Collaboration Across Industries

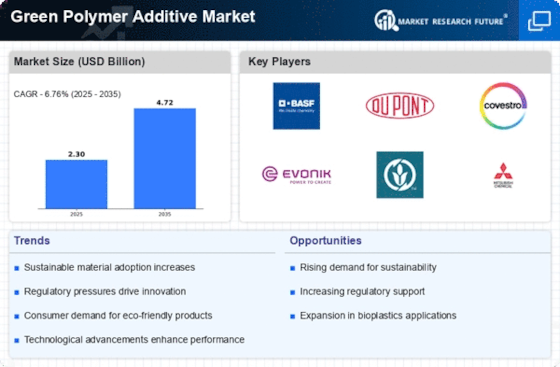

Collaboration among various industries is emerging as a significant driver in the Green Polymer Additive Market. Partnerships between manufacturers, research institutions, and environmental organizations are fostering innovation and accelerating the development of sustainable materials. These collaborations often lead to the sharing of knowledge and resources, which can enhance the efficiency of additive production and application. Market Research Future reveal that companies engaged in collaborative efforts are more likely to introduce innovative products that meet the growing demand for sustainability. As industries unite to address environmental challenges, the Green Polymer Additive Market stands to benefit from a collective approach to sustainability, potentially leading to breakthroughs that could reshape the market landscape.

Consumer Awareness and Education

The growing awareness and education surrounding environmental issues are crucial drivers in the Green Polymer Additive Market. As consumers become more informed about the impacts of plastic waste and the benefits of sustainable materials, their purchasing decisions are increasingly influenced by environmental considerations. This shift in consumer behavior is prompting manufacturers to prioritize the development of green polymer additives. Market data indicates that brands that effectively communicate their sustainability efforts are likely to capture a larger market share. Consequently, the Green Polymer Additive Market is evolving, with companies investing in marketing strategies that highlight the eco-friendly attributes of their products. This trend suggests a promising future for the industry as consumer demand for transparency and sustainability continues to rise.

Government Initiatives and Incentives

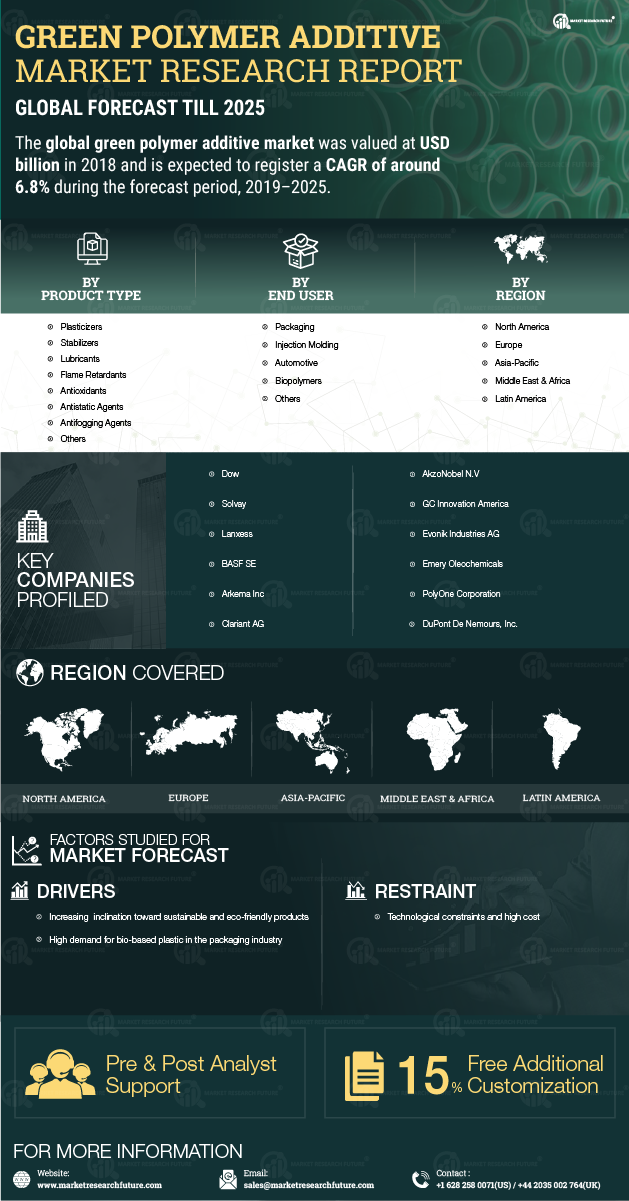

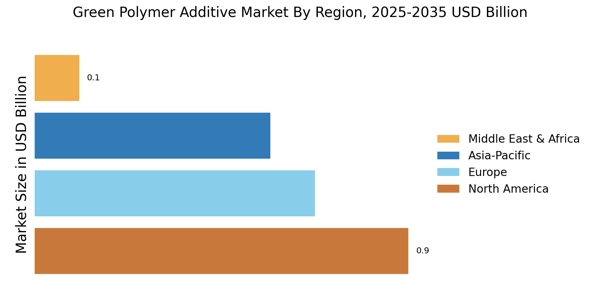

Government initiatives aimed at promoting sustainable practices are significantly influencing the Green Polymer Additive Market. Various countries are implementing policies that encourage the use of eco-friendly materials, including green polymer additives. For instance, tax incentives and subsidies for companies adopting sustainable practices are becoming more prevalent. This regulatory support is expected to bolster the market, as businesses seek to comply with environmental standards while capitalizing on financial benefits. Market data suggests that regions with robust government backing for green initiatives are experiencing faster growth in the adoption of green polymer additives. Consequently, the Green Polymer Additive Market is likely to expand as more companies align their operations with governmental sustainability goals.

Rising Demand for Biodegradable Products

The increasing consumer preference for biodegradable products is a pivotal driver in the Green Polymer Additive Market. As environmental awareness grows, consumers are gravitating towards products that minimize ecological footprints. This trend is reflected in market data, indicating that the demand for biodegradable additives is projected to grow at a compound annual growth rate of approximately 12% over the next five years. Manufacturers are responding by integrating green polymer additives into their product lines, thereby enhancing their market appeal. This shift not only aligns with consumer values but also positions companies favorably in a competitive landscape. The Green Polymer Additive Market is thus witnessing a transformation, where sustainability becomes a core component of product development and marketing strategies.

Technological Innovations in Polymer Chemistry

Technological advancements in polymer chemistry are driving the evolution of the Green Polymer Additive Market. Innovations such as bio-based polymers and advanced compounding techniques are enhancing the performance and applicability of green additives. These developments not only improve the functionality of products but also reduce reliance on fossil fuels. Market analysis indicates that the introduction of new technologies could lead to a 15% increase in the efficiency of additive production processes. As a result, manufacturers are increasingly investing in research and development to harness these innovations, thereby positioning themselves competitively within the Green Polymer Additive Market. This focus on technology is likely to yield products that meet both performance and sustainability criteria.