Automotive Industry Growth

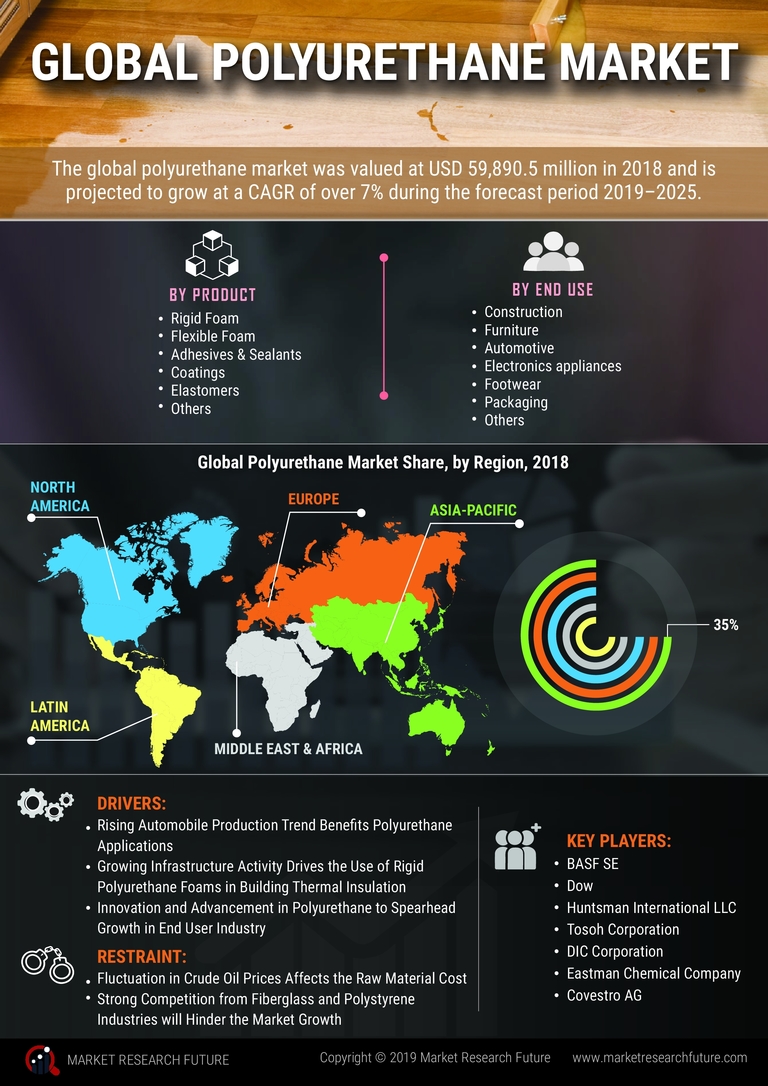

The automotive industry is a significant driver for the polyurethane market, as manufacturers increasingly utilize polyurethane in various applications, including seating, interior components, and insulation. The Polyurethane Market is poised to benefit from the anticipated growth in vehicle production, which is expected to reach over 100 million units by 2025. This growth is largely attributed to rising consumer demand for lightweight and fuel-efficient vehicles. Polyurethane Market's lightweight nature contributes to improved fuel efficiency, making it an attractive option for automotive manufacturers. Furthermore, advancements in polyurethane technology are enabling the development of more durable and high-performance materials, further enhancing their appeal in the automotive sector.

Increasing Use in Consumer Goods

The consumer goods sector is witnessing a growing adoption of polyurethane materials, particularly in the production of furniture, footwear, and household items. The Polyurethane Market is likely to see a significant uptick in demand as consumers increasingly favor products that offer comfort, durability, and aesthetic appeal. In 2025, the market for polyurethane in consumer goods is projected to grow by approximately 4% annually. This growth is driven by the rising trend of customization and personalization in consumer products, where polyurethane's versatility allows for innovative designs and applications. As manufacturers continue to explore new uses for polyurethane, the market is expected to expand further.

Rising Demand in Construction Sector

The construction sector is experiencing a notable surge in demand for polyurethane products, driven by their versatility and durability. Polyurethane Market benefits from the increasing use of insulation materials, coatings, and adhesives in residential and commercial buildings. In 2025, the construction industry is projected to grow at a rate of approximately 5.5% annually, which is likely to bolster the demand for polyurethane solutions. The energy efficiency properties of polyurethane insulation materials are particularly appealing, as they contribute to reduced energy consumption in buildings. This trend indicates a robust future for the polyurethane market, as builders and architects increasingly prioritize sustainable and efficient materials in their projects.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of polyurethane are playing a crucial role in shaping the market landscape. The Polyurethane Market is benefiting from innovations such as improved production techniques and the development of bio-based polyurethanes. These advancements not only enhance the performance characteristics of polyurethane products but also align with sustainability goals. In 2025, the market for bio-based polyurethanes is expected to grow significantly, driven by increasing consumer awareness and regulatory pressures for environmentally friendly materials. As manufacturers adopt these technologies, the efficiency and quality of polyurethane products are likely to improve, further driving market growth.

Regulatory Support for Sustainable Materials

Regulatory frameworks promoting the use of sustainable materials are emerging as a key driver for the polyurethane market. The Polyurethane Market is likely to benefit from policies encouraging the adoption of eco-friendly materials in various applications, including construction and automotive. Governments are increasingly implementing regulations aimed at reducing carbon footprints and promoting energy efficiency, which aligns with the properties of polyurethane. In 2025, the market is expected to see a rise in demand for low-emission and recyclable polyurethane products, as manufacturers seek to comply with these regulations. This trend suggests a promising future for the polyurethane market, as sustainability becomes a central focus in material selection.