Growth of Online Grocery Shopping

The rise of online grocery shopping in Japan is significantly impacting the cold chain-monitoring market. As more consumers opt for home delivery services, retailers are compelled to enhance their cold chain logistics to ensure the freshness of perishable items. This shift in consumer behavior is expected to drive the cold chain-monitoring market, as businesses invest in technologies that provide real-time tracking and monitoring of temperature-sensitive goods. By 2025, the online grocery market is projected to grow by over 40%, creating a substantial demand for effective cold chain solutions. Retailers must implement robust monitoring systems to maintain product quality and comply with safety regulations, thereby positioning the cold chain-monitoring market as a critical component of the evolving retail landscape.

Rising Demand for Perishable Goods

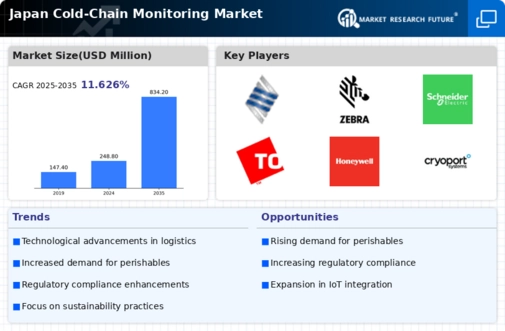

The increasing consumption of perishable goods in Japan is a primary driver for the cold chain-monitoring market. As consumers become more health-conscious, the demand for fresh produce, dairy products, and meat has surged. This trend necessitates robust cold chain solutions to ensure product quality and safety. In 2025, the market for perishable goods is projected to reach approximately $200 billion, highlighting the need for effective monitoring systems. The cold chain-monitoring market plays a crucial role in maintaining optimal temperature and humidity levels, thereby reducing spoilage and waste. This growing demand for perishable items is likely to propel investments in advanced monitoring technologies, ensuring compliance with safety standards and enhancing consumer trust in food quality.

Expansion of the Pharmaceutical Sector

The pharmaceutical sector in Japan is experiencing rapid growth, which is driving demand for the cold chain-monitoring market. With the increasing production of temperature-sensitive medications and vaccines, the need for reliable cold chain solutions has become paramount. The market for pharmaceuticals is projected to reach $100 billion by 2026, necessitating stringent monitoring to ensure product efficacy. Cold chain-monitoring systems are critical in maintaining the required temperature ranges for these products, thereby preventing spoilage and ensuring patient safety. As the pharmaceutical industry continues to expand, the cold chain-monitoring market is likely to see substantial growth, as companies invest in advanced technologies to safeguard their products during transportation and storage.

Increased Focus on Food Safety Regulations

Japan's stringent food safety regulations are a significant driver for the cold chain-monitoring market. The government has implemented rigorous standards to ensure the safety and quality of food products, particularly in the wake of foodborne illnesses. Compliance with these regulations necessitates the use of advanced monitoring systems to track temperature and humidity levels throughout the supply chain. As of 2025, the cold chain-monitoring market is expected to grow by approximately 25% due to the heightened emphasis on regulatory compliance. Companies that fail to adhere to these standards risk facing severe penalties and reputational damage. Therefore, the cold chain-monitoring market is essential for businesses aiming to meet regulatory requirements and maintain consumer confidence.

Technological Integration in Supply Chains

The integration of advanced technologies such as IoT and blockchain into supply chains is significantly influencing the cold chain-monitoring market. In Japan, companies are increasingly adopting these technologies to enhance visibility and traceability throughout the supply chain. IoT devices enable real-time monitoring of temperature and humidity, while blockchain ensures data integrity and transparency. This technological shift is expected to drive the cold chain-monitoring market, as businesses seek to optimize operations and reduce losses. By 2026, the market for IoT in supply chain management is anticipated to grow by over 30%, indicating a strong trend towards digital transformation. The cold chain-monitoring market is poised to benefit from these advancements, as they facilitate better decision-making and improve overall efficiency.