Increasing Demand for Ethical Products

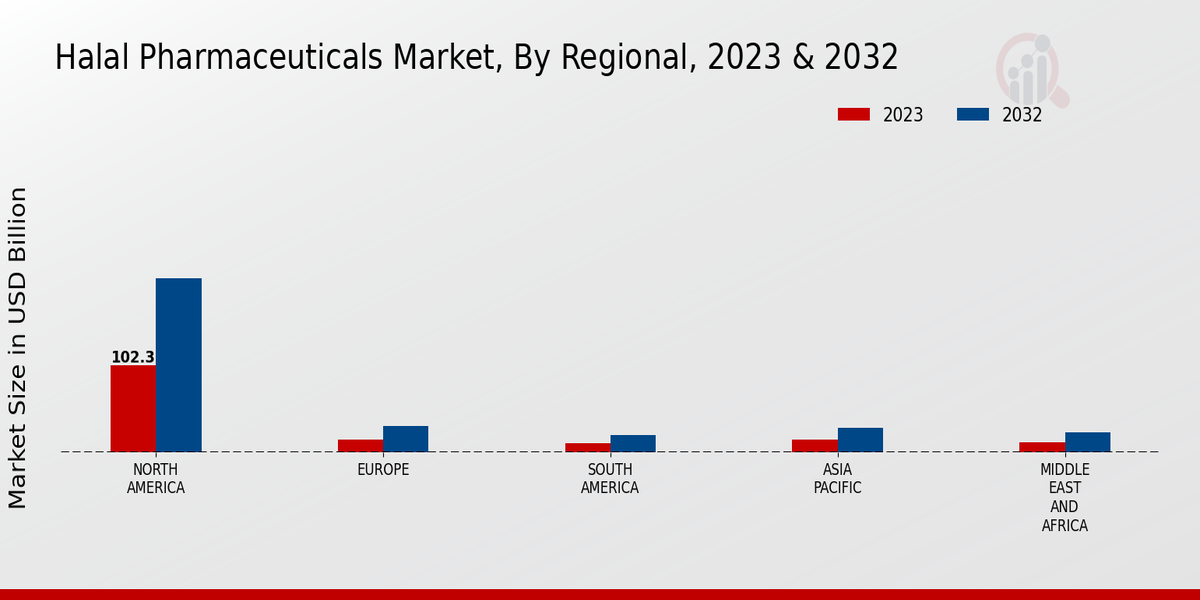

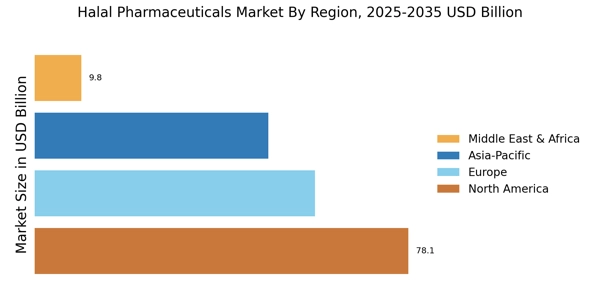

The Halal Pharmaceuticals Market is witnessing a notable surge in demand for ethical products. Consumers are increasingly inclined towards pharmaceuticals that align with their ethical and religious beliefs. This trend is particularly pronounced among Muslim populations, who prioritize Halal-certified products. According to recent estimates, the Halal pharmaceuticals segment is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by a heightened awareness of health and wellness, coupled with a desire for transparency in product sourcing and manufacturing processes. As a result, pharmaceutical companies are increasingly investing in Halal certifications to cater to this expanding consumer base, thereby enhancing their market presence and competitiveness.

Regulatory Support for Halal Standards

The Halal Pharmaceuticals Market benefits from increasing regulatory support for Halal standards across various regions. Governments and regulatory bodies are recognizing the importance of Halal certification in ensuring product integrity and consumer trust. This support is evident in the establishment of guidelines and frameworks that facilitate the certification process for pharmaceutical products. For instance, several countries have implemented policies that encourage the production and distribution of Halal-certified pharmaceuticals, thereby fostering a conducive environment for market growth. This regulatory backing not only enhances consumer confidence but also incentivizes pharmaceutical companies to pursue Halal certifications, potentially leading to a broader range of products available in the market.

Expansion of Halal Certification Bodies

The Halal Pharmaceuticals Market is experiencing growth due in part to the expansion of Halal certification bodies. These organizations play a crucial role in ensuring that pharmaceutical products meet Halal standards, thereby enhancing consumer trust and market credibility. The proliferation of certification bodies across various regions has made it easier for pharmaceutical companies to obtain Halal certifications, which in turn facilitates market entry and product diversification. As more companies seek to tap into the Halal market, the presence of multiple certification bodies is likely to lead to increased competition and innovation within the industry. This trend not only benefits consumers by providing a wider array of Halal-certified products but also encourages pharmaceutical companies to adhere to stringent quality standards.

Rising Health Consciousness Among Consumers

The Halal Pharmaceuticals Market is significantly influenced by the rising health consciousness among consumers. As individuals become more aware of the impact of their lifestyle choices on their health, there is a growing preference for pharmaceuticals that are perceived as safe, natural, and ethically produced. This trend is particularly relevant in the context of Halal pharmaceuticals, which are often associated with higher quality and purity standards. Market data indicates that the demand for Halal-certified health supplements and medications is on the rise, with consumers actively seeking products that align with their health goals. This shift in consumer behavior is prompting pharmaceutical companies to innovate and expand their Halal product offerings, thereby contributing to the overall growth of the industry.

Technological Advancements in Production Processes

The Halal Pharmaceuticals Market is being transformed by technological advancements in production processes. Innovations in manufacturing techniques, such as the use of biotechnology and advanced quality control measures, are enabling pharmaceutical companies to produce Halal-certified products more efficiently and at a lower cost. These advancements not only enhance the quality and safety of Halal pharmaceuticals but also streamline the certification process, making it more accessible for manufacturers. As technology continues to evolve, it is likely that the industry will see an increase in the availability of Halal-certified products, catering to the growing consumer demand. This technological shift is expected to play a pivotal role in shaping the future landscape of the Halal pharmaceuticals market.

Leave a Comment