Sustainability Trends

The Global Glass Container Market Industry is experiencing a notable shift towards sustainability, driven by increasing consumer awareness regarding environmental issues. Glass is perceived as a more eco-friendly alternative to plastic, as it is recyclable and does not leach harmful chemicals. This trend is reflected in the growing demand for glass packaging across various sectors, including food and beverages. In 2024, the market is valued at approximately 71.8 USD Billion, and this figure is expected to rise as companies adopt more sustainable practices. The emphasis on reducing carbon footprints and promoting circular economies further bolsters the growth of the Global Glass Container Market Industry.

Market Growth Projections

The Global Glass Container Market Industry is projected to experience robust growth over the next decade. With a current valuation of 71.8 USD Billion in 2024, the market is expected to reach 145.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 6.6% from 2025 to 2035. Factors contributing to this expansion include increasing consumer demand for sustainable packaging, stringent regulations favoring glass, and technological advancements in production. As the market evolves, it is likely to attract new investments and innovations, reinforcing the position of glass containers in various sectors.

Health and Safety Regulations

Stringent health and safety regulations are propelling the Global Glass Container Market Industry forward. Governments worldwide are implementing policies that favor glass packaging due to its inert nature, which ensures that no harmful substances migrate into food and beverages. This regulatory environment encourages manufacturers to invest in glass production technologies and innovations. As a result, the market is likely to see increased growth, with projections indicating a rise to 145.0 USD Billion by 2035. Compliance with these regulations not only enhances consumer trust but also positions glass as a preferred choice in sectors where safety is paramount.

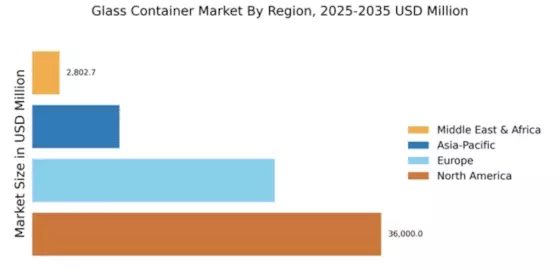

Rising Demand in Emerging Markets

Emerging markets are becoming increasingly important for the Global Glass Container Market Industry, as urbanization and rising disposable incomes drive demand for packaged goods. Countries in Asia-Pacific and Latin America are witnessing a surge in the consumption of beverages and food products, leading to a higher demand for glass packaging. This trend is likely to continue, as consumers in these regions become more health-conscious and environmentally aware. The growth potential in these markets presents opportunities for manufacturers to expand their reach and innovate their product offerings, further contributing to the overall growth trajectory of the Global Glass Container Market Industry.

Consumer Preference for Premium Products

There is a discernible shift in consumer preferences towards premium products, which is positively impacting the Global Glass Container Market Industry. Consumers are increasingly willing to pay a premium for products packaged in glass, associating it with higher quality and better preservation of taste and freshness. This trend is particularly evident in the beverage sector, where craft beers and artisanal spirits often utilize glass containers to enhance brand image. As the market evolves, the demand for glass packaging is expected to grow, contributing to a compound annual growth rate of 6.6% from 2025 to 2035, further solidifying the position of the Global Glass Container Market Industry.

Technological Advancements in Production

Technological advancements in glass production are significantly influencing the Global Glass Container Market Industry. Innovations such as automated manufacturing processes and improved melting techniques enhance efficiency and reduce production costs. These advancements allow manufacturers to meet the rising demand for glass containers while maintaining quality standards. Furthermore, the integration of smart technologies in production lines is expected to streamline operations and minimize waste. As a result, the market is poised for growth, with an anticipated increase in value from 71.8 USD Billion in 2024 to 145.0 USD Billion by 2035, underscoring the importance of technology in the Global Glass Container Market Industry.