Rising Demand for Early Diagnosis

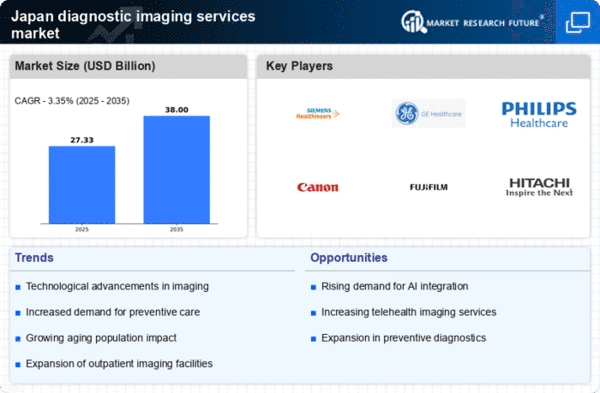

The increasing emphasis on early diagnosis in the healthcare sector is a pivotal driver for the diagnostic imaging-services market. In Japan, healthcare providers are increasingly adopting advanced imaging technologies to facilitate timely and accurate diagnoses. This trend is underscored by a growing awareness among patients regarding the benefits of early detection of diseases, particularly cancer and cardiovascular conditions. As a result, the market is projected to witness a compound annual growth rate (CAGR) of approximately 6.5% over the next few years. The integration of imaging services into routine health check-ups further propels this demand, as patients seek comprehensive evaluations to ensure their well-being. Consequently, the diagnostic imaging-services market is likely to expand significantly, driven by the need for efficient diagnostic solutions.

Investment in Healthcare Infrastructure

Japan's commitment to enhancing its healthcare infrastructure serves as a crucial driver for the diagnostic imaging-services market. The government has allocated substantial funding to modernize healthcare facilities, which includes upgrading imaging equipment and technology. This investment is expected to reach approximately ¥1 trillion by 2027, reflecting a strong focus on improving diagnostic capabilities. Enhanced infrastructure not only facilitates the adoption of advanced imaging modalities but also ensures that healthcare providers can deliver high-quality services to patients. As hospitals and clinics upgrade their facilities, the demand for diagnostic imaging services is likely to increase, thereby fostering growth in the market. This trend indicates a robust future for the diagnostic imaging-services market, as infrastructure improvements align with the evolving needs of the population.

Technological Integration in Healthcare

The integration of cutting-edge technologies into healthcare practices is transforming the diagnostic imaging-services market. In Japan, the adoption of artificial intelligence (AI) and machine learning in imaging analysis is gaining traction, enhancing the accuracy and efficiency of diagnoses. These technologies can potentially reduce the time required for image interpretation, thereby improving patient outcomes. Furthermore, the market is witnessing a shift towards telemedicine, where remote imaging consultations are becoming more prevalent. This trend is likely to expand access to diagnostic services, particularly in rural areas. As healthcare providers increasingly leverage technology to optimize imaging services, the diagnostic imaging-services market is expected to experience substantial growth, driven by innovation and improved service delivery.

Increased Health Awareness Among Population

The rising health consciousness among the Japanese population is a significant driver for the diagnostic imaging services market. As individuals become more proactive about their health, there is a growing inclination towards preventive healthcare measures, including regular imaging tests. This trend is reflected in the increasing number of health screenings and check-ups that incorporate diagnostic imaging services. According to recent statistics, approximately 40% of adults in Japan participate in annual health check-ups, many of which include imaging procedures. This heightened awareness not only boosts demand for imaging services but also encourages healthcare providers to offer comprehensive diagnostic solutions. Consequently, the diagnostic imaging-services market is poised for growth as more individuals seek to monitor their health proactively.

Government Initiatives for Healthcare Improvement

Government initiatives aimed at improving healthcare access and quality are significantly influencing the diagnostic imaging-services market. In Japan, policies promoting universal healthcare coverage have led to increased accessibility to diagnostic services for the population. The government has implemented various programs to subsidize imaging costs, making these services more affordable for patients. Additionally, initiatives to enhance training for radiologists and technicians are expected to improve the quality of imaging services. As a result, The diagnostic imaging services market is likely to benefit from increased utilization of imaging technologies, driven by supportive government policies. This alignment between government efforts and market needs suggests a promising outlook for the diagnostic imaging-services market in Japan.