Increased Healthcare Expenditure

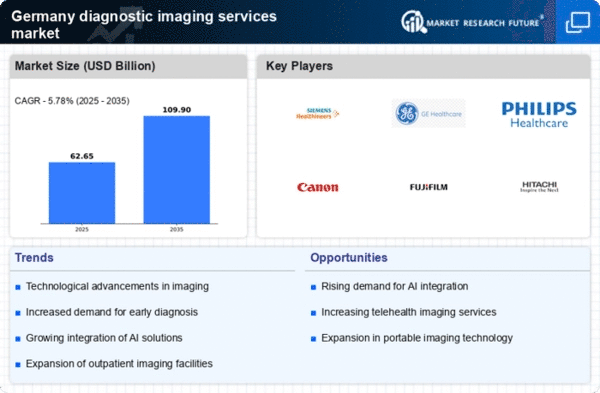

The diagnostic imaging-services market in Germany is benefiting from increased healthcare expenditure, which is projected to rise by approximately 4% annually. This growth in spending is primarily driven by government initiatives aimed at improving healthcare infrastructure and access to advanced medical technologies. As funding for healthcare expands, hospitals and clinics are more likely to invest in diagnostic imaging services, enhancing their capabilities and service offerings. The German government has prioritized healthcare funding, which is expected to reach €500 billion by 2025. This financial commitment is likely to facilitate the acquisition of cutting-edge imaging technologies, thereby propelling the diagnostic imaging-services market forward. Increased healthcare expenditure is a crucial driver, as it enables healthcare providers to meet the growing demand for imaging services.

Rising Awareness of Early Diagnosis

There is a growing awareness among the German population regarding the importance of early diagnosis, which is significantly influencing the diagnostic imaging-services market. Public health campaigns and educational initiatives are emphasizing the benefits of preventive healthcare, leading to an increase in patient demand for diagnostic imaging services. This heightened awareness is likely to result in more individuals seeking imaging tests for early detection of diseases, thereby driving market growth. As patients become more proactive about their health, healthcare providers are expected to respond by expanding their diagnostic imaging offerings. The trend towards early diagnosis is a vital driver for the diagnostic imaging-services market, as it aligns with the broader shift towards preventive healthcare in Germany.

Regulatory Support for Imaging Innovations

The regulatory environment in Germany is increasingly supportive of innovations in the diagnostic imaging-services market. Regulatory bodies are streamlining approval processes for new imaging technologies, which encourages the development and adoption of advanced diagnostic tools. This supportive framework is likely to foster innovation, enabling healthcare providers to access cutting-edge imaging solutions more rapidly. As regulations evolve to accommodate new technologies, the market is expected to witness an influx of innovative imaging services. The facilitation of regulatory processes is a significant driver for the diagnostic imaging-services market, as it not only enhances the availability of advanced imaging options but also promotes competition among service providers.

Aging Population and Rising Chronic Diseases

Germany's demographic shift towards an aging population is significantly impacting the diagnostic imaging-services market. As the population ages, the prevalence of chronic diseases such as cardiovascular conditions and cancer is increasing. This demographic trend necessitates more frequent diagnostic imaging procedures, as early detection is crucial for effective treatment. Reports indicate that by 2030, nearly 25% of the German population will be over 65 years old, leading to a projected increase in imaging services demand. Consequently, healthcare providers are likely to expand their diagnostic imaging capabilities to cater to this growing need, thereby driving market growth. The correlation between an aging population and the rising incidence of chronic diseases is a pivotal factor influencing the diagnostic imaging-services market.

Technological Advancements in Imaging Equipment

The diagnostic imaging-services market in Germany is experiencing a surge in technological advancements, particularly in imaging equipment. Innovations such as high-resolution MRI and CT scanners are enhancing diagnostic accuracy and efficiency. The integration of advanced imaging modalities is expected to increase the market's value, projected to reach approximately €3 billion by 2026. These advancements not only improve patient outcomes but also streamline workflows in healthcare facilities. As hospitals and clinics invest in state-of-the-art technology, the demand for diagnostic imaging services is likely to rise, reflecting a growing trend towards precision medicine. This evolution in imaging technology is a key driver for the diagnostic imaging-services market, as it enables healthcare providers to offer more effective and timely diagnoses.