Expansion of Nutraceuticals Market

The glycine supplement market in South America is benefiting from the broader expansion of the nutraceuticals market. As consumers become more aware of the health benefits associated with dietary supplements, the demand for nutraceutical products is on the rise. This growth is driven by an increasing focus on preventive healthcare and the desire for products that enhance health and longevity. The nutraceuticals market in South America is projected to reach $10 billion by 2027, with glycine supplements likely to capture a share of this expanding market. The integration of glycine into various formulations, such as functional foods and beverages, further enhances its market potential. This trend indicates a promising future for the glycine supplement market as it aligns with consumer preferences for health-oriented products.

Growing Awareness of Sleep Disorders

The glycine supplement market in South America is significantly influenced by the increasing awareness of sleep disorders. As more individuals recognize the importance of quality sleep for overall health, the demand for supplements that promote better sleep patterns is on the rise. Research suggests that glycine may improve sleep quality by lowering body temperature and promoting relaxation. This has led to a growing consumer base seeking glycine supplements as a natural remedy for sleep-related issues. Market analysis reveals that the sleep aid segment is projected to grow by 20% in the next five years, indicating a robust opportunity for glycine products. As awareness of sleep health continues to expand, the glycine supplement market is likely to benefit from this trend.

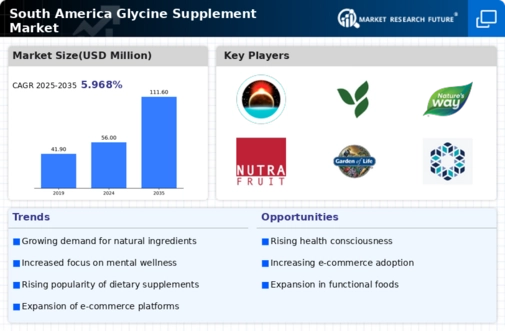

Increasing Demand for Natural Ingredients

The glycine supplement market in South America experiences a notable surge in demand for natural ingredients. Consumers are increasingly inclined towards products that are perceived as safe and derived from natural sources. This trend is particularly pronounced among health-conscious individuals who prefer supplements that align with their lifestyle choices. The market data indicates that the demand for natural supplements has grown by approximately 15% annually in recent years. This shift towards natural ingredients is likely to drive the glycine supplement market, as manufacturers adapt their offerings to meet consumer preferences for clean-label products. Furthermore, the rise of organic farming practices in South America supports the availability of high-quality glycine, enhancing its appeal among consumers seeking holistic health solutions.

Influence of Social Media and Online Communities

The glycine supplement market in South America is increasingly shaped by the influence of social media and online communities. As consumers turn to digital platforms for health information and product recommendations, the visibility of glycine supplements is enhanced. Influencers and health advocates play a crucial role in promoting the benefits of glycine, leading to increased consumer interest and engagement. Market Research Future suggests that social media marketing strategies can boost product awareness by up to 30%. This trend indicates that the glycine supplement market must leverage digital channels to reach a broader audience. The growing reliance on online reviews and community discussions further emphasizes the importance of maintaining a positive online presence to attract potential customers.

Rising Popularity of Fitness and Wellness Trends

The glycine supplement market in South America is positively impacted by the rising popularity of fitness and wellness trends. As more individuals engage in fitness activities and prioritize their health, the demand for supplements that support muscle recovery and overall well-being is increasing. Glycine, known for its role in collagen synthesis and muscle repair, is gaining traction among athletes and fitness enthusiasts. Market data indicates that the sports nutrition segment is expected to grow by 25% over the next few years, creating a favorable environment for glycine supplements. This trend reflects a broader shift towards proactive health management, positioning the glycine supplement market as a key player in the wellness sector.