Market Analysis

In-depth Analysis of Health Wellness Packaged Food Market Industry Landscape

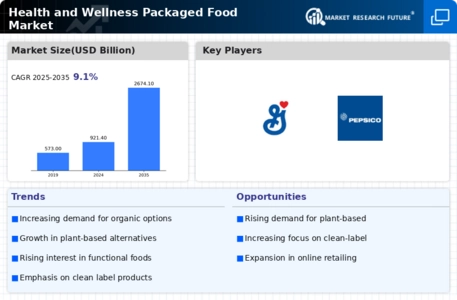

The health and wellness packaged food market is experiencing dynamic shifts driven by changing consumer preferences and an increased focus on well-being. This market, fueled by a growing awareness of the importance of a healthy lifestyle, has witnessed a surge in demand for packaged foods that align with nutritional and dietary goals. Consumers are seeking products with cleaner labels, reduced additives, and ingredients that promote overall health. This shift in mindset has prompted manufacturers to reformulate their products, emphasizing natural and functional ingredients to cater to health-conscious consumers.

The rise of dietary preferences and restrictions has also played a pivotal role in shaping the dynamics of the health and wellness packaged food market. With an increasing number of people adopting vegetarian, vegan, gluten-free, or other specialized diets, manufacturers are diversifying their product offerings to accommodate these diverse dietary needs. This inclusivity has led to a broader range of options in the market, catering to individuals with specific health and lifestyle preferences.

Moreover, technological advancements and innovation are driving market dynamics in the health and wellness packaged food sector. With a focus on convenience and on-the-go lifestyles, there's a surge in the development of functional foods and snacks fortified with vitamins, minerals, and other beneficial components. This trend is not only meeting the demand for convenient and nutritious options but is also contributing to the overall growth of the market.

The influence of social media and online platforms has been a significant factor in shaping consumer behavior in the health and wellness packaged food market. The accessibility of information has empowered consumers to make informed choices about their diets, pushing manufacturers to be transparent about their products' nutritional content. Positive reviews, testimonials, and endorsements from influencers contribute to building trust among consumers and influence their purchasing decisions in this market.

Economic factors also play a role in the market dynamics of health and wellness packaged foods. While premium products with specialized ingredients may thrive during periods of economic prosperity, budget-friendly options with basic nutritional value may become more popular during economic downturns. Manufacturers need to adapt their strategies to cater to diverse consumer segments based on economic conditions.

The global nature of the health and wellness packaged food market has led to increased globalization and cross-cultural influences. Traditional foods from various regions with perceived health benefits are finding a place in the international market. This has not only broadened the product portfolio but has also allowed consumers to explore and integrate diverse dietary practices into their lifestyles.

E-commerce has revolutionized the distribution and accessibility of health and wellness packaged foods. Online platforms provide consumers with a wide array of choices, allowing them to compare products, read reviews, and make informed decisions. This digital landscape has intensified competition among manufacturers, prompting them to focus on packaging, branding, and online marketing strategies to capture consumer attention.

Leave a Comment