Global Green Power Market Overview:

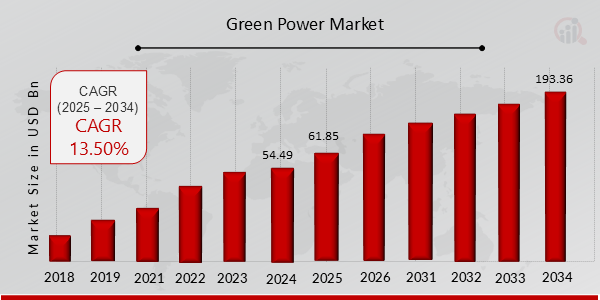

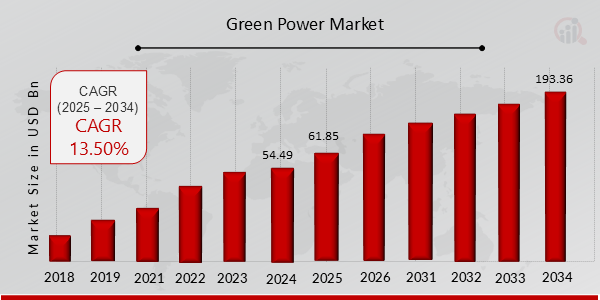

As per MRFR analysis, the Green Power Market Size was estimated at 54.49 (USD Billion) in 2024. The Green Power Market Industry is expected to grow from 61.85 (USD Billion) in 2025 to 193.36 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 13.50% during the forecast period (2025 - 2034). The volatile nature of fossil fuels and the rise in stringent regulations for reducing greenhouse gas emissions are the key market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Green Power Market Trends

-

Rising environmental awareness owing to rapid climate change and rising technological advancement is driving market growth

Market CAGR for the green power market is being driven by rising environmental awareness owing to rapid climate change and rising technological advancement. The rising environmental awareness owing to rapid climate change and rising technological advancement is a driving force behind the growth in market revenue.

The global green power industry is poised for substantial growth, driven by increasing awareness of the detrimental effects of greenhouse gases (GHGs). Furthermore, the significant emissions of carbon dioxide, nitrous oxide, and methane, primarily stemming from outdated fossil fuel-based energy extraction methods, are acting as key drivers of market expansion. Additionally, the depletion of fossil fuel reserves due to their widespread utilization is amplifying the demand for green power solutions, further bolstering industry growth.

The rapid electrification of the transportation and industrial sectors, the expansion of the electrical value chain within the oil and gas industry, and the rising demand for renewable energy sources all play a significant role in the upward trajectory of the green power energy sector. Renewables 2022, the latest annual report from the International Energy Agency (IEA), reveals that global renewable power capacity is projected to experience substantial growth, adding 2,400 gigawatts (GW) between 2022 and 2027.

This impressive increase is equivalent to China's entire current power capacity. The report highlights a significant shift in the energy landscape, with renewable energy sources expected to lead the charge in global electricity expansion over the next five years. By early 2025, renewables are poised to surpass coal as the predominant global electricity source, accounting for over 90% of the expansion. This marks a pivotal moment in the transition towards cleaner and more sustainable energy solutions on a global scale.

The significant expansion of renewable power capacity presents abundant investment opportunities in green energy projects, including solar, wind, hydro, and other sustainable sources. Investors, both public and private, are likely to be attracted to these projects, fostering growth in the green power market. These developments have the potential to foster collaborations, paving the way for innovative business models and expediting the transition towards cleaner and more sustainable energy practices, thus providing a significant boost to the green power industry.

As a result, it is anticipated that throughout the projection period, demand for the Green Power Market will increase due to the Rising Environmental Awareness Owing to Rapid Climate Change and Rising Technological Advancement. Thus, driving the Green Power Market revenue.

Green Power Market Segment Insights:

Green Power Market Type Insights

The Green Power Market segmentation, based on Type includes Hydroelectric Power, Wind Power, Bioenergy, Solar Energy, and Geothermal Energy. The hydroelectric power segment dominated the market, accounting for 58% of market revenue (24.53 Billion). Hydroelectric power offers a stable and consistent energy supply. Unlike some other renewable sources like wind or solar, it is not subject to weather-related fluctuations. This reliability makes it appealing for both energy providers and consumers, including industries that require a constant and uninterrupted power supply.

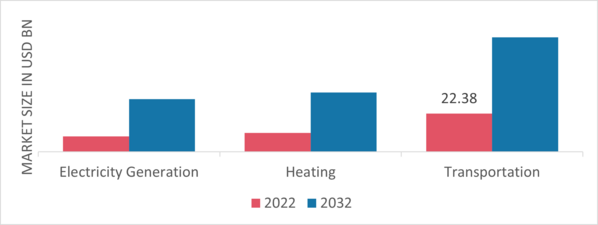

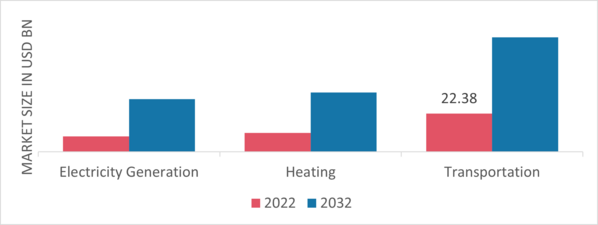

Green Power Market Application Insights

The Green Power Market segmentation, based on Application, includes Electricity Generation, Heating, and Transportation. The transportation segment dominated the market, accounting for 55% of market revenue (23.26 Billion). The development of the electric car charging infrastructure is a key driver in the rise of the green transportation market. As more charging stations become available, it becomes more convenient for consumers to own and operate electric vehicles, alleviating concerns about range anxiety.

Figure 1: Green Power Market By Application, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Green Power Market End User Insights

The Green Power Market segmentation, based on End Users, includes Utility, Residential, Commercial, and Industrial. The utility segment dominated the market, accounting for 60% of market revenue (25.38 Billion). Utility companies are becoming more aware of the financial and environmental advantages of using renewable energy sources in their energy mix. Green power sources like wind, solar, and hydro are becoming more cost-effective and reliable, making them attractive options for utilities to meet their energy generation needs.

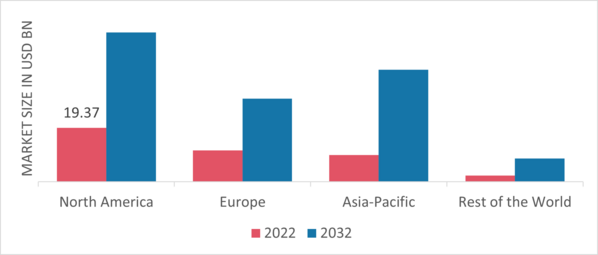

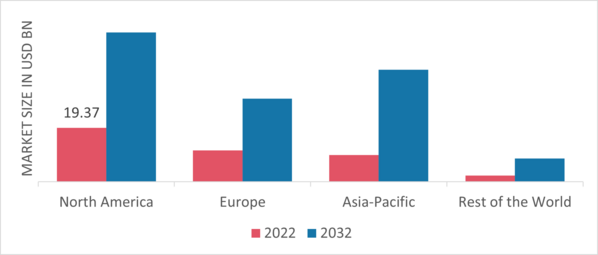

Green Power Market Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and Rest of the World. Many North American countries, including the United States and Canada, have implemented policies and regulations that incentivize the development and adoption of green power sources. These policies may include renewable energy mandates, tax incentives, and emissions reduction targets, which encourage the use of renewable energy technologies. In 2019, the United States had an installed renewable energy capacity of nearly 264,504 megawatts.

The country possesses a substantial offshore wind energy potential, estimated at over 2,000 gigawatts, which is nearly double its current electricity consumption. This significant potential presents lucrative opportunities for providing large-scale clean and reliable electricity to meet the nation's future needs. Furthermore, the U.S. government has committed to expanding its renewable energy infrastructure and achieving specific targets by 2025, which is expected to accelerate market growth.

Further, the major countries studied in the market report are The US, Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Green Power Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe's Green Power market accounts for the second-largest market share as the energy crisis experienced in 2022 expedited Europe's determination to undergo an energy transition. Germany has taken decisive and swift actions to advance its renewable energy agenda. These measures include streamlining approval processes for renewable projects, fostering the development of a domestic supply chain, offering subsidies for cost-effective electricity to energy-intensive industries, and undertaking substantial efforts to modernize the power grid infrastructure.

Germany's commitment to renewable energy is exemplified by its ambitious plan, amounting to approximately €250 billion of investment over roughly 10 years. This significant financial commitment provides a substantial boost to the overall funding available for green energy initiatives across Europe. Further, the German Green Power market held the largest market share, and the UK Green Power market was the fastest-growing market in the European region

The Asia-Pacific Green Power market is expected to grow at the fastest CAGR from 2025 to 2034. This prominence can be attributed to factors such as increased industrialization, infrastructure development, and proactive government initiatives within the region. Governments across countries like China and India are spearheading initiatives aimed at ensuring widespread access to electricity, further boosting market prospects. China, in particular, holds a significant share of the Asia Pacific green power market. The Chinese government is actively pursuing a strategy to reduce its reliance on fossil fuels by embracing renewable energy sources for electricity generation.

This not only aligns with environmental goals but also presents substantial market opportunities. In 2019, the United States had an installed renewable energy capacity of nearly 264,504 megawatts.

The country possesses a substantial offshore wind energy potential, estimated at over 2,000 gigawatts, which is nearly double its current electricity consumption. This significant potential presents lucrative opportunities for providing large-scale clean and reliable electricity to meet the nation's future needs. Furthermore, the U.S. government has committed to expanding its renewable energy infrastructure and achieving specific targets by 2025, which is expected to accelerate market growth. The expansion of renewable energy capacity, including wind, solar, and hydropower, will lead to a substantial increase in clean energy generation.

This will contribute to a larger share of green power in the overall energy mix. Moreover, China’s Green Power market held the largest market share, and the Indian Green Power market was the fastest-growing market in the Asia-Pacific region.

Green Power Market Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Green Power market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, the Green Power industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Green Power industry to benefit clients and increase the market sector. In recent years, the Green Power industry has offered some of the most significant advantages to society and the environment.

Major players in the Green Power market, including Trina Solar, First Solar, Canadian Solar, ABB, GE, Tata Power Solar Systems Limited, Innergex, Enel Green Power, Xcel Energy, EDF, Geronimo Energy, Invenergy LLC, ACCIONA, Vestas, UpWind Solutions, Inc., Senvion, and Sinovel Wind Group Co., Ltd., are attempting to increase market demand by investing in research and development operations.

Trina Solar, a vertically integrated solar power product manufacturer, operates a comprehensive business model that spans the design, construction, operation, and sale of solar power projects both within China and internationally. The company specializes in providing smart PV solutions tailored for large-scale power stations, energy storage systems, commercial and residential applications, and the production of photovoltaic modules. Trina Solar's extensive range of services encompasses project development, including engineering, procurement, financing, installation, monitoring, construction, as well as operations and maintenance.

The company's distribution network extends across the Asia Pacific, North America, South America, the Middle East, Europe, Africa, and various other regions. Trina Solar maintains a global presence, with offices and operations located in key strategic markets, including China, the UK, Japan, Switzerland, and the US, among others. The company's headquarters are situated in Changzhou, Jiangsu, China, serving as its central hub for overseeing its diverse portfolio and operations.

Acciona is a well-known supplier of environmentally friendly options for infrastructure and renewable energy projects. The business provides a full range of services that cover every stage of a project's lifespan, from design and construction through operation and maintenance. Acciona specializes in the development and management of various infrastructure projects, renewable energy initiatives, water facilities, and other critical assets. Furthermore, Acciona extends its expertise to provide Engineering, Procurement, and Construction (EPC) services to third-party clients. The company is also engaged in the sale of renewable energy and the development of wind turbines, utilizing its proprietary Acciona Wind Power technology.

Beyond its core activities, Acciona diversifies its portfolio by offering financial services, fund management, stock broking, and housing development services.

Additionally, the company is involved in wine production. Acciona operates on a global scale, with a presence spanning across Europe, North America, Asia, Oceania, Central and South America, as well as the Middle East and Africa. Its corporate headquarters are situated in Alcobendas, Madrid, Spain. Notably, in May 2020, the Cerro Dominador solar thermal project, which is owned by EIG Global Energy Partners, was being built with help from Acciona and Abengoa.

This project involved the intricate process of melting 46,000 tons of salts sourced from the Chilean Atacama Desert and boasts an impressive capacity of 110 MW, underlining Acciona's commitment to pioneering renewable energy solutions.

Key Companies in the Green Power market include

- Tata Power Solar Systems Limited

- Sinovel Wind Group Co., Ltd.

Green Power Market Developments

-

Q2 2024: Infintium Fuel Cells acquires Goldenstone Acquisition for $18 million On June 26, 2024, Infintium Fuel Cells, a hydrogen power cell manufacturer, acquired Goldenstone Acquisition for $18 million through a reverse merger to secure new manufacturing facilities and expand its sales and marketing operations.

-

Q3 2024: Ørsted acquires Sunrise Wind for $230 million On July 10, 2024, Ørsted acquired Eversource’s 50% share of Sunrise Wind, a 924 MW offshore wind farm delivering power to New York, marking Ørsted’s third offshore wind farm off the northeast coast.

-

Q3 2024: ConnectM Technology Solutions Inc. acquires Monterey Capital Acquisition through reverse merger On July 12, 2024, ConnectM Technology Solutions Inc., a clean energy technology company, acquired Monterey Capital Acquisition through a reverse merger as a step toward becoming a publicly traded company.

-

Q4 2024: ACCIONA Energía (BME:ANE) acquired Green Pastures I and II Power Plant for $202.5 million On November 5, 2024, ACCIONA Energía acquired the Green Pastures I and II wind farms, which together will generate approximately 1.1 TWh of renewable energy per year.

-

Q4 2024: Axium Infrastructure Inc. has agreed to acquire 49.0% interest in two operating wind facilities from Capital Power Corp. (TSX:CPX) for $340.0 million On November 26, 2024, Axium Infrastructure agreed to acquire a 49% stake in two operating wind facilities with a combined 246 MW capacity from Capital Power Corp. for $340 million.

-

Q4 2024: TotalEnergies (NYSE:TTE) signed an agreement with funds managed by Apollo for the sale of 50.0% of a portfolio of 2 GW solar and battery energy storage systems projects located in Texas On December 4, 2024, TotalEnergies signed an agreement to sell a 50% stake in a 2 GW portfolio of solar and battery energy storage projects in Texas to funds managed by Apollo.

-

Q1 2025: Blackstone (NYSE:BX) has agreed to acquire Potomac Energy Center, a 774 MW natural gas-fired power plant in northern Virginia, from Ares Management (NYSE:ARES) On January 24, 2025, Blackstone agreed to acquire the Potomac Energy Center, a 774 MW natural gas-fired power plant in northern Virginia, from Ares Management for approximately $1 billion.

-

Q1 2025: Global Renewable Energy M&A Totals $32B in Q1 2025 as Investors Prioritize Grid-Connected Projects In Q1 2025, global renewable energy M&A reached approximately $32 billion, with North America leading in platform takeovers and storage asset transactions, reflecting strong investor confidence in grid-connected and scalable renewable projects.

-

Q1 2025: 2025 could be a banner year for natural gas plant acquisitions, Enverus says In January 2025, Enverus reported that gas plant acquisitions in 2025 have already surpassed $1 billion, with Constellation Energy's purchase of 60 GW from Calpine estimated at nearly $30 billion, indicating a shift in investment toward low-carbon generation assets.

-

Q1 2025: U.S. Renewable Energy M&A: Review of 2024 Outlook 2025 In March 2025, FTI Consulting reported that U.S. renewable energy M&A activity in 2024 was resilient, with a strong preference for operating and late-stage development assets, and a surge in energy storage M&A as installed capacity reached 32 GW by year-end.

Green Power Market Segmentation

Green Power Market Type Outlook

Green Power Market Application Outlook

Green Power Market End User Outlook

Green Power Market Regional Outlook

| Report Attribute/Metric |

Details |

|

Market Size 2024

|

54.49 (USD Billion)

|

|

Market Size 2025

|

61.85 (USD Billion)

|

|

Market Size 2034

|

193.36 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

13.50% (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2019 - 2023

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Application, End User, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Trina Solar, First Solar, Canadian Solar, ABB, GE, Tata Power Solar Systems Limited, Innergex, Enel Green Power, Xcel Energy, EDF, Geronimo Energy, Invenergy LLC, ACCIONA, Vestas, UpWind Solutions, Inc., Senvion, and Sinovel Wind Group Co., Ltd. |

| Key Market Opportunities |

Rising initiatives by government to install renewable energy sources |

| Key Market Dynamics |

Growing awareness about the use of environment-friendly sources |

Frequently Asked Questions (FAQ):

The Green Power Market size was valued at USD 54.49 Billion in 2024.

The Green Power Market is projected to grow at a CAGR of 13.50% during the forecast period, 2025-2034.

North America had the largest share of the global market

The key players in the market are Trina Solar, First Solar, Canadian Solar, ABB, GE, Tata Power Solar Systems Limited, Innergex, Enel Green Power, Xcel Energy, EDF, Geronimo Energy, Invenergy LLC, ACCIONA, Vestas, UpWind Solutions, Inc., Senvion, and Sinovel Wind Group Co., Ltd.

The Hydroelectric Power type dominated the market in 2022.

The Transportation base had the largest share of the global market.