Investment in Infrastructure Development

Investment in infrastructure development is a significant driver of the Ground-to-Air Onboard Connectivity Market. Airlines and service providers are allocating substantial resources to upgrade existing systems and implement new technologies that facilitate better connectivity. This includes the installation of advanced antennas, routers, and satellite systems that enhance data transmission capabilities. As the demand for high-speed internet and reliable communication grows, the need for robust infrastructure becomes increasingly apparent. Moreover, partnerships with technology firms are often formed to leverage expertise in deploying cutting-edge solutions. This trend indicates a commitment to improving the passenger experience and operational efficiency, suggesting that the Ground-to-Air Onboard Connectivity Market is poised for sustained growth as investments in infrastructure continue to rise.

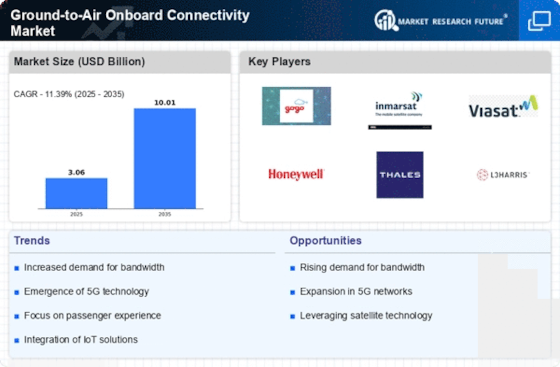

Competitive Landscape and Market Dynamics

The competitive landscape of the Ground-to-Air Onboard Connectivity Market is characterized by a diverse array of players, including telecommunications companies, satellite operators, and technology providers. This competition drives innovation and service differentiation, as companies strive to capture market share. The presence of multiple stakeholders fosters collaboration and partnerships, which can lead to the development of integrated solutions that enhance connectivity. Furthermore, as airlines seek to improve their service offerings, they are increasingly looking for unique value propositions that can set them apart from competitors. This dynamic environment suggests that the Ground-to-Air Onboard Connectivity Market will continue to evolve, with new entrants and established players alike contributing to advancements in connectivity solutions.

Regulatory Support for Enhanced Connectivity

Regulatory support plays a crucial role in shaping the Ground-to-Air Onboard Connectivity Market. Governments and aviation authorities are increasingly recognizing the importance of connectivity in enhancing passenger experience and operational efficiency. Initiatives aimed at streamlining regulations for in-flight connectivity services are being implemented, which may facilitate the deployment of advanced technologies. For example, some regions have relaxed restrictions on the use of personal electronic devices during flights, thereby encouraging airlines to invest in connectivity solutions. This regulatory environment is conducive to innovation and investment in the Ground-to-Air Onboard Connectivity Market, as it allows for the exploration of new business models and service offerings that can enhance the overall travel experience.

Rising Consumer Demand for In-Flight Connectivity

Consumer demand for in-flight connectivity is a primary driver of the Ground-to-Air Onboard Connectivity Market. Passengers increasingly expect reliable internet access during flights, akin to what they experience on the ground. This expectation is fueled by the proliferation of mobile devices and the need for constant connectivity for both personal and professional purposes. According to recent surveys, a significant percentage of travelers prioritize in-flight Wi-Fi availability when choosing airlines. Airlines are responding by enhancing their connectivity offerings, which often includes partnerships with technology providers to deliver robust solutions. This growing consumer demand is likely to propel the market forward, as airlines recognize that providing high-quality connectivity can lead to increased customer satisfaction and loyalty, ultimately impacting their bottom line.

Technological Advancements in Connectivity Solutions

The Ground-to-Air Onboard Connectivity Market is experiencing a surge in technological advancements that enhance connectivity solutions. Innovations such as satellite-based communication systems and 5G technology are transforming the way data is transmitted between ground stations and aircraft. These advancements not only improve the speed and reliability of connections but also expand the range of services available to passengers and crew. For instance, the integration of high-throughput satellites (HTS) is expected to increase bandwidth availability, allowing for seamless streaming and real-time data exchange. As a result, airlines are increasingly investing in these technologies to meet the growing expectations of passengers for high-quality in-flight connectivity. This trend indicates a robust growth trajectory for the Ground-to-Air Onboard Connectivity Market, as more airlines seek to differentiate themselves through superior connectivity offerings.

.png)