Growth of the Aged Population

The aging population in the US is a critical driver for the dental adhesives-and-sealants market. As individuals age, they often experience increased dental issues, necessitating the use of adhesives and sealants for restorative procedures. The US Census Bureau projects that by 2030, approximately 20% of the population will be over 65 years old, leading to a higher demand for dental care services. This demographic shift is likely to result in a significant increase in the use of dental adhesives and sealants, as older adults seek to maintain their oral health. Consequently, the dental adhesives-and-sealants market is expected to expand in response to this growing need for effective dental solutions tailored to an aging population.

Expansion of Dental Insurance Coverage

The expansion of dental insurance coverage is poised to positively impact the dental adhesives-and-sealants market. As more insurance plans begin to cover preventive and restorative dental procedures, patients are more likely to seek treatments that utilize adhesives and sealants. This trend is particularly evident in employer-sponsored insurance plans, which have seen an increase in coverage for preventive services. According to the National Association of Dental Plans, approximately 77% of Americans had some form of dental insurance in 2025. This increase in coverage is likely to drive demand for dental adhesives and sealants, as patients are more willing to undergo necessary procedures. Thus, the dental adhesives-and-sealants market stands to benefit from this favorable shift in insurance policies.

Rising Aesthetic Concerns Among Consumers

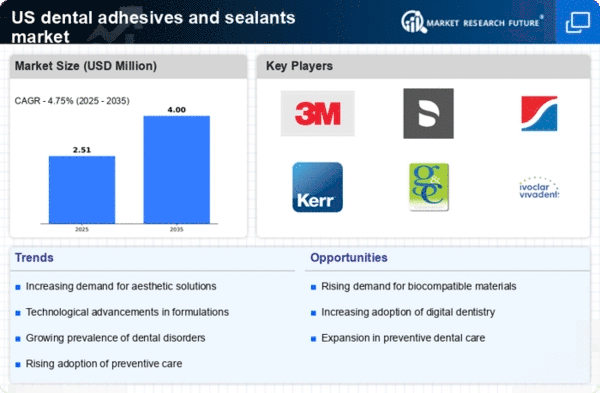

Aesthetic considerations are increasingly influencing consumer choices in the dental adhesives-and-sealants market. Patients are more concerned about the appearance of their dental work, leading to a higher demand for clear and tooth-colored adhesives and sealants. This trend is particularly prominent among younger demographics, who prioritize aesthetics in their dental treatments. The market for aesthetic dental products is expected to grow significantly, with projections indicating a potential increase of 8% annually through 2028. As dental professionals adapt to these preferences, the dental adhesives-and-sealants market is likely to see a shift towards products that not only provide functional benefits but also meet aesthetic demands.

Increasing Demand for Preventive Dental Care

The dental adhesives-and-sealants market experiences a notable surge in demand due to the growing emphasis on preventive dental care among the population. As awareness regarding oral health increases, more patients seek preventive treatments to avoid costly procedures in the future. This trend is reflected in the rising number of dental visits, with approximately 65% of adults in the US visiting a dentist annually. Consequently, the demand for effective dental adhesives and sealants, which play a crucial role in preventive care, is expected to rise. The market is projected to reach $1.5 billion by 2026, driven by this increasing focus on preventive measures. Thus, the dental adhesives-and-sealants market is likely to benefit significantly from this shift in consumer behavior.

Technological Innovations in Dental Materials

Technological advancements in dental materials are transforming the dental adhesives-and-sealants market. Innovations such as improved bonding agents and bioactive sealants enhance the effectiveness and longevity of dental treatments. For instance, the introduction of light-cured adhesives has revolutionized the application process, allowing for quicker and more efficient procedures. The market for dental adhesives is projected to grow at a CAGR of 6.5% from 2025 to 2030, indicating a robust demand for these innovative products. Furthermore, the integration of nanotechnology in adhesive formulations is expected to enhance their performance, making them more appealing to dental professionals. As a result, the dental adhesives-and-sealants market is poised for substantial growth driven by these technological innovations.