Rising Awareness and Education

There is a growing awareness regarding women's health issues in South America, which is significantly impacting the gynecological devices-instruments market. Educational campaigns and initiatives by non-governmental organizations are informing women about the importance of regular gynecological check-ups and the availability of advanced treatment options. This heightened awareness is likely to increase the demand for gynecological instruments, as more women seek preventive care and treatment for various conditions. The market is expected to see a growth rate of around 6% as a result of these educational efforts, which are crucial for fostering a proactive approach to women's health.

Government Initiatives and Funding

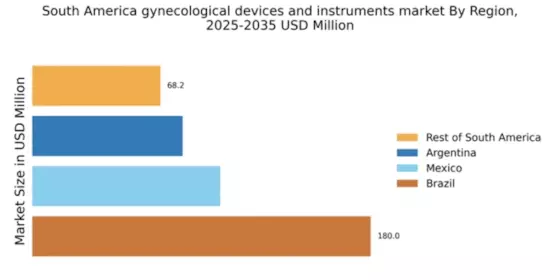

Government initiatives aimed at improving women's health services are playing a crucial role in the gynecological devices-instruments market in South America. Various countries in the region are allocating funds to enhance healthcare infrastructure, which includes the procurement of advanced gynecological instruments. For instance, Brazil has launched programs to increase access to women's health services, which has led to a surge in demand for innovative devices. The investment in healthcare is expected to reach approximately $10 billion by 2026, thereby providing a substantial boost to the market for gynecological devices and instruments.

Increase in Healthcare Expenditure

The rise in healthcare expenditure across South America is a significant driver for the gynecological devices-instruments market. As countries in the region allocate more resources to healthcare, there is a corresponding increase in the availability of advanced medical devices. For instance, Argentina has reported a 15% increase in healthcare spending, which is expected to enhance the procurement of gynecological instruments. This trend indicates a growing commitment to improving women's health services, thereby fostering a favorable environment for the growth of the gynecological devices-instruments market.

Technological Integration in Healthcare

The integration of technology in healthcare is transforming the gynecological devices-instruments market in South America. Innovations such as telemedicine and digital health records are enhancing the efficiency of gynecological practices. This technological shift allows for better patient management and improved access to specialized care. As healthcare providers adopt these technologies, the demand for compatible gynecological instruments is likely to rise. The market is projected to expand by approximately 7% over the next few years, driven by the need for devices that can seamlessly integrate with new healthcare technologies.

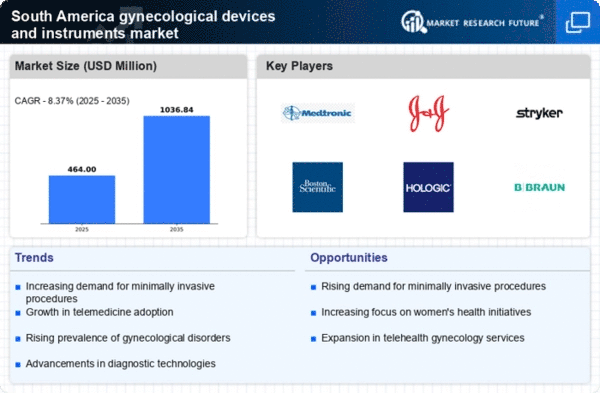

Growing Demand for Minimally Invasive Procedures

The gynecological devices-instruments market in South America is experiencing a notable shift towards minimally invasive procedures. This trend is driven by the increasing preference among patients for surgeries that promise reduced recovery times and lower risk of complications. As a result, manufacturers are focusing on developing advanced instruments that facilitate such procedures. The market for minimally invasive gynecological surgeries is projected to grow at a CAGR of approximately 8% over the next five years. This growth is indicative of a broader acceptance of these techniques among healthcare providers and patients alike, thereby enhancing the overall demand for specialized gynecological devices and instruments.