- Q2 2024: Olympus Launches New Hysteroscopic Tissue Removal Device in Europe Olympus announced the European launch of its new hysteroscopic tissue removal device, expanding its gynecological product portfolio and aiming to improve minimally invasive procedures for uterine pathologies.

- Q2 2024: CooperSurgical Receives FDA Clearance for Endosee Advance Hysteroscopy System CooperSurgical received FDA 510(k) clearance for its Endosee Advance Hysteroscopy System, a portable device designed to simplify in-office diagnostic and therapeutic hysteroscopy procedures.

- Q3 2024: Hologic Announces Acquisition of Endomag to Expand Women’s Health Portfolio Hologic completed the acquisition of Endomag, a company specializing in minimally invasive technologies for breast and gynecological cancer surgery, strengthening Hologic’s position in the women’s health device market.

- Q2 2024: Boston Scientific to Acquire Obsidio, Inc. for $325 Million Boston Scientific announced a definitive agreement to acquire Obsidio, Inc., a developer of minimally invasive embolization technology, with applications in gynecological procedures among other specialties.

- Q1 2025: Medtronic Launches Hugo™ Robotic-Assisted Surgery System for Gynecological Procedures in the U.S. Medtronic launched its Hugo™ robotic-assisted surgery system for gynecological procedures in the United States, following FDA clearance, aiming to enhance precision and outcomes in minimally invasive gynecologic surgery.

- Q2 2025: BD (Becton, Dickinson and Company) Announces Opening of New Manufacturing Facility for Gynecological Devices in Ireland BD inaugurated a new manufacturing facility in Ireland dedicated to producing gynecological devices, supporting increased global demand and expanding its production capabilities.

- Q2 2024: Aspivix Raises $20 Million Series B to Advance Gentle Cervical Device Aspivix, a Swiss medical device company, raised $20 million in Series B funding to accelerate commercialization of its non-traumatic cervical device for gynecological procedures.

- Q3 2024: Minerva Surgical Receives CE Mark for Next-Generation Endometrial Ablation System Minerva Surgical received CE Mark approval for its next-generation endometrial ablation system, enabling commercial launch in the European Union for the treatment of abnormal uterine bleeding.

- Q1 2025: Olympus Appoints New Head of Global Gynecology Business Unit Olympus announced the appointment of Dr. Maria Sanchez as the new Head of its Global Gynecology Business Unit, aiming to drive innovation and growth in its women’s health segment.

- Q2 2025: CooperSurgical Partners with FemTech Startup to Develop Smart Intrauterine Device CooperSurgical entered a strategic partnership with a FemTech startup to co-develop a smart intrauterine device (IUD) featuring real-time monitoring capabilities for enhanced contraceptive management.

- Q3 2024: Hologic Wins Major Hospital Contract for NovaSure Endometrial Ablation System Hologic secured a multi-year contract to supply its NovaSure endometrial ablation system to a leading U.S. hospital network, expanding its footprint in the gynecological devices market.

- Q2 2024: Lumenis Receives FDA Clearance for FemTouch Laser for Vaginal Health Lumenis received FDA clearance for its FemTouch CO2 laser system, designed for minimally invasive treatment of vaginal health conditions, enabling U.S. commercialization.

Gynecological Devices and Instruments Market Segment Insights

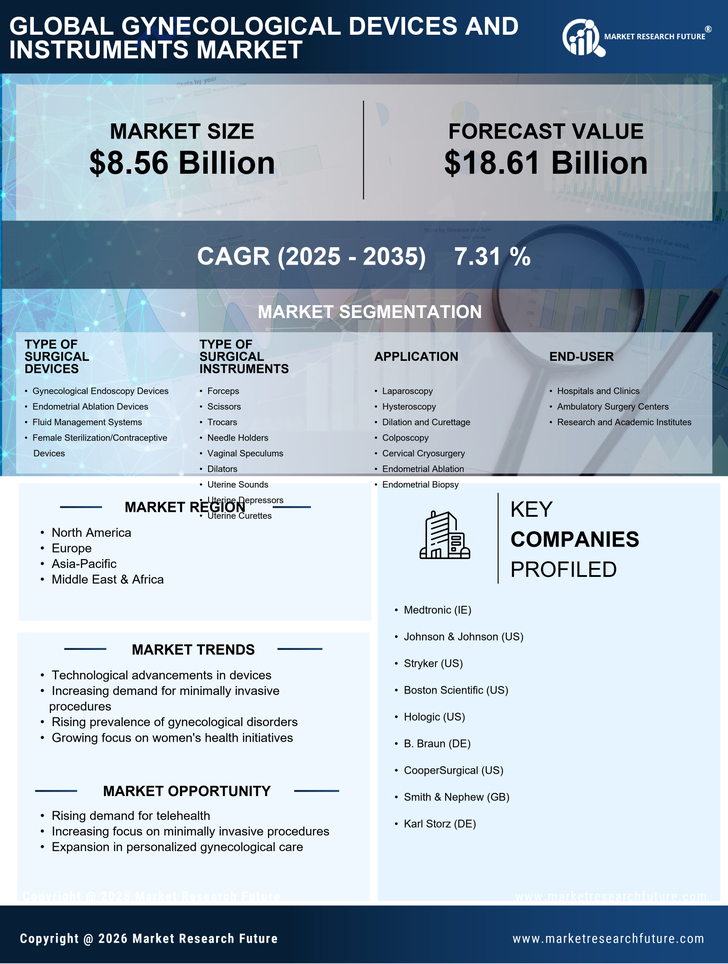

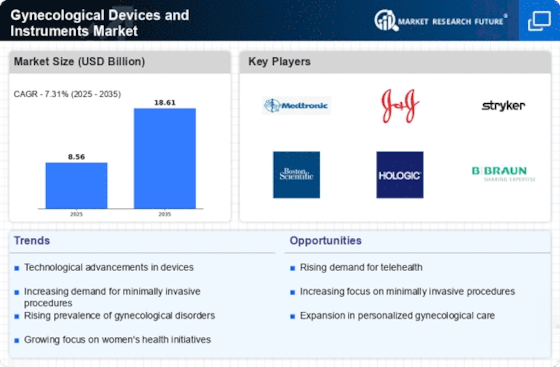

The market of gynecological devices and instruments is segmented on the basis of type of surgical devices, type of surgical instruments, application, and end-user.

Gynecological Devices and Instruments Type Insights

On the basis of type of surgical devices, the gynecological devices and instruments market is classified as gynecological endoscopy devices, endometrial ablation devices, fluid management systems, and female sterilization/contraceptive devices. The gynecological endoscopy devices are further segmented into hysteroscope, colposcope, resectoscope, laparoscope, and endoscopic imaging systems. Endometrial ablation devices are further segmented into hydrothermal ablation devices, Radiofrequency ablation devices, balloon ablation devices, and others. Female sterilization/contraceptive devices are further segmented into permanent birth control and temporary birth control. The temporary birth control segment includes IUD, intravaginal rings, and subdermal contraceptive implants.

On the basis of type of surgical instruments, the market for gynecological devices and instruments is classified as forceps, scissors, trocars, needle holders, vaginal speculums, dilators, uterine sounds, uterine depressors, uterine curettes, and others. The forceps segment is further classified as Allis forceps, artery forceps, and other forceps. The vaginal speculums segment is further classified as sim’s vaginal speculums, Cusco vaginal speculums, graves’ vaginal speculums, pediatric vaginal speculums, Pederson vaginal speculums, and others.

Gynecological Devices and Instruments Application Insights

On the basis of application, the market for gynecological devices and instruments is classified as laparoscopy, hysteroscopy, dilation and curettage, colposcopy, cervical cryosurgery, endometrial ablation, endometrial biopsy, and others.

Gynecological Devices and Instruments End-user Insights

On the basis of end-user, the market is classified as hospitals and clinics, ambulatory surgery centers, research and academic institutes, and others.

Gynecological Devices and Instruments Regional Insights

The Americas dominates the gynecological devices market owing to the increasing prevalence of gynecological problems, well-developed technology, high healthcare expenditure, and the presence of leading players. According to the statistics suggested by the Center for Disease Control and Prevention (CDC), cervical cancer is one of the leading causes of deaths of women in the United States. It is reported that in 2014, around 12,578 women in the United States were diagnosed with cervical cancer, and nearly 4,115 women in the United States died from cervical cancer.

Europe holds the second position in the market of gynecological devices and instruments. It is expected that the rising contribution towards research and development and increasing competition among marketers are likely to drive the European gynecological devices and instruments market.

Asia Pacific is the fastest growing gynecological devices and instruments market owing to a huge patient pool, increasing demand for treatment, and rising healthcare expenditure. As per the data suggested by the Australian Institute of Health and Welfare during the year 2015–2016, the total health expenditure was nearly USD 170.4 billion, i.e., 3.6% higher than the expenditure in 2014–2015. The initiatives taken by the government towards gynecological issues are also boosting the market growth.

For instance, the Pradhan Mantri Surakshit Matritva Abhiyan (PMSMA) initiated by the Ministry of Health and Family Welfare in 2016, is focusing towards the reduction of maternal and infant mortality rates through safe pregnancies and safe deliveries. This national programme supported around three crore pregnant women across the country by providing special free antenatal care. The main aim of the programme is to detect and prevent high-risk pregnancies.

The Middle East and Africa holds the lowest share of the global market of gynecological devices and instruments due to low development, lack of technical knowledge, and poor medical facilities.

Key Players

Some of the key players in the global gynecological devices and instruments market are

- B. Braun Melsungen AG (Germany)

- Boston Scientific Corporation (U.S.)

- CooperSurgical Inc. (U.S.)

- Ethicon, Inc. (U.S.)

- Hologic, Inc. (U.S.)

- Karl Storz GmbH & Co. KG (Germany)

- MedGyn Products (U.S.)

- Medtronic plc (U.S.)

- Olympus Corporation (Japan)

- Richard WOLF GmbH (Germany)

- Sklar Surgical Instruments (U.S.)

- Stryker Corporation (U.S.)

Intended Audience

- Medical Devices Companies

- Research and Development (R&D) Companies

- Government Research Institutes

- Academic Institutes and Universities