Glass Packaging Market Summary

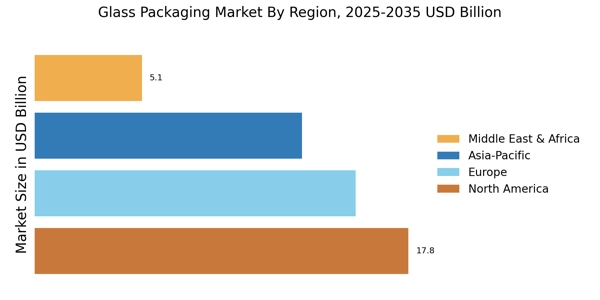

As per Market Research Future analysis, the Glass Packaging Market Size was estimated at 73.62 USD Billion in 2024. The Glass Packaging industry is projected to grow from 77.4 USD Billion in 2025 to 127.4 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 5.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Glass Packaging Market is experiencing a robust shift towards sustainability and innovation, driven by evolving consumer preferences and regulatory support.

- The market is increasingly prioritizing sustainability, with manufacturers adopting eco-friendly practices and materials.

- Technological innovations are enhancing the production processes, leading to improved efficiency and product quality.

- Aesthetic appeal remains a crucial factor, as consumers gravitate towards visually appealing packaging designs.

- Sustainability initiatives and health and safety standards are major drivers, particularly in the North American beverage packaging segment and the rapidly growing pharmaceutical packaging sector in Asia-Pacific.

Market Size & Forecast

| 2024 Market Size | 73.62(USD Billion) |

| 2035 Market Size | 127.4(USD Billion) |

| CAGR (2025 - 2035) | 5.1% |

Major Players

Owens-Illinois, Ardagh Group, Verallia, Saint-Gobain, Amcor, Crown Holdings, Gerresheimer AG, Hindustan National Glass & Industries Ltd., SGD Pharma, Piramal Glass Pvt. Ltd.