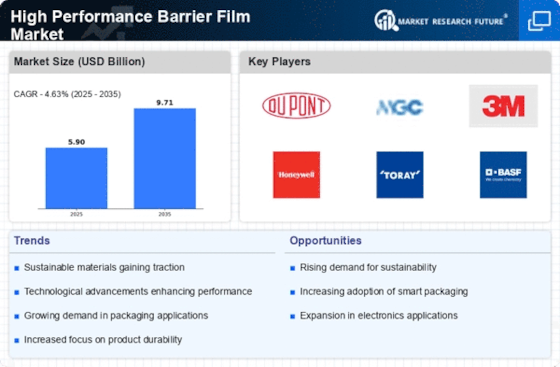

Rising Demand for Food Packaging

The High Performance Barrier Film Market is experiencing a notable increase in demand for food packaging solutions. This trend is driven by the need for extended shelf life and enhanced product safety. As consumers become more health-conscious, the requirement for packaging that preserves food quality is paramount. The market for food packaging films is projected to reach USD 45 billion by 2026, indicating a robust growth trajectory. High performance barrier films provide superior moisture and oxygen barriers, which are essential for maintaining the freshness of perishable goods. This demand is further fueled by the rise in e-commerce food deliveries, necessitating packaging that can withstand various shipping conditions. Consequently, manufacturers are focusing on developing innovative barrier films that cater to these evolving consumer preferences, thereby propelling the High Performance Barrier Film Market forward.

Increased Focus on Sustainability

The High Performance Barrier Film Market is witnessing a shift towards sustainable packaging solutions. As environmental concerns gain prominence, manufacturers are increasingly adopting eco-friendly materials and practices. The market for sustainable packaging is projected to grow at a CAGR of 7% through 2027, reflecting a significant trend towards reducing plastic waste. High performance barrier films made from biodegradable or recyclable materials are becoming more prevalent, as they offer the necessary barrier properties without compromising environmental integrity. This transition not only aligns with consumer preferences for sustainable products but also helps companies comply with stringent regulations regarding plastic usage. As a result, the High Performance Barrier Film Market is likely to evolve, with a greater emphasis on developing sustainable alternatives that meet both performance and environmental standards.

Expansion of the Pharmaceutical Sector

The High Performance Barrier Film Market is also being driven by the expansion of the pharmaceutical sector. With the increasing demand for effective drug delivery systems and packaging that ensures product integrity, high performance barrier films are becoming essential. The pharmaceutical packaging market is projected to reach USD 100 billion by 2026, highlighting the critical role of barrier films in maintaining the efficacy of medications. These films provide protection against moisture, light, and oxygen, which are vital for preserving the stability of pharmaceutical products. As the industry continues to innovate with new drug formulations and delivery methods, the High Performance Barrier Film Market is expected to grow in tandem, providing tailored solutions that meet the stringent requirements of pharmaceutical applications.

Technological Innovations in Film Production

The High Performance Barrier Film Market is benefiting from ongoing technological advancements in film production processes. Innovations such as nanotechnology and advanced coating techniques are enhancing the performance characteristics of barrier films. These technologies enable the creation of films with superior barrier properties, improved durability, and reduced thickness, which can lead to cost savings in material usage. The market for advanced barrier films is expected to grow significantly, with estimates suggesting a value of USD 30 billion by 2025. As manufacturers invest in research and development to leverage these technologies, the High Performance Barrier Film Market is likely to see a wave of new products that cater to diverse applications, from food packaging to electronics, thereby broadening its market reach.

Growth in Electronics and Semiconductor Industries

The High Performance Barrier Film Market is significantly influenced by the expansion of the electronics and semiconductor sectors. These industries require advanced packaging solutions to protect sensitive components from moisture and contaminants. The High Performance Barrier Film Market is anticipated to reach USD 1 trillion by 2025, which underscores the increasing need for high-quality barrier films. High performance barrier films are essential in the production of flexible displays, printed circuit boards, and other electronic devices. Their ability to provide excellent barrier properties while maintaining flexibility makes them ideal for these applications. As the demand for miniaturization and lightweight components grows, the High Performance Barrier Film Market is likely to see a surge in innovation and product development tailored to meet these specific requirements.