Rising Demand for Gene Therapies

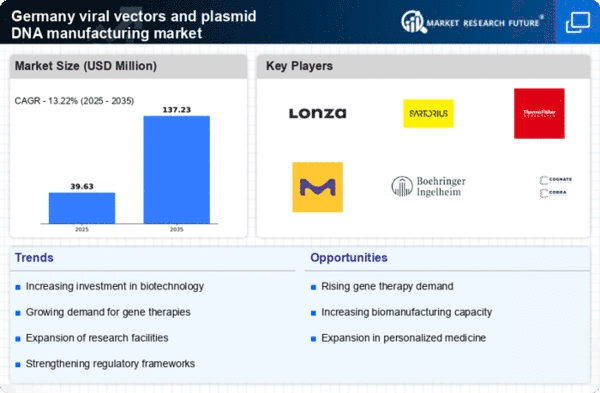

The increasing prevalence of genetic disorders and chronic diseases in Germany is driving the demand for innovative treatment solutions. The viral vectors-and-plasmid-dna-manufacturing market is experiencing growth as gene therapies become more mainstream. According to recent estimates, the gene therapy market in Germany is projected to reach approximately €1.5 billion by 2026, reflecting a compound annual growth rate (CAGR) of around 15%. This surge is attributed to advancements in genetic engineering and the growing acceptance of gene therapies among healthcare professionals and patients. As a result, manufacturers in the viral vectors-and-plasmid-dna-manufacturing market are likely to expand their production capabilities to meet this rising demand, thereby enhancing their market presence and competitiveness.

Increased Focus on Personalized Medicine

The shift towards personalized medicine is reshaping the landscape of the viral vectors-and-plasmid-dna-manufacturing market in Germany. As healthcare providers increasingly recognize the value of tailored therapies, there is a growing demand for viral vectors and plasmid DNA that can be customized to individual patient needs. This trend is likely to drive innovation in manufacturing processes, as companies strive to develop more flexible and adaptable production methods. Additionally, the market for personalized medicine is projected to grow significantly, with estimates suggesting it could reach €2 billion by 2027. This focus on individualized treatment options may lead to a more dynamic and competitive environment within the viral vectors-and-plasmid-dna-manufacturing market.

Regulatory Support for Advanced Therapies

The regulatory environment in Germany is evolving to support the development and commercialization of advanced therapies, including those utilizing viral vectors and plasmid DNA. Recent initiatives by regulatory bodies aim to streamline the approval process for gene therapies, which could significantly impact the viral vectors-and-plasmid-dna-manufacturing market. By providing clearer guidelines and faster review timelines, these regulations are likely to encourage investment and innovation within the sector. As a result, companies may find it easier to bring their products to market, thereby enhancing their competitive edge. This supportive regulatory framework could potentially lead to an increase in the number of approved therapies, further driving market growth.

Growing Collaboration Between Academia and Industry

The collaboration between academic institutions and industry players in Germany is fostering innovation in the viral vectors-and-plasmid-dna-manufacturing market. Universities and research centers are increasingly partnering with biotech companies to develop novel therapies and improve manufacturing processes. This synergy is expected to accelerate the translation of research findings into practical applications, thereby enhancing the market's growth potential. Furthermore, such collaborations often lead to increased funding opportunities, with public and private investments supporting joint research initiatives. As a result, the viral vectors-and-plasmid-dna-manufacturing market may experience a boost in innovation and product development, positioning Germany as a leader in this field.

Technological Advancements in Manufacturing Processes

Innovations in manufacturing technologies are significantly impacting the viral vectors-and-plasmid-dna-manufacturing market. The introduction of automated systems and improved bioreactor designs has led to enhanced efficiency and scalability in production. For instance, the adoption of single-use technologies is streamlining operations and reducing contamination risks. These advancements not only lower production costs but also improve the quality of the final products. In Germany, companies are increasingly investing in research and development to leverage these technologies, which could potentially lead to a more robust and competitive market landscape. As a result, the viral vectors-and-plasmid-dna-manufacturing market is likely to witness a shift towards more efficient and cost-effective production methods.