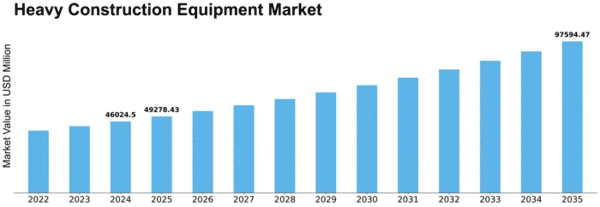

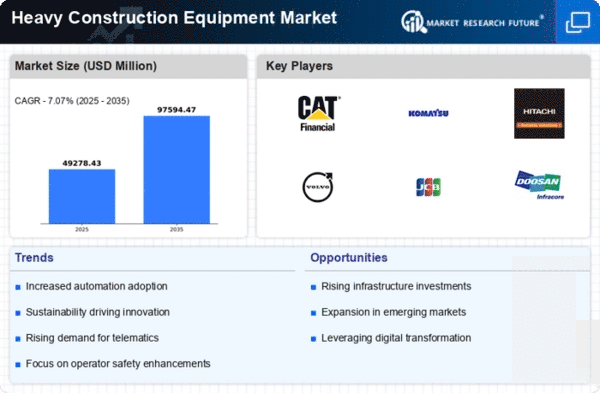

Heavy Construction Equipment Size

Heavy Construction Equipment Market Growth Projections and Opportunities

The Europe heavy construction equipment market is a dynamic and evolving sector, shaped by a combination of economic, technological, and regulatory factors. As one of the key players in the global construction industry, Europe experiences a fluctuating demand for heavy equipment due to various influences.

Economic conditions play a pivotal role in shaping the market dynamics. The overall economic health of the region, including factors like GDP growth, infrastructure investments, and construction activities, significantly impacts the demand for heavy construction equipment. During periods of economic expansion, there is a surge in construction projects, leading to increased demand for excavators, bulldozers, cranes, and other heavy machinery. Conversely, economic downturns can result in a slowdown in construction activities and a subsequent decrease in equipment demand.

Technological advancements also contribute to the market dynamics of the heavy construction equipment sector in Europe. The industry has witnessed a continual evolution in equipment design, incorporating advanced features such as GPS tracking, telematics, and automation. These innovations enhance the efficiency, safety, and productivity of construction processes, influencing purchasing decisions by contractors and construction firms. As European countries embrace smart construction technologies, the demand for modernized heavy equipment is likely to persist.

Government regulations and policies play a crucial role in shaping the market dynamics of the heavy construction equipment sector in Europe. Stringent environmental regulations, safety standards, and emission norms impact the design and manufacturing of heavy equipment. The push towards sustainable and eco-friendly construction practices has led to the development of more fuel-efficient and environmentally friendly construction machinery. Manufacturers operating in the European market must adhere to these regulations, influencing their production strategies and the types of equipment offered.

The competitive landscape also contributes significantly to the market dynamics of heavy construction equipment in Europe. The region is home to several prominent manufacturers and suppliers, each vying for market share through product differentiation, innovation, and strategic partnerships. The presence of both global and local players adds complexity to the market dynamics, creating a competitive environment that fosters continuous improvement in equipment quality and functionality.

Furthermore, the rental market has emerged as a key influencer in the European heavy construction equipment sector. Many construction companies prefer renting equipment rather than making substantial capital investments, especially for short-term projects. This trend has led to the growth of rental agencies and the availability of a wide range of equipment for contractors, impacting the purchasing patterns of heavy construction machinery.

The European heavy construction equipment market also experiences certain challenges that shape its dynamics. These challenges include economic uncertainties, geopolitical factors, and the impact of external events such as the COVID-19 pandemic. Such unforeseen events can disrupt supply chains, affect project timelines, and influence the overall demand for heavy equipment.

In conclusion, the market dynamics of the Europe heavy construction equipment sector are multifaceted, shaped by economic trends, technological advancements, regulatory frameworks, competitive forces, and evolving customer preferences. As the industry continues to navigate through these dynamic factors, adaptability, innovation, and a keen understanding of market trends will be crucial for stakeholders to thrive in this ever-changing landscape.

Leave a Comment