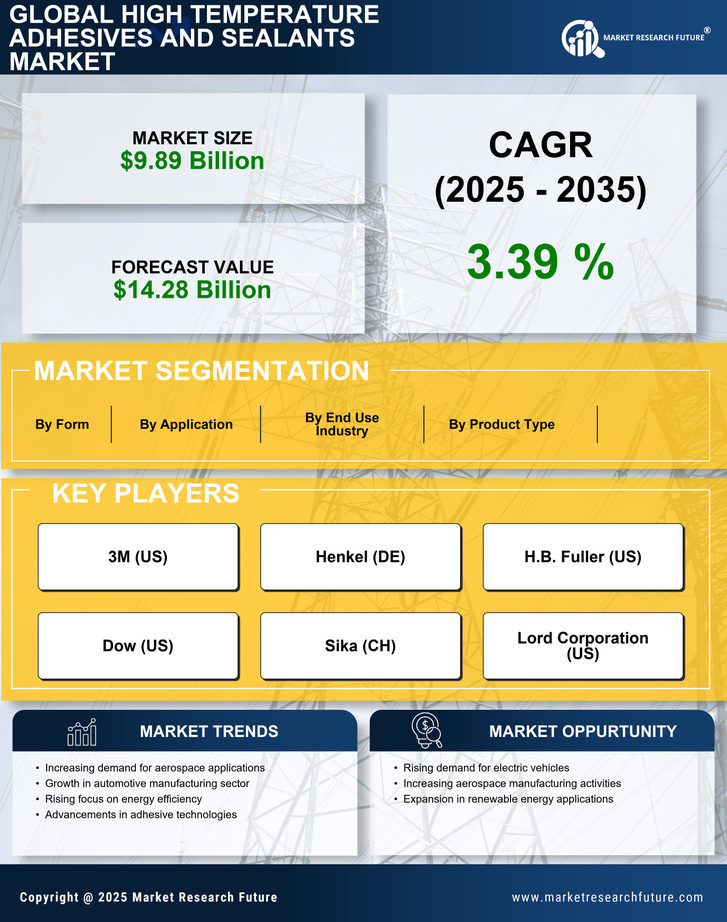

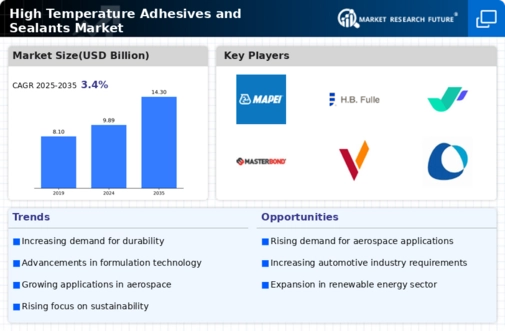

Rising Demand in Automotive Sector

The automotive sector is experiencing a notable increase in the utilization of high temperature adhesives and sealants. This trend is primarily driven by the need for lightweight materials that can withstand extreme conditions, such as high temperatures and vibrations. In 2025, the automotive industry is projected to account for a substantial share of the high temperature adhesives and sealants market, as manufacturers seek to enhance vehicle performance and fuel efficiency. The shift towards electric vehicles further amplifies this demand, as these vehicles require advanced bonding solutions to ensure structural integrity and thermal management. Consequently, the high temperature adhesives and sealants market is likely to witness significant growth, fueled by innovations in adhesive formulations that cater to the specific needs of automotive applications.

Expansion in Aerospace Applications

The aerospace industry is increasingly adopting high temperature adhesives and sealants due to their critical role in ensuring safety and performance. As aircraft manufacturers strive for improved fuel efficiency and reduced weight, the demand for advanced bonding solutions is on the rise. In 2025, the aerospace sector is expected to represent a considerable portion of the high temperature adhesives and sealants market, driven by stringent regulations and the need for durable materials that can withstand extreme thermal conditions. The development of new adhesive technologies that offer enhanced performance characteristics, such as resistance to chemicals and moisture, further supports this trend. Thus, the high temperature adhesives and sealants market is poised for growth as aerospace companies continue to innovate and seek reliable bonding solutions.

Increasing Focus on Renewable Energy

The renewable energy sector is becoming a pivotal driver for the high temperature adhesives and sealants market. As the world shifts towards sustainable energy solutions, the demand for reliable bonding materials in applications such as solar panels and wind turbines is growing. In 2025, the renewable energy industry is expected to significantly influence the high temperature adhesives and sealants market, as manufacturers require adhesives that can withstand harsh environmental conditions and high temperatures. The development of innovative adhesive solutions that enhance the durability and efficiency of renewable energy systems is crucial. Consequently, the high temperature adhesives and sealants market is likely to benefit from this trend, as the push for clean energy continues to gain momentum.

Growth in Electronics and Electrical Applications

The electronics and electrical sectors are witnessing a surge in the use of high temperature adhesives and sealants, primarily due to the increasing complexity of electronic devices. As devices become more compact and require efficient thermal management, the demand for adhesives that can endure high temperatures is escalating. In 2025, the electronics industry is anticipated to contribute significantly to the high temperature adhesives and sealants market, as manufacturers seek materials that provide reliable insulation and bonding under extreme conditions. The rise of advanced technologies, such as 5G and electric vehicles, further drives this demand, necessitating the development of specialized adhesives that can meet the rigorous performance standards. Therefore, the high temperature adhesives and sealants market is likely to expand as these sectors continue to evolve.

Technological Innovations in Adhesive Formulations

Technological advancements in adhesive formulations are playing a crucial role in shaping the high temperature adhesives and sealants market. The introduction of new materials and chemistries is enabling the development of adhesives that offer superior performance characteristics, such as enhanced thermal stability and resistance to environmental factors. In 2025, the market is expected to see a rise in demand for these innovative adhesive solutions, as industries seek to improve product reliability and longevity. The ability to customize adhesive properties to meet specific application requirements further drives this trend. As a result, the high temperature adhesives and sealants market is likely to experience robust growth, fueled by ongoing research and development efforts aimed at creating cutting-edge adhesive technologies.