Advancements in Imaging Technologies

Technological innovations in imaging modalities are playing a crucial role in shaping the interventional radiology-products market. Enhanced imaging techniques, such as MRI, CT, and ultrasound, provide real-time visualization, which is essential for the success of interventional procedures. These advancements not only improve the accuracy of diagnoses but also facilitate minimally invasive interventions, thereby increasing patient safety and satisfaction. The integration of artificial intelligence and machine learning into imaging technologies further enhances the capabilities of interventional radiology, allowing for more precise targeting of treatments. As these technologies continue to evolve, the interventional radiology-products market is expected to benefit from increased adoption rates among healthcare providers, ultimately leading to improved patient outcomes and operational efficiencies.

Aging Population and Healthcare Needs

The demographic shift towards an aging population in the US is significantly influencing the interventional radiology-products market. As individuals age, they are more susceptible to various health issues that often require interventional procedures. The US Census Bureau indicates that by 2030, all baby boomers will be over 65 years old, leading to a higher demand for healthcare services, including interventional radiology. This demographic trend suggests that healthcare providers will increasingly adopt interventional radiology techniques to address age-related health concerns, such as vascular diseases and tumors. Consequently, the interventional radiology-products market is likely to experience substantial growth as the healthcare system adapts to meet the needs of an older population, emphasizing the importance of innovative and effective treatment options.

Growing Focus on Patient-Centric Care

The shift towards patient-centric care in the US healthcare system is driving the interventional radiology-products market. Healthcare providers are increasingly prioritizing patient preferences and outcomes, leading to a greater emphasis on minimally invasive procedures that reduce recovery times and improve quality of life. This trend aligns with the growing body of evidence supporting the benefits of interventional radiology techniques, which often result in less pain and shorter hospital stays compared to traditional surgical methods. As patients become more informed and involved in their healthcare decisions, the demand for interventional radiology products is likely to rise. This focus on patient-centric care not only enhances patient satisfaction but also encourages healthcare systems to invest in innovative interventional radiology solutions, further propelling market growth.

Increasing Prevalence of Chronic Diseases

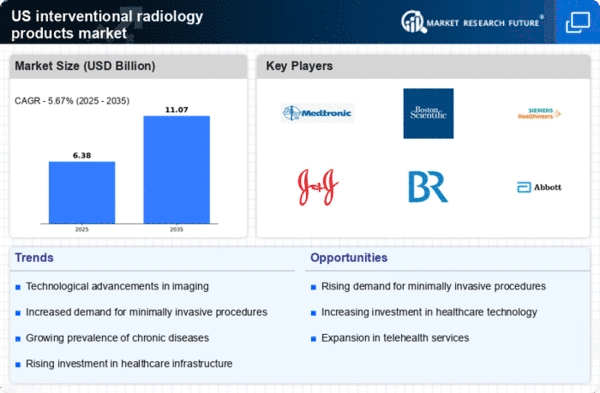

The rising incidence of chronic diseases such as cardiovascular disorders, cancer, and diabetes in the US is a primary driver for the interventional radiology-products market. As these conditions often require advanced diagnostic and therapeutic interventions, the demand for interventional radiology products is expected to grow. According to the Centers for Disease Control and Prevention (CDC), chronic diseases account for 7 out of 10 deaths each year in the US, highlighting the urgent need for effective treatment options. This trend suggests that healthcare providers are increasingly relying on interventional radiology techniques to manage these diseases, thereby propelling market growth. Furthermore, the interventional radiology-products market is projected to expand as healthcare systems adapt to the increasing burden of chronic conditions, necessitating innovative solutions to improve patient outcomes.

Increased Investment in Healthcare Infrastructure

Investment in healthcare infrastructure is a significant driver of the interventional radiology-products market. The US government and private sector are allocating substantial resources to enhance healthcare facilities, which includes upgrading interventional radiology departments. This investment is aimed at improving access to advanced medical technologies and ensuring that healthcare providers can deliver high-quality care. According to the American Hospital Association, hospitals in the US are expected to invest over $100 billion in capital projects in the coming years, which will likely include the acquisition of state-of-the-art interventional radiology equipment. As healthcare facilities expand and modernize, the interventional radiology-products market is poised for growth, as providers seek to incorporate the latest technologies to meet the evolving needs of patients.