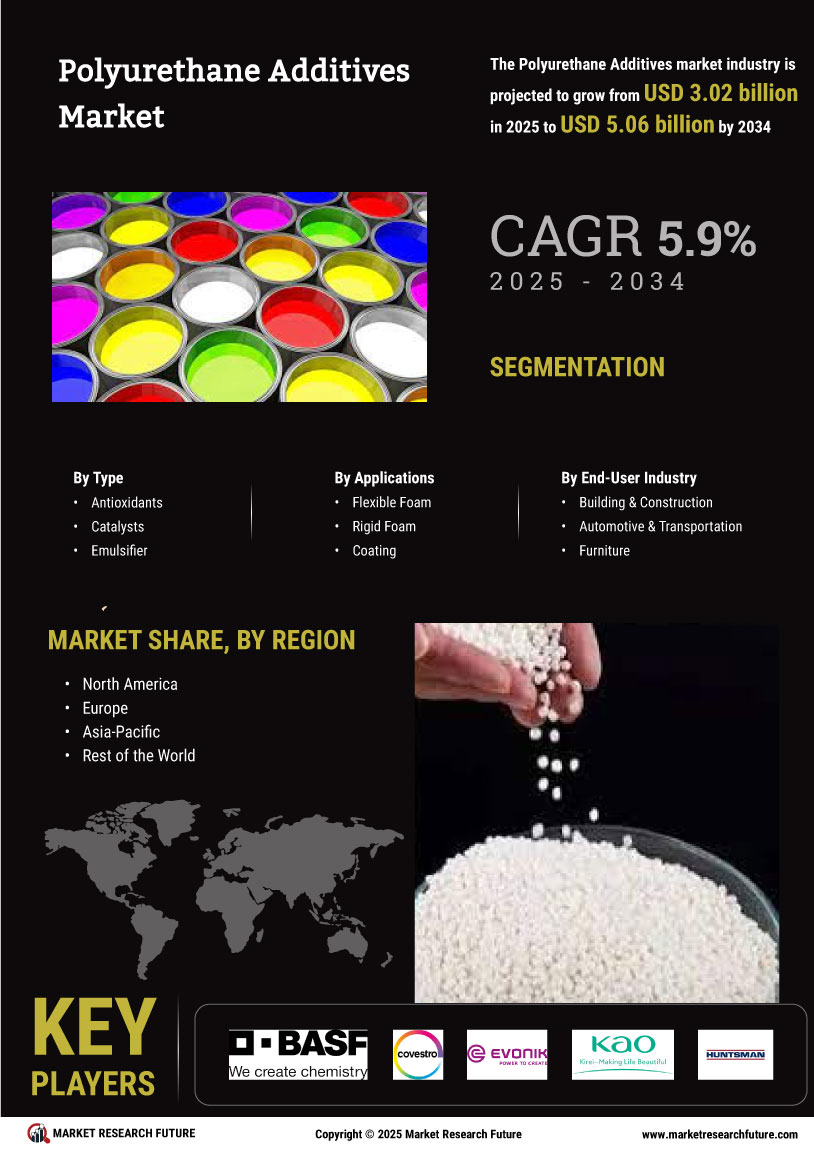

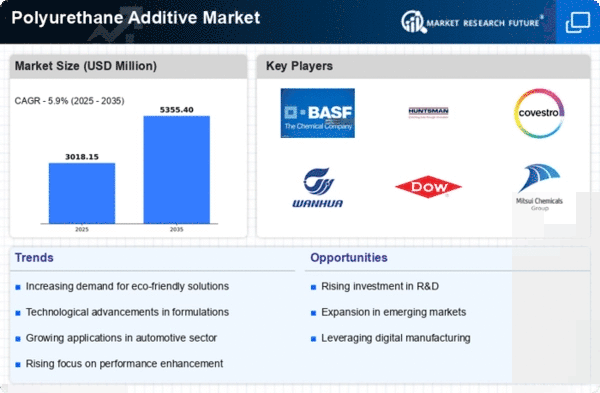

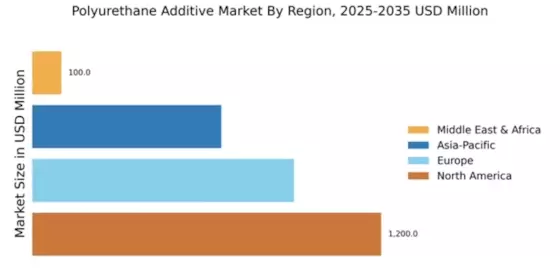

Market Growth Projections

The Global Polyurethane Additives Market Industry is poised for substantial growth, with projections indicating a market value of 2.85 USD Billion in 2024 and an anticipated increase to 5.36 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 5.91% from 2025 to 2035, driven by rising demand across various sectors, including construction, automotive, and consumer goods. The increasing focus on sustainability and technological advancements further supports this growth, positioning the polyurethane additives market as a key player in the global materials industry. These projections highlight the industry's potential to adapt and thrive in a rapidly changing market landscape.

Growth in Automotive Applications

The automotive industry significantly influences the Global Polyurethane Additives Market Industry, as these additives are crucial for producing lightweight, durable components. With the automotive sector's ongoing shift towards electric vehicles, the demand for polyurethane additives is expected to rise. These materials are utilized in various applications, including interior parts, insulation, and coatings, enhancing vehicle performance and comfort. The industry's growth is reflected in the projected market expansion, with an anticipated value of 5.36 USD Billion by 2035. This shift towards advanced materials in automotive manufacturing suggests a sustained demand for polyurethane additives, reinforcing their importance in the evolving automotive landscape.

Rising Demand in Construction Sector

The Global Polyurethane Additives Market Industry experiences a notable surge in demand driven by the construction sector. Polyurethane additives are integral in enhancing the performance of insulation materials, sealants, and coatings. As urbanization accelerates globally, the need for energy-efficient buildings increases, leading to a projected market value of 2.85 USD Billion in 2024. The construction industry's focus on sustainability and durability further propels the adoption of polyurethane additives, which are essential for achieving high-performance standards in modern architecture. This trend indicates a robust growth trajectory for the industry, aligning with the increasing emphasis on green building practices.

Increasing Applications in Consumer Goods

The Global Polyurethane Additives Market Industry benefits from the expanding applications in consumer goods, where these additives enhance product performance and longevity. Polyurethane additives are utilized in various consumer products, including furniture, footwear, and textiles, providing improved durability and comfort. As consumer preferences shift towards high-quality and sustainable products, the demand for polyurethane additives is expected to rise. This trend is indicative of a broader movement towards premium consumer goods, which could further stimulate market growth. The increasing emphasis on product performance in the consumer goods sector suggests a promising outlook for the polyurethane additives market.

Technological Advancements in Manufacturing

Technological innovations play a pivotal role in shaping the Global Polyurethane Additives Market Industry. Advances in manufacturing processes, such as the development of high-performance additives and eco-friendly formulations, enhance product efficiency and sustainability. These innovations not only improve the quality of polyurethane products but also reduce environmental impact, aligning with global sustainability goals. As manufacturers adopt these technologies, the market is likely to witness a compound annual growth rate of 5.91% from 2025 to 2035. This growth trajectory underscores the importance of continuous innovation in meeting the evolving demands of various industries reliant on polyurethane additives.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable practices significantly impact the Global Polyurethane Additives Market Industry. Governments worldwide are implementing stringent regulations aimed at reducing environmental impact, which encourages the adoption of eco-friendly polyurethane additives. These regulations not only drive innovation in product development but also create a favorable market environment for sustainable solutions. As industries adapt to these regulations, the demand for environmentally friendly polyurethane additives is likely to increase, contributing to market growth. This regulatory support aligns with global sustainability initiatives, suggesting a positive outlook for the polyurethane additives market as it evolves to meet new standards.