Rising Prevalence of Chronic Diseases

The increasing incidence of chronic diseases in Germany is a pivotal driver for the interventional radiology-products market. Conditions such as cardiovascular diseases, cancer, and diabetes necessitate advanced treatment options. According to recent health statistics, chronic diseases account for approximately 70% of all deaths in Germany, highlighting the urgent need for effective medical interventions. Interventional radiology offers minimally invasive solutions that can significantly improve patient outcomes. As the population ages and the prevalence of these diseases rises, the demand for innovative interventional radiology products is expected to grow. This trend is likely to stimulate investments in research and development, further enhancing the capabilities of interventional radiology techniques and products in the healthcare sector.

Increased Awareness and Patient Education

There is a growing awareness among patients regarding the benefits of interventional radiology procedures, which is positively impacting the market. Educational initiatives by healthcare providers and organizations are informing patients about the advantages of minimally invasive treatments, such as shorter recovery times and reduced hospital stays. In Germany, surveys indicate that approximately 60% of patients are now more informed about interventional radiology options compared to previous years. This heightened awareness is likely to lead to increased patient demand for these procedures, thereby driving the interventional radiology-products market. As patients become more proactive in their healthcare decisions, the market is expected to expand, reflecting the shift towards patient-centered care.

Regulatory Support for Innovative Treatments

Regulatory frameworks in Germany are increasingly supportive of innovative treatments, which is a crucial driver for the interventional radiology-products market. The German Medicines Agency (BfArM) has streamlined the approval processes for new medical devices and technologies, facilitating quicker access to market for innovative interventional products. This regulatory environment encourages manufacturers to invest in research and development, leading to the introduction of advanced interventional radiology solutions. As a result, the market is likely to witness a surge in new product launches, enhancing the overall treatment landscape. The supportive regulatory climate not only fosters innovation but also ensures that patients have access to the latest and most effective interventional radiology products.

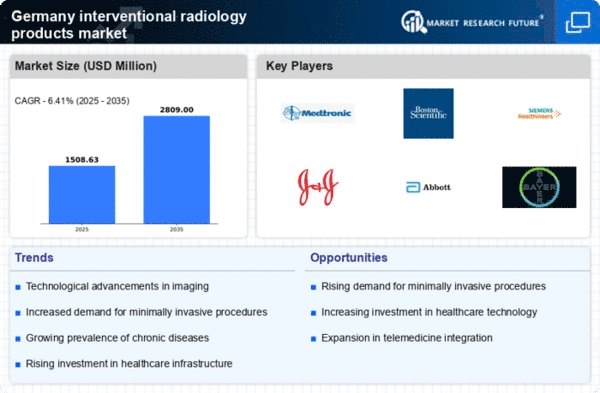

Growing Investment in Healthcare Infrastructure

The expansion of healthcare infrastructure in Germany is a significant driver for the interventional radiology products market. The government and private sector are investing heavily in modernizing hospitals and clinics, which includes upgrading interventional radiology facilities. Recent reports indicate that healthcare spending in Germany is projected to reach €500 billion by 2026, with a substantial portion allocated to advanced medical technologies. This investment is expected to enhance the availability and accessibility of interventional radiology services, thereby increasing the demand for related products. As healthcare facilities adopt state-of-the-art equipment and technologies, the interventional radiology-products market is likely to experience robust growth, driven by the need for efficient and effective treatment options.

Technological Innovations in Imaging Techniques

Technological advancements in imaging modalities are transforming the interventional radiology-products market. Innovations such as 3D imaging, real-time ultrasound, and advanced CT scans are enhancing the precision and effectiveness of interventional procedures. These technologies allow for better visualization of anatomical structures, which is crucial for successful interventions. In Germany, the adoption of these advanced imaging techniques is on the rise, with a reported increase of 15% in the use of 3D imaging in interventional procedures over the past year. This trend not only improves patient safety but also expands the range of treatable conditions, thereby driving the demand for interventional radiology products. As healthcare providers seek to enhance procedural outcomes, the integration of cutting-edge imaging technologies will likely continue to propel market growth.