Expansion of Medical Tourism

The expansion of medical tourism in the GCC region is contributing to the growth of the surgical sutures market. As the region becomes a hub for international patients seeking high-quality medical care, the demand for surgical procedures is expected to rise. Countries like the UAE and Saudi Arabia are investing in healthcare facilities to attract medical tourists, which in turn increases the need for surgical sutures. The influx of patients from abroad often requires advanced surgical techniques and materials, thereby driving the demand for innovative suturing solutions. This trend not only enhances the surgical sutures market but also positions the GCC as a competitive player in the global healthcare landscape.

Growing Healthcare Expenditure

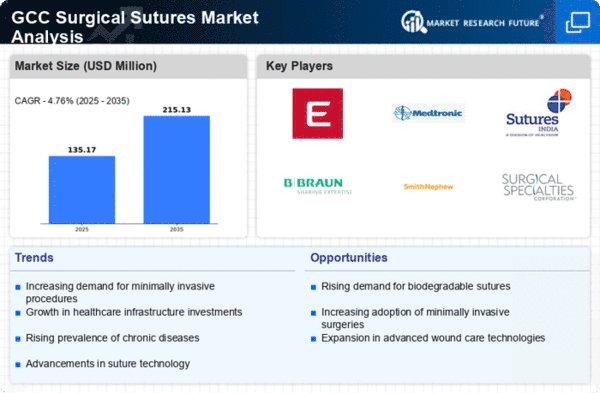

Healthcare expenditure in the GCC countries has been on an upward trajectory, which significantly impacts the surgical sutures market. Governments and private sectors are investing heavily in healthcare infrastructure, leading to improved access to surgical services. For instance, the healthcare spending in the GCC is projected to reach $100 billion by 2025, reflecting a compound annual growth rate (CAGR) of around 10%. This increase in funding allows for the procurement of high-quality surgical sutures, including innovative materials and designs that enhance surgical outcomes. As healthcare facilities upgrade their equipment and supplies, the demand for advanced suturing products is likely to rise, further stimulating the surgical sutures market.

Increasing Surgical Procedures

The rising number of surgical procedures in the GCC region is a primary driver for the surgical sutures market. As healthcare facilities expand and improve their capabilities, the demand for surgical interventions increases. This trend is particularly evident in specialties such as orthopedics, cardiology, and general surgery. According to recent data, the number of surgeries performed annually in the GCC has seen a growth rate of approximately 8% over the past few years. This surge in surgical activity necessitates a corresponding increase in the availability and variety of surgical sutures. Consequently, healthcare providers are seeking advanced suturing solutions to enhance patient outcomes, thereby propelling the surgical sutures market forward.

Rising Awareness of Surgical Safety

There is a growing awareness of surgical safety and patient outcomes among healthcare professionals and patients in the GCC. This heightened focus on safety is driving the demand for high-quality surgical sutures that minimize complications and enhance healing. Healthcare providers are increasingly prioritizing the selection of sutures based on their biocompatibility and effectiveness. As a result, manufacturers are compelled to innovate and produce sutures that meet these safety standards. The emphasis on surgical safety is likely to influence purchasing decisions, thereby impacting the surgical sutures market positively. This trend reflects a broader commitment to improving patient care and outcomes in the region.

Technological Innovations in Suturing Techniques

Technological advancements in suturing techniques are reshaping the surgical sutures market. Innovations such as minimally invasive surgery and robotic-assisted procedures are becoming more prevalent in the GCC region. These techniques often require specialized sutures that can accommodate unique surgical needs. The introduction of smart sutures, which can monitor healing and provide real-time feedback, is also gaining traction. As healthcare providers adopt these advanced techniques, the demand for innovative suturing solutions is expected to increase. This shift towards technology-driven surgical practices indicates a promising future for the surgical sutures market, as it aligns with the evolving needs of modern surgical procedures.