Demand for Scalable Data Solutions

The demand for scalable data solutions is a significant driver in the Graph Database Market. As organizations generate vast amounts of data, the need for databases that can scale efficiently becomes critical. Graph databases offer unique advantages in handling large datasets with complex relationships, making them ideal for industries such as telecommunications and logistics. The ability to scale horizontally allows businesses to manage growing data volumes without compromising performance. Market forecasts indicate that the graph database segment is expected to reach a valuation of several billion dollars within the next few years, driven by this increasing demand for scalable solutions. As companies prioritize flexibility and performance, the Graph Database Market is likely to thrive.

Rising Demand for Data-Driven Insights

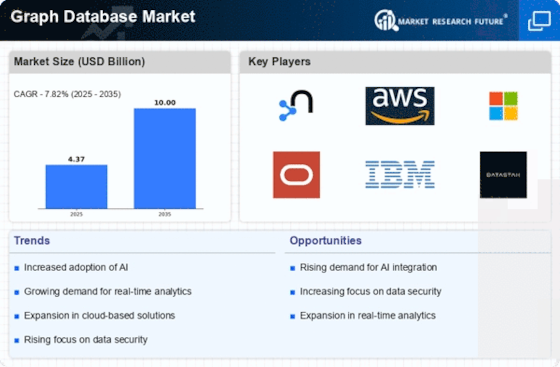

The Graph Database Market experiences a notable surge in demand for data-driven insights across various sectors. Organizations increasingly recognize the value of leveraging complex data relationships to enhance decision-making processes. This trend is particularly evident in industries such as finance, healthcare, and retail, where the ability to analyze interconnected data points can lead to improved customer experiences and operational efficiencies. According to recent estimates, the market for graph databases is projected to grow at a compound annual growth rate of over 30%, reflecting the urgency for businesses to adopt advanced data management solutions. As companies strive to remain competitive, the Graph Database Market is likely to witness sustained growth driven by this insatiable appetite for actionable insights.

Growing Need for Relationship Management

The Graph Database Market is witnessing a growing need for relationship management solutions. As businesses increasingly focus on customer engagement and retention, the ability to manage and analyze relationships becomes paramount. Graph databases excel in this area, allowing organizations to visualize and understand complex relationships between customers, products, and services. This capability is particularly beneficial for sectors such as telecommunications and social media, where user interactions are multifaceted. The market is projected to see a significant uptick in adoption as companies seek to leverage graph databases for personalized marketing strategies and improved customer service. With the potential to enhance customer satisfaction and loyalty, the Graph Database Market is poised for continued expansion.

Integration with Artificial Intelligence

The integration of artificial intelligence (AI) with graph databases is a pivotal driver in the Graph Database Market. As organizations seek to harness the power of AI for predictive analytics and machine learning, graph databases provide a robust framework for managing complex data relationships. This synergy enables businesses to derive deeper insights and make more informed decisions. The market is likely to benefit from this trend, as AI-driven applications increasingly rely on graph databases to enhance their capabilities. Analysts predict that the combination of AI and graph databases could lead to a more than 40% increase in the efficiency of data processing tasks, thereby solidifying the role of graph databases in modern data architectures.

Enhanced Capabilities for Fraud Detection

In the Graph Database Market, enhanced capabilities for fraud detection are becoming increasingly critical. Financial institutions and e-commerce platforms are turning to graph databases to identify and mitigate fraudulent activities effectively. By mapping relationships between transactions, users, and devices, organizations can uncover hidden patterns indicative of fraud. This capability is particularly vital in an era where cyber threats are evolving rapidly. The market for graph databases is expected to expand as more companies recognize the potential of these technologies to safeguard their operations. Analysts suggest that the integration of graph databases into fraud detection systems could reduce false positives by up to 50%, thereby streamlining operations and enhancing security measures.

.png)