Evolving Consumer Expectations

Consumer expectations in the GCC are evolving rapidly, with a growing demand for seamless and secure transaction experiences. The transaction monitoring market is adapting to these changes by integrating advanced technologies that enhance user experience while ensuring compliance with regulatory standards. In 2025, it is projected that 70% of consumers will prefer digital banking solutions that offer real-time transaction monitoring capabilities. This shift is compelling financial institutions to invest in sophisticated monitoring systems that not only detect fraudulent activities but also provide customers with instant alerts and insights. Consequently, the transaction monitoring market is poised for growth as organizations strive to meet these heightened consumer expectations.

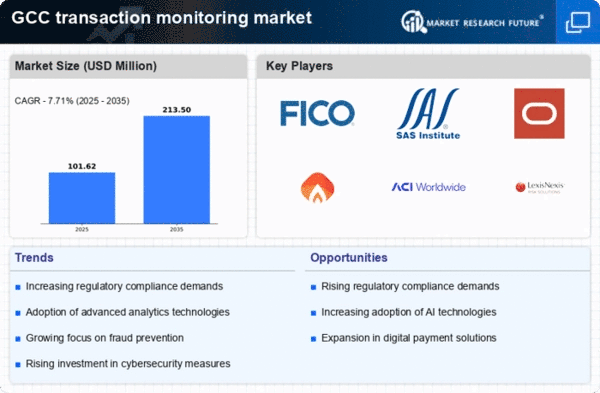

Regulatory Landscape Evolution

The regulatory landscape in the GCC is evolving, with authorities implementing stricter compliance requirements for financial institutions. This shift is driving the transaction monitoring market as organizations seek to align their operations with new regulations. In 2025, it is anticipated that compliance costs for banks in the region could rise by 20%, prompting a surge in demand for automated transaction monitoring solutions. These systems enable organizations to efficiently track and report suspicious activities, thereby reducing the risk of non-compliance penalties. As regulatory pressures continue to mount, the transaction monitoring market is likely to expand, providing essential tools for financial institutions to navigate this complex environment.

Increasing Cybersecurity Threats

The transaction monitoring market is experiencing heightened demand due to the increasing prevalence of cybersecurity threats. Financial institutions in the GCC are under pressure to enhance their security measures to protect sensitive customer data and prevent fraud. In 2025, it is estimated that cybercrime could cost the global economy over $10 trillion annually, prompting GCC banks to invest significantly in transaction monitoring solutions. This investment is aimed at identifying suspicious activities in real-time, thereby mitigating risks associated with data breaches and financial fraud. As a result, the transaction monitoring market is likely to see substantial growth as organizations prioritize cybersecurity in their operational strategies.

Rise of Digital Payment Solutions

The rise of digital payment solutions in the GCC is significantly impacting the transaction monitoring market. As more consumers and businesses adopt digital payment methods, the volume of transactions is increasing, necessitating robust monitoring systems to detect fraudulent activities. In 2025, it is projected that digital payments in the region will surpass $100 billion, creating a pressing need for effective transaction monitoring solutions. Financial institutions are investing in advanced technologies to ensure that they can manage this influx of transactions while maintaining compliance with regulatory standards. Consequently, the transaction monitoring market is expected to grow as organizations seek to enhance their monitoring capabilities in response to this digital transformation.

Adoption of Artificial Intelligence

The adoption of artificial intelligence (AI) technologies is transforming the transaction monitoring market in the GCC. Financial institutions are increasingly leveraging AI to enhance their monitoring capabilities, enabling them to analyze vast amounts of transaction data in real-time. By 2025, it is expected that AI-driven solutions will account for over 30% of the transaction monitoring market, as organizations seek to improve accuracy and reduce false positives. This technological advancement allows for more efficient detection of fraudulent activities, ultimately leading to better customer trust and satisfaction. As AI continues to evolve, its integration into transaction monitoring systems is likely to drive significant market growth.