Growing Focus on Energy Efficiency

The High Performance Film Market is increasingly influenced by a global emphasis on energy efficiency. Industries are actively seeking solutions that minimize energy consumption and enhance operational efficiency. High-performance films, known for their thermal insulation properties, are being integrated into building materials and appliances to reduce energy loss. In 2025, the construction sector is anticipated to be a key driver of market growth, as regulations become more stringent regarding energy efficiency standards. This shift is likely to result in a substantial increase in the adoption of high-performance films, with estimates suggesting a market expansion of around 7% in this segment alone. Additionally, the push for energy-efficient solutions in electronics and automotive applications further underscores the potential for high-performance films to contribute to sustainability goals.

Expanding Applications in Electronics

The High Performance Film Market is witnessing a significant expansion in applications within the electronics sector. As consumer electronics continue to evolve, the demand for high-performance films that offer superior electrical insulation and thermal management is on the rise. These films are increasingly utilized in flexible displays, circuit boards, and battery components, where performance and reliability are paramount. In 2025, the electronics segment is projected to account for a considerable share of the market, driven by the proliferation of smart devices and the Internet of Things (IoT). This trend indicates a potential market growth rate of approximately 8% in the electronics sector, highlighting the critical role that high-performance films will play in supporting technological advancements and innovation.

Rising Demand for Lightweight Materials

The High Performance Film Market is experiencing a notable increase in demand for lightweight materials across various sectors, including automotive and aerospace. As manufacturers seek to enhance fuel efficiency and reduce emissions, the adoption of high-performance films, which offer superior strength-to-weight ratios, becomes increasingly attractive. In 2025, the automotive sector is projected to account for a significant share of the market, driven by stringent regulations aimed at reducing carbon footprints. This trend suggests that high-performance films will play a crucial role in the development of next-generation vehicles, potentially leading to a market growth rate of over 5% annually. Furthermore, the aerospace industry is also likely to leverage these materials for their lightweight properties, indicating a broader acceptance of high-performance films in critical applications.

Advancements in Manufacturing Technologies

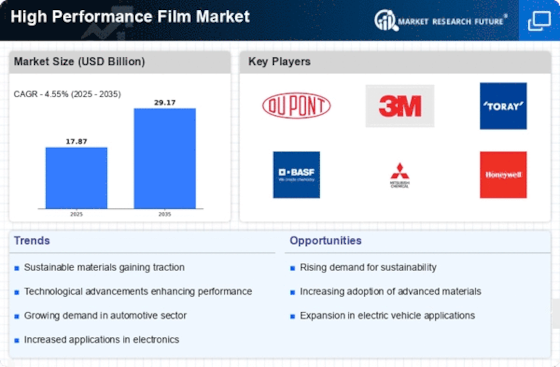

Technological innovations in the production processes of high-performance films are reshaping the High Performance Film Market. Enhanced manufacturing techniques, such as extrusion and coating technologies, are enabling the creation of films with improved properties, including enhanced durability and resistance to extreme temperatures. These advancements not only increase the efficiency of production but also expand the range of applications for high-performance films. For instance, the introduction of nanotechnology in film production is expected to enhance barrier properties, making these films suitable for packaging applications in the food and pharmaceutical industries. As a result, the market is likely to witness a surge in demand, with projections indicating a compound annual growth rate of approximately 6% over the next five years.

Increased Investment in Research and Development

Investment in research and development within the High Performance Film Market is fostering innovation and driving market growth. Companies are increasingly allocating resources to develop new formulations and applications for high-performance films, aiming to meet the evolving needs of various industries. This focus on R&D is likely to result in the introduction of advanced materials with enhanced properties, such as improved chemical resistance and higher thermal stability. As industries continue to seek customized solutions, the market is expected to benefit from these innovations, with projections indicating a growth rate of around 5% annually. Furthermore, collaborations between manufacturers and research institutions are anticipated to accelerate the development of next-generation high-performance films, further solidifying their position in diverse applications.

.png)