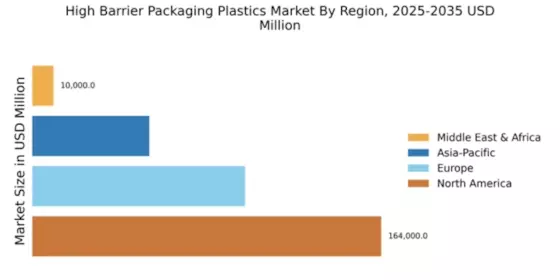

North America : Market Leader in High Barrier Plastics

North America is poised to maintain its leadership in the High Barrier Packaging Plastics Market, holding a significant market share of 164,000.0. The region's growth is driven by increasing demand for sustainable packaging solutions and stringent regulations promoting eco-friendly materials. The rise in e-commerce and food safety concerns further catalyze the need for high barrier packaging, ensuring product integrity and shelf life.

The competitive landscape in North America is robust, featuring key players such as Amcor, Sealed Air, and DuPont. These companies are investing in innovative technologies and sustainable practices to enhance their product offerings. The U.S. remains the largest market, supported by advanced manufacturing capabilities and a strong focus on R&D. This dynamic environment positions North America as a hub for high barrier packaging innovations.

Europe : Sustainable Packaging Initiatives

Europe's High Barrier Packaging Plastics Market is projected to grow significantly, with a market size of 100,000.0. The region is characterized by stringent regulations aimed at reducing plastic waste and promoting recycling. Initiatives such as the European Green Deal are driving demand for sustainable packaging solutions, pushing manufacturers to innovate and comply with environmental standards. This regulatory landscape is a key growth driver for the market.

Leading countries in Europe include Germany, France, and the UK, where major players like BASF and Mondi are actively enhancing their product lines. The competitive landscape is marked by a focus on sustainability, with companies investing in biodegradable materials and advanced recycling technologies. This commitment to eco-friendly practices positions Europe as a leader in the high barrier packaging sector.

Asia-Pacific : Emerging Market Potential

The Asia-Pacific region is witnessing rapid growth in the High Barrier Packaging Plastics Market, with a market size of 55,000.0. This growth is fueled by increasing urbanization, rising disposable incomes, and a growing preference for packaged food and beverages. Additionally, the region's expanding e-commerce sector is driving demand for high barrier packaging solutions that ensure product safety and longevity. Regulatory support for sustainable practices is also emerging, further enhancing market prospects.

Key countries in this region include China, Japan, and India, where major players like Berry Global and SABIC are establishing a strong presence. The competitive landscape is evolving, with companies focusing on innovation and sustainability to meet the diverse needs of consumers. As the market matures, investments in technology and infrastructure are expected to bolster growth in the Asia-Pacific high barrier packaging sector.

Middle East and Africa : Developing Market Landscape

The Middle East and Africa (MEA) region is gradually emerging in the High Barrier Packaging Plastics Market, with a market size of 10,000.0. The growth in this region is driven by increasing demand for packaged goods, particularly in the food and beverage sector. Additionally, rising awareness of product safety and shelf life is pushing manufacturers to adopt high barrier packaging solutions. Regulatory frameworks are also beginning to support sustainable packaging initiatives, albeit at a slower pace compared to other regions.

Countries like South Africa and the UAE are leading the way in adopting high barrier packaging technologies. The competitive landscape is characterized by a mix of local and international players, with companies like WestRock and Clariant making significant inroads. As the market develops, there are ample opportunities for growth, particularly in enhancing production capabilities and expanding distribution networks.