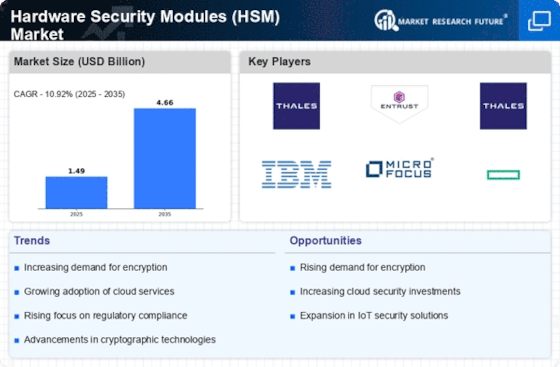

Top Industry Leaders in the Hardware Security Modules Market

Competitive Landscape of the Hardware Security Modules Market:

The Hardware Security Modules (HSM) market is poised for significant growth in the coming years, propelled by the ever-escalating threat landscape and the increasing need to safeguard sensitive data. This growth presents a dynamic and competitive environment for HSM providers, with established players vying for dominance alongside new entrants seeking to disrupt the market. Understanding the competitive landscape is crucial for both established companies and potential players to navigate this lucrative yet demanding space.

Some of the Hardware Security Modules companies listed below:

- Gemalto NV

- Thales e-Security Inc.

- Utimaco GmbH

- International Business Machines Corporation

- FutureX

- Hewlett-Packard Enterprise Development L.P.

- SWIFT

- Atos S.E.

- Ultra-Electronics

- Yubico

Dominant Players and Established Strategies:

- Comprehensive product portfolios: Offering a wide range of HSMs catering to diverse needs, from high-performance appliances to cloud-based solutions.

- Focus on security and compliance: Meeting rigorous industry standards and compliance mandates, building trust with customers handling sensitive data.

- Continuous innovation: Investing in R&D to develop cutting-edge features, functionalities, and integration with emerging technologies like blockchain and IoT.

- Strategic partnerships: Collaborating with technology vendors, cloud providers, and channel partners to expand reach and market penetration.

Factors for Market Share Analysis:

Analyzing market share in the HSM market requires a nuanced approach, considering factors like:

- HSM type: Demand varies for different types, including appliance, blade, virtual, and cloud-based.

- Deployment model: On-premise versus cloud deployments cater to different security needs and budget considerations.

- Vertical market: Different industries like finance, healthcare, and government have specific requirements and regulations.

- Geographical reach: Global presence and understanding of regional regulations are crucial.

New and Emerging Companies:

The HSM market is witnessing an influx of new entrants, often focusing on specific niches or offering innovative solutions. Examples include:

- Cloud-based HSM providers: Companies like CloudHSM and Fortanix are targeting the growing demand for cloud-secure solutions.

- Open-source HSMs: Projects like Ledger Vault offer cost-effective alternatives to traditional proprietary HSMs.

- Startups with specialized solutions: Companies like Pwnie Express and CyberArk are developing HSMs with unique features for specific security challenges.

Latest Company Updates:

October 2023- As security threats change and become more complex, engineers creating industrial and consumer products need to think about adding security features into their devices while designing them. Microchip Technology has unveiled a new series of 32-bit PIC32CZ CA microcontrollers with a 300-MHz Arm Cortex-M7 chip, a built-in hardware security module (HSM) and a variety of connectivity and flash memory choices for more flexibility. Having the MCU inside the HSM gives a firewalled security subsystem focused on security functions.

August 2023- Thales recently announced the launch of Thales payShield Cloud HSM, a new subscription-based digital payments security service built using their leading payShield 10K Payment Hardware Security Module (HSM) technology. The goal is to help customers more quickly adopt cloud-based payments infrastructure. The new service provides fast deployment, increased flexibility, and seamless integration with major cloud providers like Amazon Web Services (AWS), the Microsoft Azure, and Google Cloud Platform (GCP). The payShield Cloud HSM service enables hybrid deployments, allowing existing customers to transition any application to the cloud on their own timeline without disrupting their current on-premises HSM infrastructure. The service can be set up in minutes, immediately providing security, trust, separation of duties, and capabilities that support the requirements of top payment brands such as American Express, Discover, JCB, Mastercard, UnionPay, and Visa.

August 2023- Thales, a company headquartered in France, has unveiled its new payShield Cloud HSM offering. This service is designed to boost the uptake of cloud payments infrastructure. It enables customers to add more hardware security modules (HSMs) swiftly and securely. The added HSMs can be utilized for resilience, backup or increased capacity.