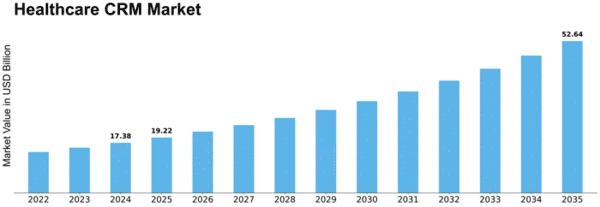

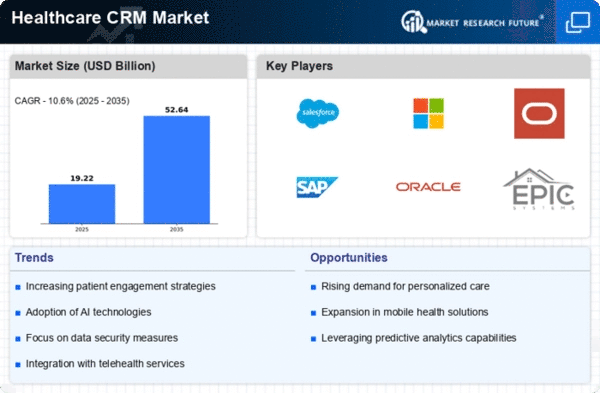

Healthcare Crm Size

Healthcare CRM Market Growth Projections and Opportunities

Rising patient-centered care in healthcare influences the CRM market. To improve patient experience and engagement, healthcare professionals use CRM systems to capture patient interactions, preferences, and feedback. IT advances are increasing healthcare CRM. Integrated customer relationship management (CRM) solutions simplify patient data administration, increase communication, and assist healthcare firms make data-driven choices using data analytics, AI, and cloud computing. Fee-for-service to value-based treatment is changing healthcare CRM. Clinicians prioritize patient satisfaction and quality outcomes to achieve value-based care objectives. Healthcare firms use CRM tools to monitor patient outcomes, coordinate treatment, and improve communication. Growing patient participation affects the healthcare industry. CRM systems may boost patient engagement via communication, appointment scheduling, and customized health information. Engaging patients in therapy boosts healthcare CRM adoption. The healthcare business needs CRM-EHR connectivity. Integration gives doctors a complete picture of patient data to enhance decision-making and treatment coordination. CRM-EHR integration improves healthcare efficiency. Growing population health management affects healthcare CRM. CRM systems analyze patient data to discover patterns, manage chronic illnesses, and prevent disease. CRM systems benefit from population health objectives. Healthcare CRM is affected by data protection and regulation. Healthcare rules like HIPAA apply to CRM companies. Data security and privacy regulations make healthcare organizations trust CRM systems. Markets ask whether healthcare CRM systems can grow and adapt. CRM solutions must be customizable and extensible for rising healthcare data. Customization and scalability boost CRM technology. CRM systems help healthcare firms retain patients. CRM systems enhance patient-provider communication, scheduling, and personalization. Healthcare performance increases with patient loyalty. Healthcare CRM vendors innovate and differentiate to compete. CRM suppliers provide more features, user-friendly interfaces, and great functionality to maintain industry leadership. This dynamic competitive atmosphere drives healthcare customer relationship management system development, which helps healthcare organizations seek cutting-edge solutions.

Leave a Comment