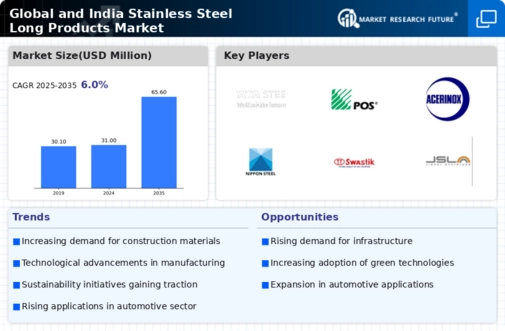

Global & India Stainless Steel Long Products Market is characterized by a high level of competition, with many players emerging for market share. The top 10 companies in the market account for a significant market share of Global & India Stainless Steel Long Products Market. The competitive landscape of Global Stainless Steel Long Products Market is dynamic, with companies constantly innovating and expanding their product offerings. Despite the challenges, there are several factors that are driving growth in the Stainless Steel Long Products Market.

These include an increasing number of power outages and rising demand for uninterrupted & reliable power supply. The Stainless Steel Long Products Market is expected to witness significant growth in the coming years, owing to rising rural electrification.

The market is benefiting from the development of new technologies. The key players in the Marcegaglia Group, Tata Steel, POSCO, ArcelorMittal S.A., JFE Steel Corporation, Valbruna S.p.A., ThyssenKrupp AG, Aperam S.A., Acerinox S.A., Nippon Steel, Swastik Pipes, Usha Martin Limited, Jindal Stainless, Viraj Profiles, Shyam Ferro, Mukand Ltd., Ambica Steels Ltd., Panchmahal Steel Ltd., Shah Alloys Ltd., and Chandan Steel Ltd. These companies compete based on product quality, innovation, price, customer service, and market share.

Companies also engage in various strategic initiatives, such as mergers and acquisitions, new product launches, partnerships, joint ventures, and expansions, to enhance their market position and expand their product portfolio. Companies are also focusing on developing new and innovative products that meet the specific needs of their customers. Companies will need to continue to innovate and expand their product offerings to remain competitive.

Marcegaglia Group: Marcegaglia Group is a prominent global leader in the steel processing and manufacturing industry, with a rich history dating back to its founding in 1959 in Italy. The company specializes in producing a wide array of steel products, including flat and long products, pipes, and tubes, which serve diverse sectors such as construction, automotive, energy, and appliances. Marcegaglia operates numerous production facilities across Europe, Asia, and the Americas, enabling it to maintain a strong international presence and respond effectively to regional market demands.

The company's commitment to quality is underscored by its adherence to international standards and certifications, ensuring reliability and performance in its offerings. Marcegaglia places a significant emphasis on innovation and sustainability, investing in research and development to enhance its manufacturing processes and develop eco-friendly products, aligning with the growing demand for sustainable solutions in the industry. The group has operations worldwide with 7,000 employees, 60 sales offices, 210 representations and 43 manufacturing plants in Italy and overseas (Europe, USA, South America, Asia).

Tata Steel: Tata Steel, one of the largest steel manufacturing companies in the world, is headquartered in Mumbai, India. Established in 1907 by Jamshedji Tata, it was India's first integrated steel plant and has since grown into a global leader in the industry. The company operates across 26 countries, with manufacturing units in India, the UK, the Netherlands, and various other locations, employing over 65,000 people worldwide. Tata Steel offers a comprehensive portfolio of steel products, including flat and long products, tubes, and specialty steels, which cater to diverse sectors such as automotive, construction, consumer goods, and engineering.

The company is known for its innovative approaches, such as the development of advanced high-strength steel grades that meet the evolving demands of its customers.