Rising Demand in Agriculture

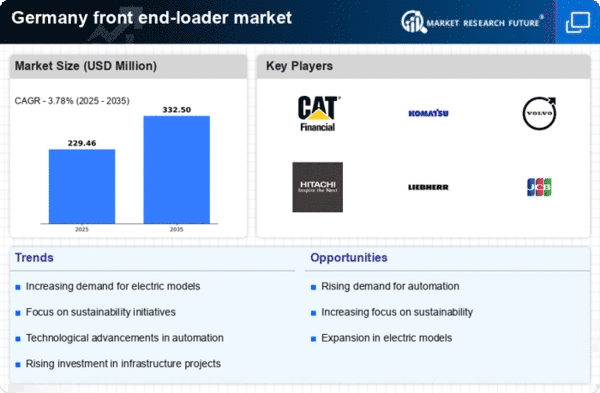

The agricultural sector in Germany is witnessing a notable increase in the adoption of advanced machinery, including front end-loaders. With the push for higher productivity and efficiency in farming practices, farmers are increasingly investing in versatile equipment that can handle various tasks, such as loading, transporting, and material handling. The front end-loader market is likely to see a growth rate of approximately 5% annually, driven by the need for mechanization in agriculture. Furthermore, the trend towards larger farms and the consolidation of agricultural operations necessitate the use of robust machinery capable of managing heavier loads. As farmers seek to optimize their operations, the demand for front end-loaders that offer enhanced performance and reliability is expected to rise, thereby positively impacting the market.

Infrastructure Development Initiatives

The front end-loader market in Germany is experiencing a boost due to ongoing infrastructure development initiatives. The German government has committed substantial funding, amounting to €10 billion, for the enhancement of transportation networks, including roads and bridges. This investment is likely to increase the demand for construction equipment, particularly front end-loaders, which are essential for earthmoving and material handling tasks. As urbanization continues to rise, municipalities are also investing in public works projects, further driving the need for efficient machinery. The front end-loader market is poised to benefit from these developments, as contractors seek reliable equipment to meet project deadlines and specifications. Additionally, the emphasis on modernizing existing infrastructure may lead to a surge in replacement demand for older machinery, thereby creating further opportunities for growth in the sector.

Technological Integration in Equipment

The integration of advanced technologies into construction equipment is transforming the front end-loader market in Germany. Innovations such as telematics, automation, and smart sensors are enhancing the operational efficiency and safety of front end-loaders. These technologies allow for real-time monitoring of equipment performance, predictive maintenance, and improved fuel efficiency, which are crucial for contractors aiming to reduce operational costs. The front end-loader market is likely to see a shift towards more technologically advanced models, as companies prioritize investments in equipment that can provide a competitive edge. Additionally, the growing emphasis on data-driven decision-making in construction projects may further accelerate the adoption of smart machinery, thereby creating new avenues for growth within the market.

Environmental Regulations and Compliance

In Germany, stringent environmental regulations are shaping the front end-loader market. The government has implemented policies aimed at reducing emissions and promoting sustainable practices within the construction industry. As a result, manufacturers are compelled to develop front end-loaders that comply with these regulations, often incorporating cleaner technologies and alternative fuel options. The front end-loader market is likely to experience a shift towards eco-friendly models, which may command a premium price due to their advanced features. This regulatory landscape not only influences product development but also encourages companies to invest in research and development to meet compliance standards. Consequently, the market may see an increase in demand for innovative machinery that aligns with environmental goals, thereby fostering a more sustainable construction sector.

Increased Investment in Renewable Energy Projects

The front end-loader market in Germany is benefiting from the rising investment in renewable energy projects. As the country transitions towards sustainable energy sources, significant resources are being allocated to the development of wind farms, solar parks, and other renewable infrastructure. This shift necessitates the use of heavy machinery, including front end-loaders, for site preparation and material handling. The front end-loader market is likely to see a surge in demand as contractors engage in these large-scale projects, which require efficient and reliable equipment. Furthermore, the emphasis on renewable energy aligns with Germany's broader environmental objectives, potentially leading to long-term growth opportunities for manufacturers and suppliers within the market.