The gluten free bakery market trends suggest that the industry is currently experiencing a notable transformation, driven by an increasing awareness of health and dietary preferences among consumers. The gluten free bakery market size appears to be expanding as more individuals seek alternatives to traditional baked goods, often due to gluten intolerance or a desire for healthier options. The rise in demand for gluten-free products is not merely a trend but seems to reflect a broader shift towards clean eating and wellness. As a result, manufacturers are innovating and diversifying their product lines to cater to this evolving consumer base, which may include a variety of baked goods such as bread, pastries, and snacks.

Moreover, the Gluten Free Bakery Market is likely to witness a surge in artisanal and specialty products, as consumers increasingly favor unique flavors and high-quality ingredients. The gluten free bakery market trends predict that inclination towards premium offerings suggests that brands may need to focus on transparency in sourcing and production methods to build trust with their clientele. Additionally, the market could benefit from the integration of technology in production processes, enhancing efficiency and product quality. Overall, the Gluten Free Bakery Market appears poised for growth, with opportunities for both established players and new entrants to capitalize on changing consumer preferences and dietary needs.

Health Consciousness Driving Demand

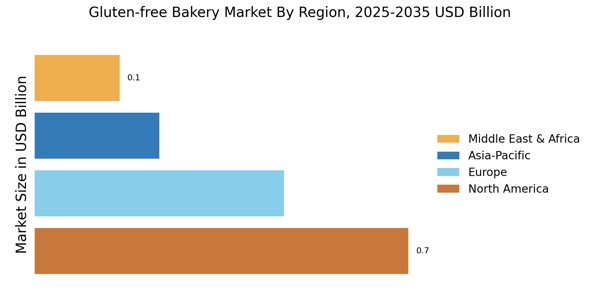

Searches for a gluten free bakery near me USA continue to rise as more consumers seek safe, high-quality baked goods tailored to gluten-free diets, driving strong local and online bakery demand. The gluten free bread market US is expanding steadily due to increased awareness of celiac disease, gluten sensitivity, and lifestyle-driven dietary choices, with improvements in taste and texture boosting wider consumer acceptance. Across the country, the best gluten free bakeries USA are recognized for combining artisan baking techniques with alternative flours to deliver breads, pastries, and desserts that closely match traditional bakery quality. The gluten free cookies market is also gaining momentum, as cookies remain a popular snack category and gluten-free versions are increasingly preferred for their convenience, flavor variety, and clean-label appeal. Looking ahead, gluten free bakery trends 2035 indicate continued growth supported by premium product innovation, plant-based and allergen-friendly formulations, digital ordering, and broader retail distribution, positioning gluten-free bakeries as a long-term growth segment within the US food industry.

The growing awareness of health and wellness among consumers is significantly influencing the gluten free bakery market size. Individuals are increasingly seeking products that align with their dietary restrictions and health goals, leading to a rise in gluten-free options.

Innovation in Product Offerings

Manufacturers are actively innovating to create diverse gluten-free baked goods, including breads, pastries, and snacks. This trend indicates a shift towards more varied and appealing options for consumers, enhancing market attractiveness.

Focus on Quality and Transparency

As consumers become more discerning, there is a noticeable emphasis on high-quality ingredients and transparent sourcing practices. This trend suggests that brands may need to prioritize authenticity and quality to build consumer loyalty.