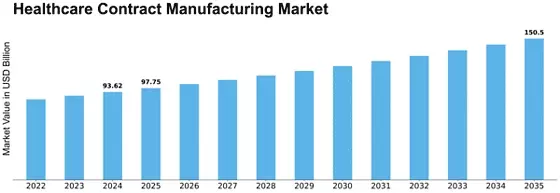

Healthcare Contract Manufacturing Size

Healthcare contract manufacturing Market Growth Projections and Opportunities

Outsourcing boosts healthcare contract manufacturing. Pharmaceutical and medical device businesses can focus on what they do best by using contract makers to make parts, devices, and pharmaceutical goods. Complexity of healthcare product production processes shapes the market. Complex pharmaceutical and medical device production requires specific skills and facilities. Contract manufacturers can handle these complications. Healthcare contract manufacturing is driven by cost-efficiency. Healthcare companies use contract manufacturers' skills and infrastructure to maximize resources and save manufacturing costs. They may deliberately manage resources and concentrate on R&D and marketing. Healthcare contract manufacturing partners are chosen due to strict regulatory and quality criteria. Contract manufacturers must follow GMP and ISO standards to provide safe, high-quality healthcare goods. Globalization boosts healthcare contract manufacturing. Companies are working with regional contract manufacturers to build robust and diverse supply chains. This strategy increases flexibility and reduces supply chain interruption concerns. Rapid innovation and shorter time-to-market cycles in healthcare items are market factors. Contract manufacturers with modern technology and specialized skills speed up drug and device research and commercialization. Biomanufacturing and biopharmaceuticals promote healthcare contract manufacturing. Biologics like vaccinations and therapeutic proteins need specialized facilities and understanding. Beginning or developing biopharmaceutical enterprises might save money on contract manufacturing. Contract manufacturing allows organizations to scale output to market demand. This versatility is vital in the healthcare business, where product demand fluctuates. Contract manufacturers scale to effectively modify production levels. Advanced manufacturing technologies including robots, automation, and data analytics affect healthcare contract manufacturing. Contract manufacturers that invest in cutting-edge technology may improve healthcare product efficiency, accuracy, and quality. Strategic agreements between healthcare corporations and contract manufacturers impact market dynamics. These partnerships enable knowledge, resource, and risk sharing, boosting industry innovation and competitiveness.

Leave a Comment