The Graphics Card Market is currently experiencing a dynamic evolution, driven by advancements in technology and shifting consumer preferences. As gaming and professional applications become increasingly demanding, the need for high-performance graphics solutions intensifies. This market is characterized by a diverse range of products catering to various segments, from casual gamers to professional designers. The integration of artificial intelligence and machine learning capabilities into graphics cards is reshaping the landscape, offering enhanced performance and efficiency.

Furthermore, the rise of virtual reality and augmented reality applications is propelling the demand for more powerful graphics solutions, as users seek immersive experiences that require superior rendering capabilities. In addition to technological advancements, the Graphics Card Market is influenced by broader economic factors and supply chain dynamics. The ongoing competition among leading manufacturers fosters innovation, while also leading to price fluctuations and availability challenges. As consumers become more discerning, the emphasis on sustainability and energy efficiency is likely to shape future product offerings. Overall, the Graphics Card Market appears poised for continued growth, with emerging trends indicating a shift towards more integrated and versatile solutions that meet the evolving needs of users across various sectors.

A graphics card, also referred to as a video card, is a specialized hardware component designed to process and render visual data for display devices. This report analyzes the global video card market, covering key trends, growth drivers, and competitive dynamics shaping the industry. The graphics card market share is dominated by a small number of global manufacturers, with NVIDIA leading due to its strong presence in gaming and data center applications. Overall graphics market share trends indicate increasing concentration among top players, driven by advanced GPU architectures and ecosystem lock-in. Continuous graphics card development in areas such as AI acceleration, ray tracing, and memory bandwidth is driving product differentiation.

Rise of AI Integration

The incorporation of artificial intelligence into graphics cards is becoming increasingly prevalent. This trend enhances performance by optimizing rendering processes and improving real-time data processing capabilities. As AI technology advances, graphics cards are likely to evolve, offering smarter solutions for both gaming and professional applications.

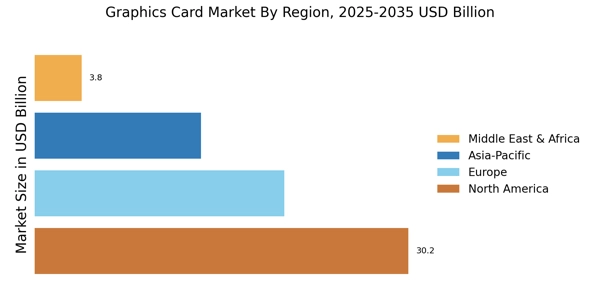

The gaming segment is a major driver of demand for high end graphics cards, particularly among enthusiasts seeking high frame rates and realistic visuals. Demand for consumer graphics solutions continues to rise as casual and competitive gaming adoption expands globally. Professional visualization applications, supported by advanced GPUs, are increasingly adopted by engineering firms and visualization companies for simulation and 3D rendering. Video card sizes, including variations in form factor and memory capacity, influence compatibility with system configurations and target applications. This report provides comprehensive computer graphics card information, including technology trends, application analysis, and regional performance.

Demand for Energy Efficiency

There is a growing emphasis on energy-efficient graphics solutions within the market. Consumers are increasingly aware of the environmental impact of their technology choices. Consequently, manufacturers are focusing on developing graphics cards that deliver high performance while minimizing energy consumption, aligning with sustainability goals.

Expansion of Virtual and Augmented Reality

The Graphics Card Market is witnessing a surge in demand driven by the expansion of virtual and augmented reality applications. As these technologies gain traction across various industries, the need for powerful graphics solutions that can support immersive experiences is becoming more pronounced. This trend is likely to shape product development in the coming years.