Rising Demand for Patient Safety

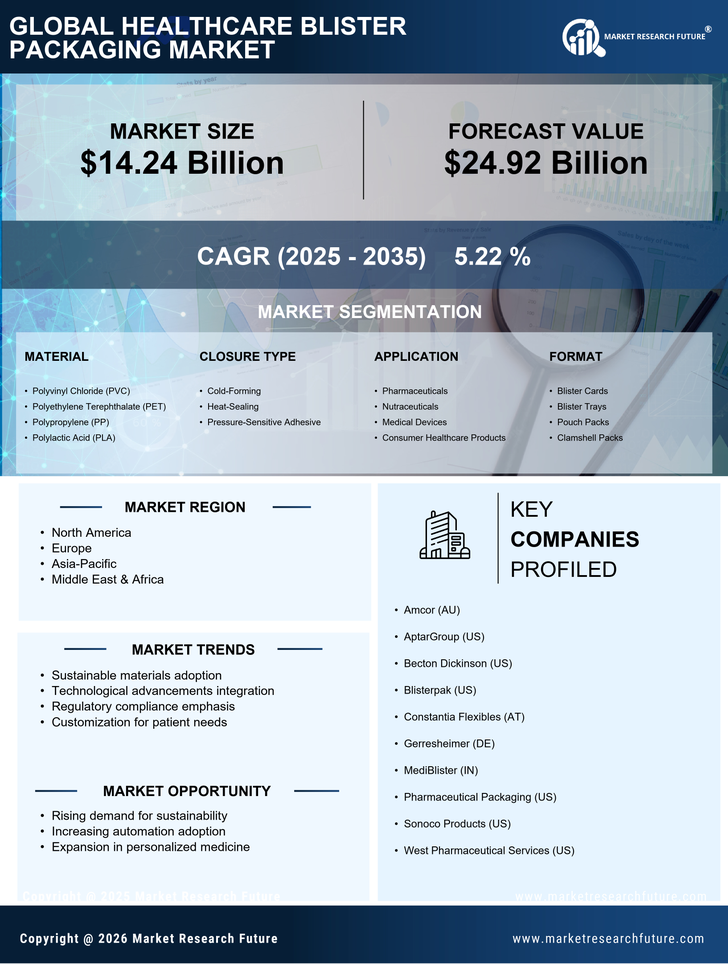

The increasing emphasis on patient safety is a pivotal driver for the Healthcare Blister Packaging Market. As healthcare providers strive to minimize medication errors, blister packaging offers a reliable solution by providing clear labeling and organized dosages. This packaging format enhances adherence to prescribed regimens, thereby improving patient outcomes. According to recent data, the market for blister packaging is projected to grow at a compound annual growth rate of approximately 6.5% over the next few years. This growth is largely attributed to the rising awareness among healthcare professionals regarding the benefits of blister packaging in ensuring patient safety and reducing the risk of medication mishaps.

Expansion of Pharmaceutical Sector

The ongoing expansion of the pharmaceutical sector significantly influences the Healthcare Blister Packaging Market. With the introduction of new drugs and therapies, there is a corresponding need for effective packaging solutions that can preserve product integrity and extend shelf life. The blister packaging format is particularly advantageous for pharmaceuticals, as it protects against moisture and contamination. Recent statistics indicate that the pharmaceutical market is expected to reach a valuation of over 1.5 trillion dollars by 2025, which will likely drive demand for blister packaging solutions. This trend underscores the importance of innovative packaging in supporting the growth of the pharmaceutical industry.

Consumer Preference for Convenience

The growing consumer preference for convenience is a significant factor propelling the Healthcare Blister Packaging Market. As patients seek easier ways to manage their medications, blister packaging provides a practical solution by offering pre-packaged doses that simplify the medication-taking process. This convenience is particularly appealing to elderly patients and those with chronic conditions who may require multiple medications. Market analysis suggests that the demand for user-friendly packaging solutions will continue to rise, further driving the growth of the blister packaging segment. This shift in consumer behavior highlights the need for packaging that aligns with modern lifestyles.

Regulatory Standards and Compliance

The stringent regulatory standards governing the healthcare sector serve as a crucial driver for the Healthcare Blister Packaging Market. Compliance with regulations ensures that packaging meets safety and quality requirements, which is essential for maintaining consumer trust. Regulatory bodies are increasingly focusing on packaging materials and processes to ensure they do not compromise product integrity. As a result, manufacturers are compelled to invest in high-quality blister packaging solutions that adhere to these regulations. This trend is expected to bolster the market, as companies prioritize compliance to avoid penalties and enhance their market reputation.

Technological Innovations in Packaging

Technological innovations are reshaping the Healthcare Blister Packaging Market, leading to enhanced functionality and efficiency. Advances in materials science and manufacturing processes have resulted in the development of more sustainable and user-friendly blister packaging options. For instance, the integration of smart technology, such as QR codes and NFC tags, allows for better tracking and information dissemination. These innovations not only improve the user experience but also align with the growing demand for transparency in healthcare. As the market adapts to these technological advancements, it is anticipated that the blister packaging segment will witness a notable increase in adoption rates.