Regulatory Support

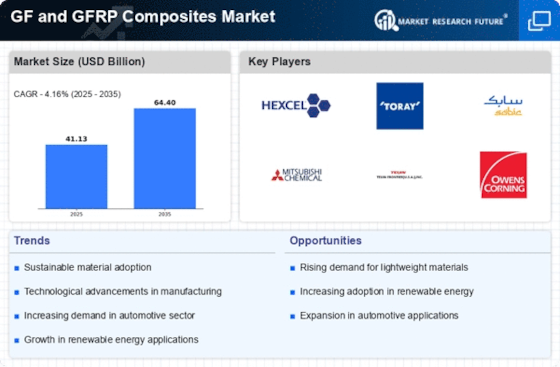

Regulatory frameworks promoting the use of advanced materials are likely to bolster the GF and GFRP Composites Market. Governments worldwide are implementing policies that encourage the adoption of lightweight and high-performance materials in various applications. For instance, regulations aimed at improving energy efficiency in vehicles are driving the automotive sector to incorporate GF and GFRP composites. This regulatory support is expected to create a conducive environment for market growth, with projections indicating a compound annual growth rate of around 7% through 2025. Such initiatives not only enhance the market's credibility but also stimulate innovation within the industry.

Technological Innovations

Technological advancements are reshaping the GF and GFRP Composites Market, fostering new applications and enhancing material properties. Innovations in manufacturing processes, such as automated fiber placement and advanced resin systems, are improving the efficiency and performance of composites. The market is expected to expand as these technologies reduce production costs and enhance product quality. For instance, the introduction of smart composites with integrated sensors is likely to open new avenues in aerospace and automotive applications. By 2025, the market could see a significant uptick in demand, potentially reaching a valuation of USD 30 billion, as industries increasingly adopt these cutting-edge materials.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the GF and GFRP Composites Market. As industries strive to reduce their carbon footprints, the demand for lightweight and durable materials has surged. GF and GFRP composites, known for their recyclability and lower environmental impact compared to traditional materials, are gaining traction. In 2025, the market is projected to witness a growth rate of approximately 8% annually, driven by the automotive and construction sectors' shift towards eco-friendly solutions. This trend not only aligns with regulatory pressures but also resonates with consumer preferences for sustainable products, thereby enhancing the market's appeal.

Diverse Application Spectrum

The versatility of GF and GFRP composites is a crucial driver for the market, as they find applications across various sectors. From automotive to aerospace, construction to sports equipment, the adaptability of these materials is noteworthy. In 2025, the automotive sector alone is anticipated to account for over 40% of the market share, driven by the need for lightweight components that enhance fuel efficiency. Additionally, the construction industry is increasingly utilizing these composites for their strength and durability in infrastructure projects. This diverse application spectrum not only broadens the market's reach but also mitigates risks associated with dependency on a single sector.

Growing Demand in Renewable Energy

The burgeoning renewable energy sector is emerging as a significant driver for the GF and GFRP Composites Market. As the world shifts towards sustainable energy sources, the demand for lightweight and durable materials in wind turbine blades and solar panel structures is increasing. GF and GFRP composites are particularly suited for these applications due to their high strength-to-weight ratio and resistance to environmental degradation. By 2025, the renewable energy sector is projected to contribute substantially to the market, with estimates suggesting a growth rate of approximately 9% in this segment alone. This trend underscores the composites' role in facilitating the transition to a more sustainable energy landscape.

Leave a Comment