shift is expected to improve the quality of steel products while minimizing environmental impact. As a result, companies that invest in these technologies may gain a competitive edge, potentially leading to increased market share in the steel products market. The ongoing evolution in production technology suggests a promising future for the industry.