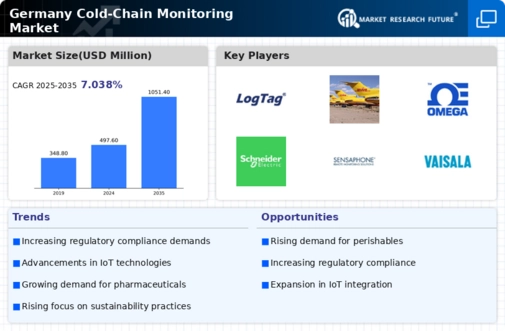

Increasing Regulatory Standards

The cold chain-monitoring market is being driven by stringent regulatory standards imposed by the German government and the European Union. Regulations concerning food safety and quality assurance are becoming more rigorous, necessitating comprehensive monitoring systems to comply with these standards. Companies are required to maintain detailed records of temperature and humidity levels throughout the supply chain, which has led to a surge in demand for advanced monitoring solutions. In 2025, it is estimated that compliance-related investments in cold chain technologies will exceed €1 billion in Germany. This regulatory landscape compels businesses to adopt sophisticated monitoring systems, thereby fostering growth in the cold chain-monitoring market. Failure to comply with these regulations can result in severe penalties, further incentivizing companies to invest in reliable monitoring solutions.

Rising Demand for Perishable Goods

The increasing consumption of perishable goods in Germany is a primary driver for the cold chain-monitoring market. As consumers become more health-conscious, the demand for fresh produce, dairy products, and meat has surged. This trend necessitates robust cold chain solutions to ensure product quality and safety. In 2025, the market for perishable goods is projected to reach €200 billion, indicating a substantial opportunity for cold chain-monitoring technologies. The need for precise temperature control and tracking during transportation and storage is paramount, as even minor deviations can lead to spoilage and financial losses. Consequently, businesses are investing in advanced monitoring systems to maintain the integrity of their supply chains, thereby propelling the growth of the cold chain-monitoring market in Germany.

Growth of the Pharmaceutical Sector

The pharmaceutical sector in Germany is experiencing robust growth, which is a significant driver for the cold chain-monitoring market. With the increasing production and distribution of temperature-sensitive medications and vaccines, the need for effective cold chain solutions is paramount. The pharmaceutical industry is projected to reach €50 billion by 2025, with a substantial portion of this growth attributed to biologics and specialty drugs that require strict temperature control. As a result, pharmaceutical companies are investing heavily in cold chain-monitoring technologies to ensure product efficacy and safety. This trend is likely to bolster the cold chain-monitoring market, as companies seek to implement reliable systems that can track and maintain optimal conditions throughout the supply chain.

Consumer Awareness and Demand for Transparency

There is a growing consumer awareness regarding food safety and quality in Germany, which is driving the cold chain-monitoring market. Consumers are increasingly demanding transparency in the supply chain, seeking assurance that products have been stored and transported under optimal conditions. This shift in consumer behavior is prompting companies to adopt advanced monitoring solutions that provide real-time data on temperature and humidity levels. In 2025, it is anticipated that 60% of consumers will prioritize purchasing from brands that demonstrate a commitment to quality and safety. This demand for transparency is likely to encourage businesses to invest in cold chain-monitoring technologies, thereby enhancing their competitive edge in the market. As a result, the cold chain-monitoring market is expected to expand significantly in response to these evolving consumer expectations.

Technological Advancements in Monitoring Solutions

Technological innovations are significantly influencing the cold chain-monitoring market. The integration of IoT devices, blockchain technology, and AI-driven analytics is enhancing the efficiency and reliability of cold chain operations. In Germany, the adoption of smart sensors and real-time tracking systems is on the rise, allowing companies to monitor temperature and humidity levels with unprecedented accuracy. This technological evolution not only reduces waste but also improves compliance with safety regulations. As of 2025, the market for IoT-enabled cold chain solutions is expected to grow by 25%, reflecting the increasing reliance on technology to optimize supply chain processes. These advancements are likely to reshape the landscape of the cold chain-monitoring market, making it more resilient and responsive to market demands.