Aging Population

Germany's aging population is a significant driver for the glycine supplement market. As the demographic shifts towards an older age group, there is an increasing focus on health maintenance and quality of life. Glycine, with its potential benefits in supporting cognitive function and muscle health, appeals to older adults seeking to enhance their vitality. According to recent statistics, approximately 22% of the German population is aged 65 and older, a figure that is expected to rise. This demographic trend suggests a growing market for supplements that cater to the specific health needs of older individuals, thereby bolstering the glycine supplement market.

E-commerce Growth

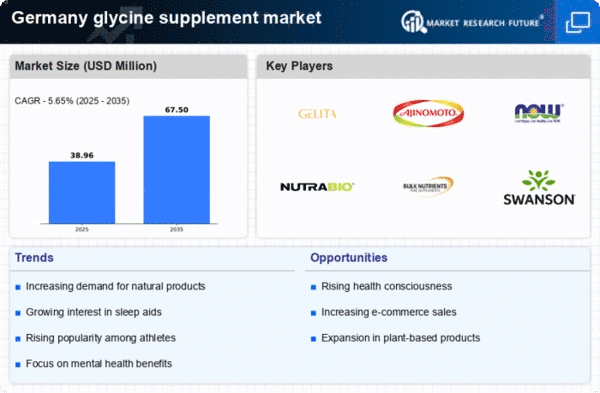

The expansion of e-commerce platforms is significantly impacting the glycine supplement market in Germany. With the convenience of online shopping, consumers are increasingly turning to digital channels to purchase health supplements. This shift is supported by a growing trend of health-conscious consumers who prefer to research and buy products online. E-commerce sales of dietary supplements in Germany are expected to account for over 30% of total sales by 2025. This trend not only broadens the reach of glycine supplements but also allows for better consumer education and access to a variety of products, thereby enhancing market growth.

Increasing Health Awareness

The glycine supplement market in Germany is experiencing growth due to a notable increase in health awareness among consumers. Individuals are becoming more conscious of their dietary choices and the impact of supplements on overall well-being. This trend is reflected in the rising demand for natural and organic products, with the market for dietary supplements projected to reach €3 billion by 2026. As consumers seek to enhance their health through supplements, glycine, known for its potential benefits in promoting sleep quality and muscle recovery, is gaining traction. The emphasis on preventive healthcare is likely to further drive the glycine supplement market, as more people turn to supplements to support their health goals.

Scientific Research and Innovation

Ongoing scientific research and innovation in the field of dietary supplements are driving the glycine supplement market in Germany. New studies highlighting the benefits of glycine, such as its potential role in improving sleep quality and reducing anxiety, are emerging. This research fosters consumer trust and encourages informed purchasing decisions. Furthermore, advancements in supplement formulation and delivery methods are enhancing the efficacy of glycine products. As the market becomes more competitive, companies are likely to invest in research and development to create innovative glycine supplements, thereby stimulating market growth and attracting a broader consumer base.

Rising Popularity of Fitness and Wellness

The glycine supplement market in Germany is benefiting from the rising popularity of fitness and wellness trends. As more individuals engage in physical activities and prioritize their health, the demand for supplements that support exercise recovery and muscle repair is increasing. Glycine, recognized for its role in collagen synthesis and muscle recovery, is becoming a preferred choice among fitness enthusiasts. The fitness industry in Germany is projected to grow by 5% annually, indicating a robust market for supplements that enhance performance and recovery. This trend is likely to propel the glycine supplement market as consumers seek effective solutions to optimize their fitness journeys.