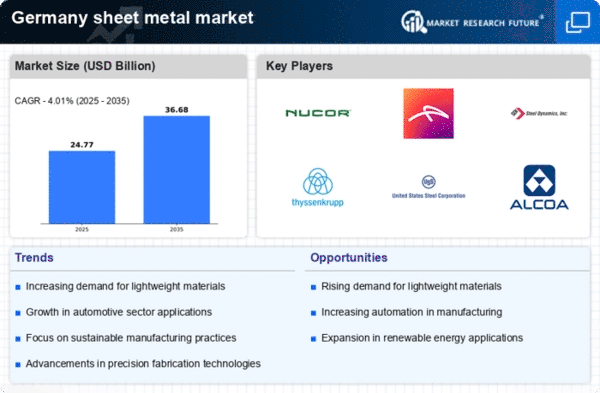

The sheet metal market in Germany is characterized by a competitive landscape that is increasingly shaped by innovation, sustainability, and strategic partnerships. Key players such as Thyssenkrupp AG (DE), ArcelorMittal (LU), and Nucor Corporation (US) are actively pursuing strategies that emphasize technological advancement and operational efficiency. Thyssenkrupp AG (DE), for instance, has been focusing on digital transformation initiatives to enhance production capabilities and reduce environmental impact, thereby positioning itself as a leader in sustainable manufacturing practices. Meanwhile, ArcelorMittal (LU) has been expanding its footprint in the renewable energy sector, indicating a strategic pivot towards greener solutions that align with global sustainability goals. These collective strategies not only enhance their competitive positioning but also contribute to a more dynamic market environment.In terms of business tactics, companies are increasingly localizing manufacturing to mitigate supply chain disruptions and optimize logistics. This approach appears to be particularly relevant in the context of rising energy costs and geopolitical uncertainties. The market structure is moderately fragmented, with a mix of large multinational corporations and smaller regional players. The influence of major companies is significant, as they set benchmarks for innovation and operational excellence, thereby shaping the competitive dynamics of the market.

In October Thyssenkrupp AG (DE) announced a partnership with a leading technology firm to develop advanced automation solutions for its sheet metal production lines. This strategic move is likely to enhance operational efficiency and reduce production costs, allowing Thyssenkrupp to maintain a competitive edge in a market that increasingly values technological integration. The collaboration underscores the importance of innovation in driving productivity and sustainability within the industry.

In September ArcelorMittal (LU) launched a new line of eco-friendly sheet metal products designed to meet the growing demand for sustainable materials in construction and automotive applications. This initiative not only reflects the company's commitment to sustainability but also positions it favorably against competitors who may not yet have adopted such environmentally conscious practices. The introduction of these products is expected to capture a significant share of the market, particularly among environmentally aware consumers and businesses.

In November Nucor Corporation (US) revealed plans to invest $500 million in expanding its sheet metal production capacity in Germany. This investment is indicative of Nucor's strategy to strengthen its presence in the European market and respond to increasing demand for high-quality steel products. By enhancing its production capabilities, Nucor aims to leverage its competitive advantages in cost efficiency and product quality, further solidifying its market position.

As of November the competitive trends in the sheet metal market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI) in manufacturing processes. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to innovate and meet evolving market demands. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future competitive differentiation will hinge on the ability to innovate and adapt to changing consumer preferences.