Market Trends

Key Emerging Trends in the Green Polymer Additive Market

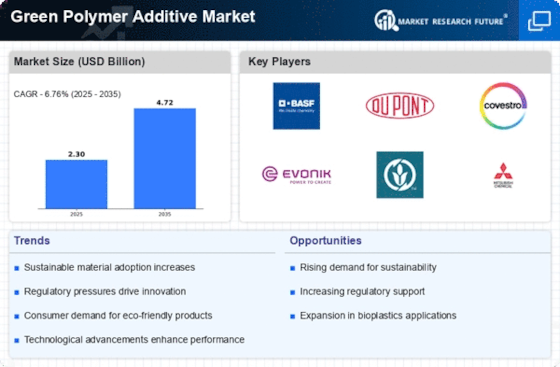

Green Polymer Additive market has grown since sustainability and environmental responsibility became more important in many sectors. A rising percentage of customers look for environmentally friendly polymer additives which play a crucial role in enhancing polymers’ properties. The demand for green polymer additives has increased significantly as more people embrace eco-friendly activities around the world; hence supporting this trend-line For instance, because it is clear that conventional polymer additives cannot be good to environment anymore; so we can expect companies searching alternatives which are easier to discard or recycle.

The Green Polymer Additive market has also experienced the development of new formulations aimed at satisfying particular industry needs. Researches as well as manufacturers are spending huge sums on developing eco-friendly additives that have specific features like being more compatible with different polymers, improved thermal stability, low toxicity levels etc. This trend has been spurred by the rising demand for green polymer additives that can address various issues specific to industries and ensure production of long-lasting high-performing polymer goods.

The market has started changing from basic materials for green polymer additives to their recyclability and end-of-life issues since the circular economy ideas have been accepted. In general, polymers as a sector are trying to become more sustainable and circular, and manufacturers have responded with additives that can make their goods more recyclable.

Technical improvements in the Green Polymer Additive market, which is witnessing technical improvements, are driven by innovations in manufacturing processes, thus improving efficiency and reducing environmental impacts. This includes companies within the manufacturing industry that are actively looking into greener additives with improved performance attributes, sourcing of raw materials that is sustainable as well as new synthesis methods. This trend is on the rise with respect to polymer additive manufacture’s industry wide expected environmentally friendly chemistry trends and method sustainability.

Moreover, there is a noticeable shift in consumer preferences towards ̳eco-friendly‘ products in this market place. A change in the dynamics of markets is being led by an increasing demand for polymer products containing eco-friendly additives by end users. Consumer-driven trend means that sustainability matters more in product offers’ and marketing tactics.

Leave a Comment