Rising Healthcare Expenditure

Healthcare expenditure in Germany is on an upward trajectory, which is positively impacting the biopharmaceuticals market. As the government and private sectors allocate more resources to healthcare, spending on innovative therapies is expected to increase. In 2025, total healthcare spending is projected to reach €500 billion, with a significant portion directed towards biopharmaceuticals. This trend is indicative of a broader commitment to improving health outcomes and ensuring access to cutting-edge treatments for patients. The rising expenditure not only supports the growth of the biopharmaceuticals market but also encourages research and development initiatives, fostering a robust ecosystem for innovation in the sector.

Growing Focus on Rare Diseases

The biopharmaceuticals market in Germany is increasingly oriented towards addressing rare diseases, which often lack effective treatment options. This focus is driven by a combination of patient advocacy and regulatory incentives, such as orphan drug designations that provide financial benefits and market exclusivity for developers. In 2025, it is anticipated that the market for orphan drugs will constitute approximately 25% of the overall biopharmaceuticals market, reflecting a growing recognition of the need for targeted therapies. The increasing prevalence of rare diseases, coupled with advancements in genetic research, is likely to spur innovation in this area, positioning Germany as a leader in the development of specialized biopharmaceuticals.

Supportive Government Policies

The German government is actively fostering a conducive environment for the biopharmaceuticals market through supportive policies and funding initiatives. In recent years, substantial investments have been made in research and development, with the government allocating over €1 billion annually to biotechnology initiatives. This financial backing is aimed at promoting innovation and facilitating the commercialization of new biopharmaceutical products. Additionally, regulatory frameworks are being streamlined to expedite the approval processes for new therapies, thereby encouraging investment in the sector. Such government support is crucial for maintaining Germany's competitive edge in the biopharmaceuticals market, as it attracts both domestic and international players to invest in research and development activities.

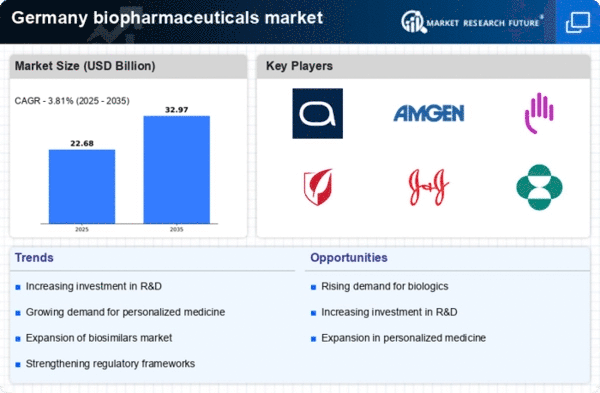

Increasing Demand for Biologics

The biopharmaceuticals market in Germany is experiencing a notable surge in demand for biologics, driven by their efficacy in treating complex diseases. Biologics, which include monoclonal antibodies and therapeutic proteins, are becoming increasingly preferred due to their targeted action and reduced side effects. In 2025, the market for biologics is projected to reach approximately €20 billion, reflecting a growth rate of around 8% annually. This trend is indicative of a broader shift towards advanced therapeutic options, as healthcare providers and patients alike seek more effective treatments. The increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, further fuels this demand, positioning the biopharmaceuticals market as a critical component of the healthcare landscape in Germany.

Technological Advancements in Drug Development

Technological innovations are playing a pivotal role in shaping the biopharmaceuticals market in Germany. The integration of artificial intelligence (AI) and machine learning in drug discovery processes is streamlining research and development, significantly reducing the time required to bring new therapies to market. In 2025, it is estimated that AI-driven drug development could decrease costs by up to 30%, enhancing the overall efficiency of the biopharmaceuticals market. Furthermore, advancements in biomanufacturing technologies are enabling the production of complex biologics at scale, ensuring that the growing demand is met. These technological strides not only improve the speed and cost-effectiveness of drug development but also enhance the quality and safety of biopharmaceutical products.