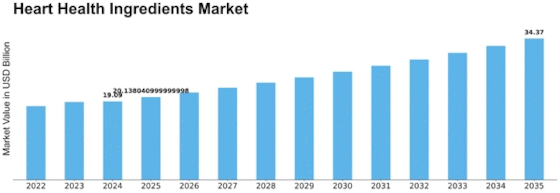

Heart Health Ingredients Size

Heart Health Ingredients Market Growth Projections and Opportunities

The global soy protein ingredients market is poised to experience a remarkable growth trajectory throughout the forecast period. The escalating utilization of soy protein ingredients in various food and beverage products is expected to be a key driver propelling the growth of the global soy protein ingredients market. This surge in demand is driven by the multifaceted benefits and versatile applications that soy protein brings to the table.

One of the noteworthy factors fueling the growth of the global market is the increasing prevalence of lactose intolerance among consumers. As a significant portion of the population grapples with lactose-related issues, the demand for alternative protein sources has witnessed a substantial rise. Soy protein, being a plant-based and lactose-free option, has emerged as a favorable choice, contributing to the expansion of the soy protein ingredients market.

Furthermore, the global market is set to receive a substantial boost from the growing trend of veganism among consumers. A shift towards plant-based diets is becoming increasingly prevalent, driven by concerns related to health, environmental sustainability, and ethical considerations. Soy protein, being a crucial component in many vegetarian and vegan food products, is poised to witness heightened demand. This trend aligns with the broader movement towards sustainable and ethical consumption, further propelling the soy protein ingredients market.

Despite the positive growth indicators, it is essential to acknowledge that the market's trajectory might face constraints due to allergy reactions associated with soy. Some individuals may exhibit allergic responses to soy-based products, posing a challenge for market expansion. As the awareness of food allergies continues to grow, manufacturers will need to address these concerns through innovative product development and clear labeling practices.

The use of soy protein ingredients is becoming increasingly pervasive across a diverse range of food and beverage applications. Soy protein is a versatile ingredient, known for its functional properties such as emulsification, gelling, and foaming. In the food industry, soy protein is widely incorporated into products like meat alternatives, dairy substitutes, baked goods, and nutritional supplements. The demand for plant-based protein sources has surged, driven by changing consumer preferences and a growing awareness of the health benefits associated with plant-based diets.

The functional attributes of soy protein make it an attractive choice for food manufacturers aiming to enhance the nutritional profile of their products. Soy protein ingredients not only contribute to protein fortification but also offer a sustainable and economically viable protein source. With the global population's increasing focus on health and wellness, soy protein ingredients are likely to find an expanding array of applications in the food and beverage sector.

In the beverage industry, soy protein ingredients are gaining prominence, particularly in the formulation of plant-based beverages. Soy milk, in particular, has gained popularity as a dairy milk alternative, appealing to consumers seeking lactose-free and plant-based options. Additionally, soy protein isolates and concentrates are finding utility in sports and nutrition beverages, catering to the growing demand for protein-enriched functional drinks.

The geographical landscape of the soy protein ingredients market reflects a global surge in demand, with regions like North America, Europe, Asia Pacific, and Latin America emerging as key contributors. The Asia Pacific region, with its rich history of soy consumption, is witnessing significant growth in the soy protein ingredients market. The region's culinary traditions, coupled with the rising health-conscious consumer base, are propelling the demand for soy protein ingredients in various food applications.

In conclusion, the global soy protein ingredients market is on a trajectory of impressive growth, driven by factors such as increased usage in food and beverage products, rising awareness of lactose intolerance, and the growing trend of veganism. While challenges related to soy allergies may pose hurdles, the versatile and functional properties of soy protein make it a valuable ingredient across diverse applications. As consumer preferences continue to evolve towards sustainable and plant-based diets, the soy protein ingredients market is poised for further expansion and innovation.

Leave a Comment