Leading market players invested heavily in research and development (R&D) to scale up their manufacturing units and product lines, which will help the GRE Pipes Market grow worldwide. Market participants are also undertaking various organic or inorganic strategic approaches to strengthen and expand their footprint, with important market developments including new product portfolios, contractual deals, mergers and acquisitions, capital expenditure, higher investments, and strategic alliances with other organizations. Businesses are also coming up with marketing strategies such as digital marketing, social media influencing, and content marketing to increase their scope of profit earnings.

The GRE Pipes industry must offer cost-effective and sustainable options to survive in a highly fragmented and dynamic market climate.

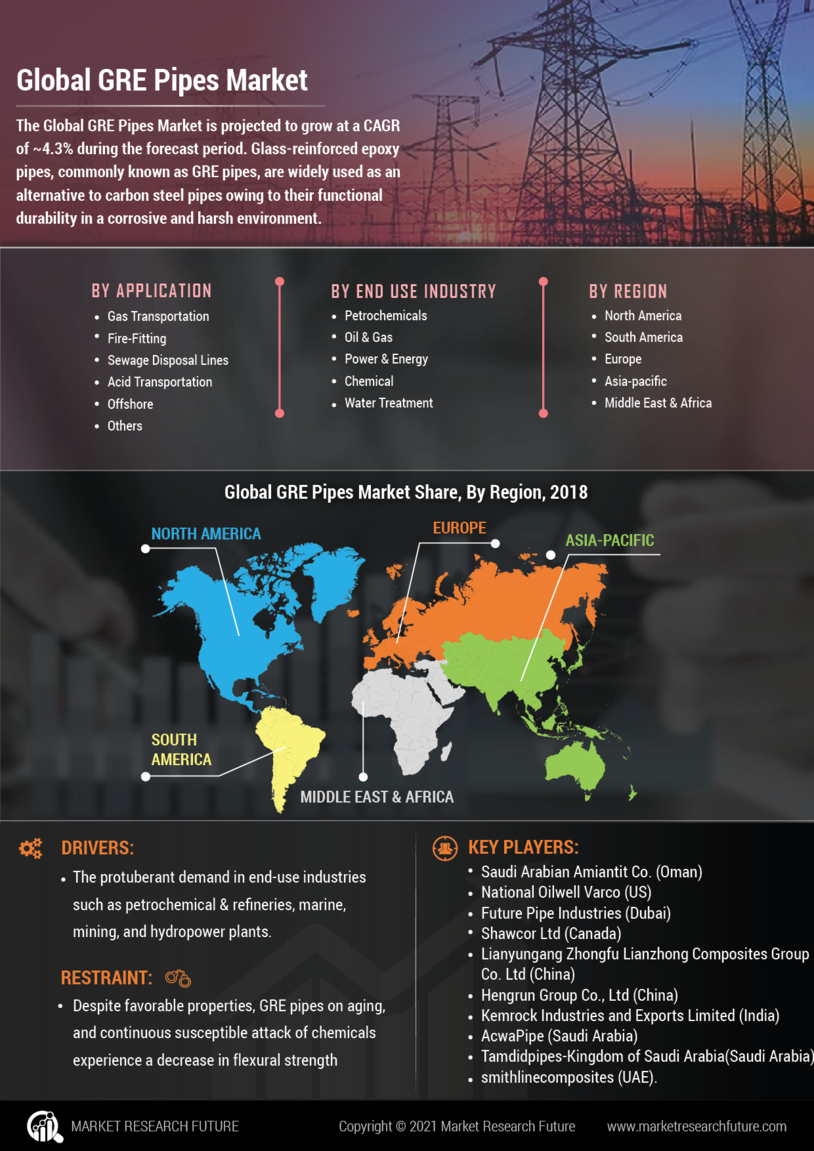

Manufacturing locally to minimize operational expenses and offer aftermarket services to customers is one of the key business strategies organizations use in the GRE Pipes industry to benefit customers and capture untapped market share and revenue. The GRE Pipes industry has recently offered significant advantages to the Oil and Gas industry. Moreover, more industry participants are utilizing and adopting cutting-edge technology has grown substantially. Major players in the GRE Pipes Market, including Saudi Arabian Amiantit Co. (Oman), National Oilwell Varco (US), Future Pipe Industries (Dubai), Shawcor Ltd (Canada), Lianyungang Zhongfu Lianzhong Composites Group Co.

Ltd (China), Hengrun Group Co., Ltd (China), a, are attempting to expand market share and demand by investing in R&D operations to produce sustainable and affordable solutions.

NOV Inc. (National Oilwell Varco) is an MNC firm that supplies oilfield machinery, technology, and experience to meet gas and oil clients' security and productivity issues. The firm operates in over 500 locations on six continents and is organized into three operating segments: Rig Technologies, Completion & Production Solutions, and Wellbore Technologies.

In November NOV opened a Fiber Glass Systems manufacturing plant in Dammam, Saudi Arabia. With a manufacturing area of 24,000 square meters, this factory will be among the initial ones in the country to manufacture spoolable and linked GRE pipe, GRE high-pressure pipeline, and downhole tubing and casings.

Haydale is a worldwide technologies and materials company that enables the incorporation of graphene and nanomaterials into the upcoming generations of business and industrial products. They have received granted patents on their technology, and it operates from six locations in the UK, the US, and the Middle East. The company has created a range of customized nano-enhanced compounds for thermosets and thermoplastic materials, elastomers and manufacturing oils, silicon carbide, inks and finishes, and 3D printing industries.

Haydale and Flowtite Technology AS signed a new collaborative development agreement in May 2020 to develop superior pipeline technologies that utilize revolutionary material science and technology, particularly Haydale-modified graphene-based thermosetting resin.